Third Consecutive Quarter Delivering Record ARR, Revenue and Adjusted EBITDA, Re-affirms Endpoint Resilience as Critical Capability for New Work Paradigm

VANCOUVER, British Columbia and SAN JOSE, Calif. – May 11, 2021 – Absolute Software Corporation (“Absolute” or the “Company”) (NASDAQ: ABST) (TSX: ABST), a leader in Endpoint Resilience™ solutions, today announced its financial results for its third quarter fiscal 2021 ended March 31, 2021. All dollar figures are stated in U.S. dollars, unless otherwise indicated.

The Company also separately announced today that it has signed a definitive agreement to acquire NetMotion Software, Inc., a leading provider of network connectivity and security solutions. Read the press release here.

“Our solid results this quarter are a direct reflection of the strong demand for Endpoint Resilience capabilities, as organizations across all industries are under pressure to define what the future of work or learning looks like,” said Christy Wyatt, Absolute Software’s President and CEO. “It is an exciting and dynamic time in this market space, and we are well-positioned to deliver the security, agility, and resiliency needed to properly scale remote and hybrid operating models for the long term.”

Added Wyatt, “In our pursuit of becoming the industry’s most trusted security provider, and delivering on what we believe has been a largely unfulfilled promise in the industry of a truly resilient, secure end-to-end user experience, we also today announced our intent to acquire NetMotion. By combining our respective market-leading capabilities, we will be strongly positioned to meet the critical need for resilient, autonomous endpoints and self-healing mobile network access.”

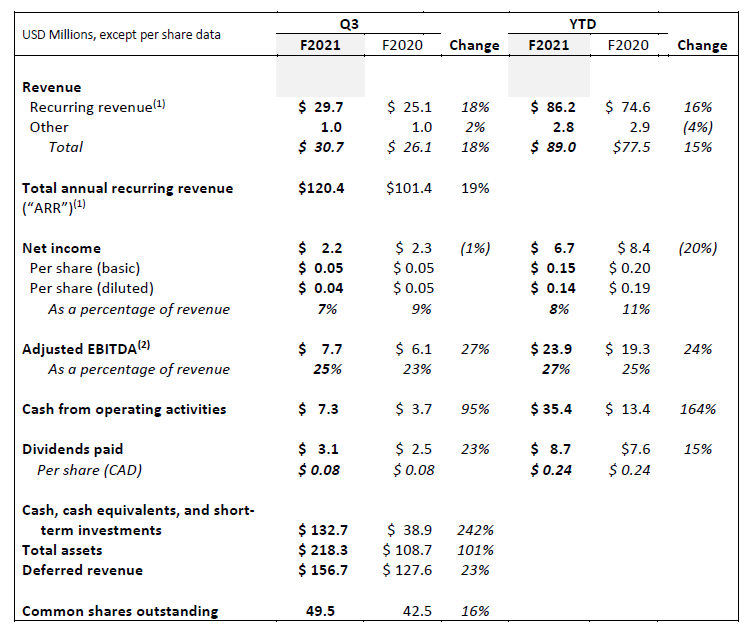

Third Quarter Fiscal 2021 (“Q3 F2021”) Financial Highlights

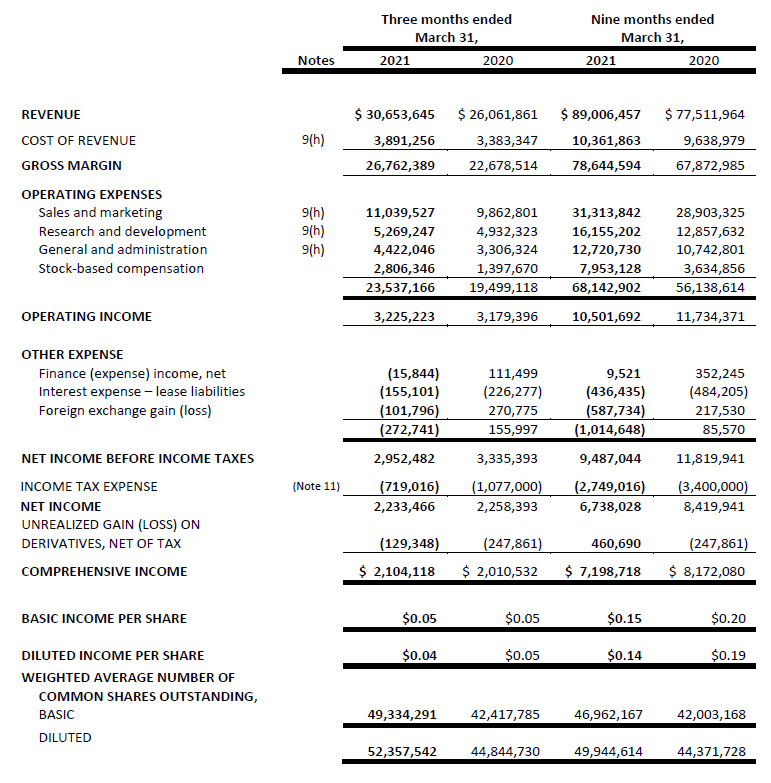

- Total revenue in Q3 F2021 was $30.7 million, representing an increase of 18% over Q3 F2020 revenue.

- Net income in Q3 F2021 was $2.2 million, compared to $2.3 million in Q3 F2020, a 1% decrease.

- Total ARR(1) at March 31, 2021 was $120.4 million, representing an increase of 19% over the prior year. The Enterprise & Government portions of Total ARR increased by 11% annually over Q3 F2020 and represented 65% of Total ARR at March 31, 2021; the Education sector portion of Total ARR increased by 35% annually over Q3 F2020 and represented 35% of Total ARR at March 31, 2021.

- New Logo ARR(1)(2) was $2.6 million in Q3 F2021, compared to $1.0 million in Q3 F2020.

- Net Dollar Retention(1)(3) from existing customers was 110% in Q3 F2021, compared with 101% in Q3 F2020.

- Adjusted EBITDA in Q3 F2021 was $7.7 million, or 25% of revenue, up from $6.1 million, or 23% of revenue, in Q3 F2020.

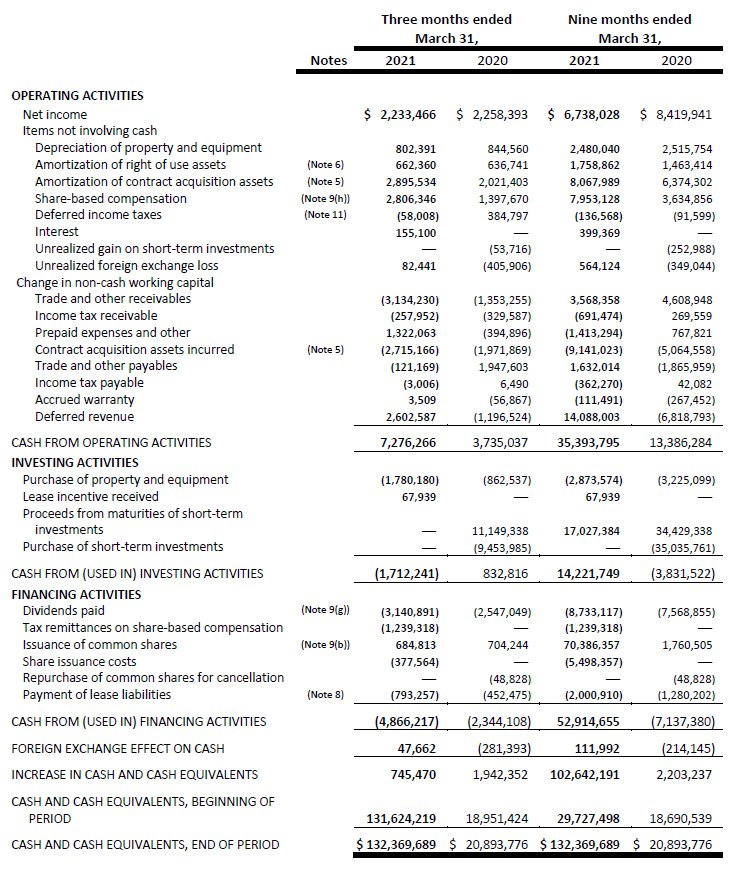

- Cash generated from operating activities in Q3 F2021 was $7.3 million, compared to $3.7 million in Q3 F2020.

- Absolute paid a quarterly dividend of CAD$0.08 per outstanding Company common share (the “Common Shares”) during Q3 F2021.

- Refer to the “Non-IFRS Measures and Key Metrics” section of the Q3 F2021 MD&A for further discussion of this measure.

- Beginning in Q2 F2021, we changed the nomenclature of Total ARR from sales to new customers during a period from “ARR from New Customers” to “New Logo ARR”. There has been no change in the methods by which these measures are calculated.

- Beginning in Q2 F2021, we changed the nomenclature of the percentage increase or decrease in Total ARR from existing customers for a given period from “Net ARR Retention” to “Net Dollar Retention” and changed the measurement period from quarterly to annual, as we believe the annual metric is more aligned with business performance measures and industry norms.

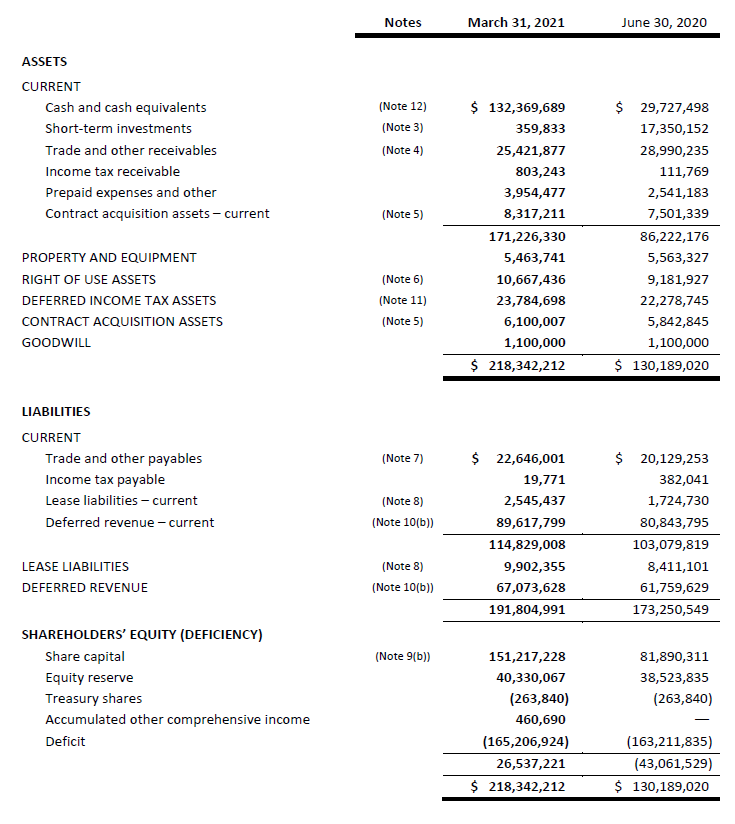

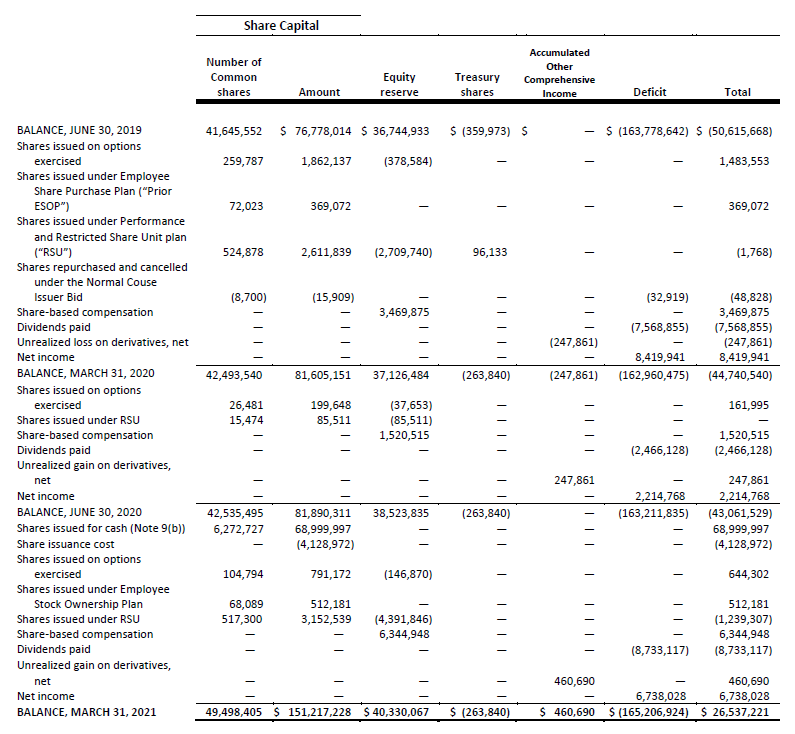

Selected Quarterly Information

Notes:

- Recurring revenue represents revenue derived from cloud services and managed services, both of which are included as part of Total ARR (as defined below). Other revenue represents revenue derived from non-recurring professional services and ancillary product lines, including consumer products. See the Q3 F2021 MD&A for full disclosure regarding these measures.

- Throughout this document, Adjusted EBITDA (as defined below) is used as a profitability measure. Please refer to the “Non-IFRS Measures and Key Metrics” section of the Q3 F2021 MD&A for further discussion on this and other non-IFRS measures.

Q3 F2021 Business Highlights

Product and service highlights:

- In January, we announced the continued expansion of our Application Persistence™ portfolio of persisted applications, including the addition of the Palo Alto Networks® GlobalProtect™ security platform and Netskope® Cloud Access Security Broker (CASB) and Next-Gen Secure Web Gateway (NG-SWG).

- In January, we announced Absolute’s designation as a Cyber Catalyst℠ by Marsh & McLennan, emphasizing our critical capabilities and high level of protection to address today’s top cyber risks.

- In March, we announced the availability of expanded Web Usage analytics, enabling IT and Security teams with deeper historical insights to better understand website usage patterns and web application adoption, as well as identify unsanctioned web apps or out-of-policy web behavior.

- In March, we expanded Web Usage analytics for both enterprise and education customers - delivering deeper historical analytics and insights into usage patterns to make better-informed decisions on the tools and applications on their devices. We increased Web Usage analytics adoption by 152% in Q3 on more than 2.5 million devices across all market segments including Enterprise and Education.

- In March, we delivered several platform enhancements, enabling IT and Security administrators to develop custom rules and be alerted to a wide range of device or user-related events, such as IP address changes or the disabling of security controls; take immediate action to freeze or wipe a device; and capture the insights needed to demonstrate timely action was taken. We also extended the power of Absolute’s persistent, self-healing connection to more mission-critical applications, including Lenovo® Device Intelligence and the VPN function of Fortinet® FortiClient.

Business and organizational developments:

- In January, we announced our prioritization by the United States Federal Risk and Authorization Management Program (FedRAMP) to pursue a Provisional Authority to Operate (P-ATO) from the Joint Authorization Board (JAB), a critical step towards increasing our sales into US federal government agencies. FedRAMP is the U.S. government's most rigorous security compliance framework in which a Cloud Service Provider (CSP) is assessed by an accredited, independent third party to meet the requirements set forth by FedRAMP.

- In February, we were recognized by the Cybersecurity Excellence Awards, winning a Gold award for Cybersecurity Company of the Year; Christy Wyatt was named a top Cybersecurity Woman of the Year; and the Absolute Resilience Platform won a Silver award for Product/Service of the Year.

- In March, Absolute was recognized in The Globe and Mail’s 2021 ‘Women Lead Here list,’ an annual editorial benchmark that identifies best-in-class executive gender diversity in corporate Canada.

- In March, Absolute was recognized in the EdTech Awards’ TrendSetter category for its ‘Remote Work + Distance Learning Insights Center,’ launched in March 2020 to enable both education and enterprise organizations to measure the health and security of their remote device programs, pre and post-COVID-19.

- In March, Absolute was recognized as one of the Top 15 Best IT Companies in Vietnam by ITviec, one of the country’s most visited IT employment sites.

Partner and other highlights:

- In March, we were recognized in CRN’s 2021 Partner Program Guide, validating the delivery of premier tools, programs and resources to meet the needs of our managed service providers and reseller partners.

- Absolute continued to see strong channel partner momentum in the quarter, including:

- 20% increase in having partners sign up to our Elite/Premier partner level

- 75% increase in partners we certified via training

- 13% increase in partners deals registered through our partner portal.

F2021 Financial Outlook

The Company is updating its previously disclosed financial outlook for the full year fiscal 2021 as follows:

- The Company is raising its outlook on revenue from $117 million to $119 million (representing 12% to 14% annual growth) to $119 million to $120 million (representing approximately 14% to 15% annual growth).

- The Company is raising its outlook on Adjusted EBITDA from 22% to 24% of revenue to 24% to 25% of revenue.

- The Company is raising its outlook on cash from operating activities margin from 26% to 34% of revenue to 32% to 35% of revenue.

- The Company is maintaining its outlook for capital expenditures and expect them to be between $3.0 million and $4.0 million.

The foregoing outlook and expectations constitute forward-looking statements and financial outlook and are qualified in their entirety by the “Forward-Looking Statements” cautionary statement below.

Quarterly Dividend

On April 20, 2021, we declared a quarterly dividend of CAD$0.08 per share on our Common Shares, payable in cash on May 28, 2021 to shareholders of record at the close of business on May 14, 2021.

Quarterly Filings and Related Quarterly Financial Information

Management’s Discussion and Analysis (“MD&A”) and Consolidated Financial Statements and the notes thereto for the fiscal period ended March 31, 2021 can be obtained today from Absolute’s corporate website at www.absolute.com. The documents will also be available under Absolute’s SEDAR profile at www.sedar.com and on EDGAR at www.sec.gov. Additionally, the Company has published on the Investor Relations section of its website (www.absolute.com/company/investors/) and Q3 F2021 Earnings Presentation and a dashboard of Selected Operating and Financial Metrics.

Conference Call

Absolute Software will hold a conference call to discuss its Q3 F2021 financial results on Tuesday, May 11, 2021, at 5:00 p.m. ET (2:00 p.m. PT). The call will be accessible by dialing 647-427-7450 or 1-888-231-8191. A live audio webcast of the conference call will also be available via the Absolute Investor Relations website. The conference call will be archived for replay until Tuesday, May 18, 2021. To access the archived conference call, please dial 416-849-0833 or 1-855-859-2056 and enter the reservation code 1175112. An archived replay of the webcast will be available for 90 days.

Non-IFRS Measures and Key Metrics

Throughout this press release, the Company refers to a number of measures and metrics that the Company believes are meaningful in the assessment of the Company’s performance. Many of these metrics are non-standard measures under International Financial Reporting Standards (“IFRS”), do not have any standardized meaning under IFRS, and are unlikely to be comparable to similarly titled measures reported by other companies. Readers are cautioned that the disclosure of these items is meant to add to, and not replace, the discussion of financial results or cash flows from operations as determined in accordance with IFRS. For more complete discussion of these non-IFRS measures, please refer to the Q3 F2021 MD&A.

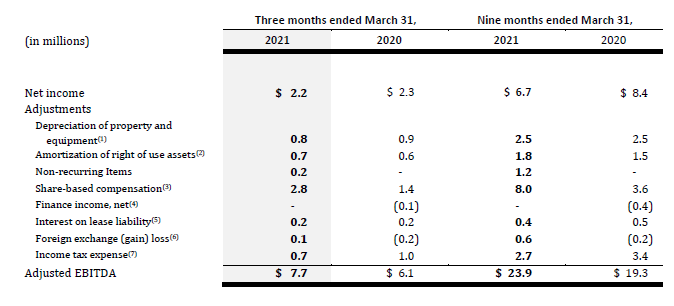

These measures and metrics, and their method of calculation or reconciliation to IFRS measures, are as follows:

-

Total ARR, Net Dollar Retention, and New Logo ARR

As the majority of our customer contracts are sold under prepaid multi-year term licenses, there is typically a significant lag between the timing of the invoice and the associated revenue recognition. As a result, we focus on the aggregate annual recurring revenue of our subscriptions under contract and generating revenue, measured by Annual Recurring Revenue (“ARR”), as an indicator of our future recurring revenues. We believe that increases in the amount of New Logo ARR, and improvement in our Net Dollar Retention, will accelerate the growth of Total ARR and, in turn, our future revenues. We provide these metrics as they are used to manage the business, however, we believe there is no similar measure under IFRS to which they would be reconciled.

Total ARR is a key metric and measures the amount of annual recurring revenue we will receive from our customers under contract at a point in time, and therefore is an indicator of our future revenue streams. Total ARR will change over a period through the retention, attrition and expansion of existing customers and the acquisition of new customers.

Net Dollar Retention (previously “Net ARR Retention”) is a key metric and measures the percentage increase or decrease in Total ARR at the end of a year for customers that comprised Total ARR at the beginning of the year. This metric provides insight into the effectiveness of our activities to retain and expand the ARR of our existing customers.

New Logo ARR (previously “ARR from New Customers”) is a key metric and measures the addition to Total ARR from sales to new customers during a period.

-

Adjusted Operating Expenses

A number of significant non-cash expenses are reported in our Cost of Revenue and Operating Expenses. In addition, restructuring and reorganization charges and post-retirement benefits are also reported in Operating Expenses. Management defines “Adjusted Operating Expenses” as IFRS Cost of Revenue, Sales and Marketing, Research and Development, and General and Administration expenses adjusted for these items, as we believe that analyzing these expenses exclusive of these items provides a useful measure of the cash invested in operating the ongoing business. The non-cash items include share-based compensation, amortization of intangible assets, and depreciation of property and equipment and amortization of right of use assets.

Specifically, management adjusts for the following items in computing its Adjusted Operating Expenses:

- Share-based compensation: Our compensation strategy includes the use of share-based awards to attract and retain key employees, executives and directors. It is principally aimed at aligning their interests with those of our shareholders and at long-term employee retention, rather than to motivate or reward operational performance for any particular period. Thus, share-based compensation expense varies for reasons that are generally unrelated to operational decisions and performance in any particular period.

- Amortization of Intangible Assets: We believe that amortization of intangible assets is not necessarily reflective of current period operational activities. In particular, the amortization of acquired technologies and customer relationships relates to items arising from pre-acquisition activities. These are costs that are determined at the time of an acquisition or when other intangible assets are acquired. While it is continually reviewed for potential impairment, amortization of the cost is a static expense, one that is typically not affected by operations during any particular period.

- Depreciation of Property and Equipment and Amortization of Right of Use Assets: We believe that depreciation / amortization of property and equipment and right of use assets is not necessarily reflective of current period operational activities. In particular, the costs associated with these assets relate to operational decisions made in prior periods. Depreciation / amortization of these costs is a static expense, one that is typically not affected by operations during any particular period.

- Restructuring or Reorganization Charges and Post-Retirement Benefits: We believe that costs incurred in certain significant post-retirement benefits afforded to executives upon departure from the Company, are not necessarily reflective of current period operational activities. In particular, these items relate to decisions which will impact future operating periods. The magnitude of these expenses is typically determined by contractual law, common law, or by statute, and is unaffected by operations and performance in any particular period.

- Non-recurring Items: We believe that costs that are non-recurring, unusual or non-operating in nature, such as non-recurring, unusual or non-operating tax, legal, restructuring and other one-time corporate expenses, are not necessarily reflective of current period operational activities.

The following table provides a reconciliation of our Net Income to Adjusted EBITDA:

Notes:

- Depreciation of property and equipment per the Statement of Cash Flows.

- Amortization of right of use assets per the Statement of Cash Flows.

- Share-based compensation per the Statement of Operations.

- Finance income, net per the Statement of Operations.

- Interest on lease liability per the Statement of Operations.

- Foreign exchange loss per the Statement of Operations.

- Income tax expense per the Statement of Operations.