Strong Demand for Expanded Product Suite Across All Target Commercial Market Verticals Drove Double-digit Fiscal 2012 Sales Contract Growth

Vancouver, Canada: August 13, 2012 – Absolute® Software Corporation (“Absolute” or the “Company”) (TSX: ABT), the leading provider of persistent endpoint security and management solutions for PC’s, Macs, iOS, Android, Windows and Blackberry devices, today announced its financial results for the three months and year ended June 30, 2012. All financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”) and reported in U.S. dollars.

Fiscal 2012 Highlights

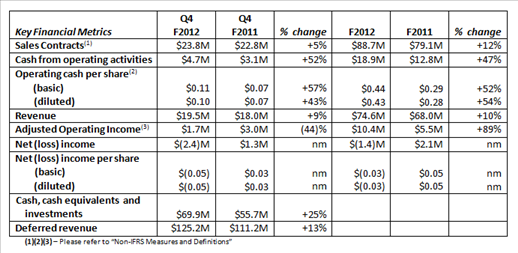

- Achieved 12% growth in Sales Contracts compared to F2011.

- Commercial Sales Contracts increased by 19% compared to F2011.

- Cash from operating activities was up 47% compared to F2011.

- Adjusted Operating Income increased 89% over F2011.

- Sales of Device Management and Security products(6) increased 67% and accounted for 30% of F2012 commercial sales contracts.

- Placed in the Visionaries Quadrant of Gartner Inc.’s Client Management Tools Magic Quadrant.

- Expanded the product platform to include new market-leading features such as:

- Absolute Manage: Windows imaging, support for Mac OS X Lion and detailed encryption status reporting;

- Absolute Manage Mobile Device Management (MDM): Support for Android and Microsoft Windows Phone 7, Absolute Safe for secure document distribution to iOS devices and automated enrolment and policy-based app installation for employee-owned devices;

- Computrace: Integration of Computrace persistence technology into the firmware of the Lenovo Thinkpad tablet, theft recovery for Android devices and ability to generate End-of-Life Data Delete Certificates.

- Partnered with InComm to sell LoJack for Laptops through major U.S. retailers.

- LoJack for Laptops named Editors’ Choice by PC Magazine.

- Received the Lenovo Top Supplier Award.

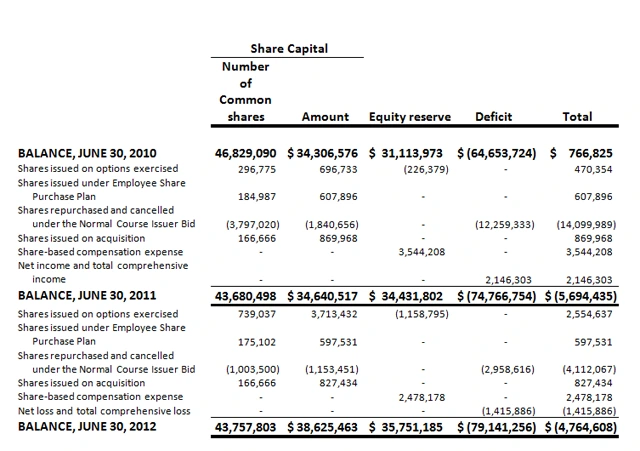

- Repurchased 1,003,500 shares for a total of $4.1 million under Company’s Normal Course Issuer Bids.

“We are pleased with the 19% commercial sales growth we delivered in fiscal 2012,” said John Livingston, CEO of Absolute. “During the year, we made good progress in all of our expansion markets: healthcare, government, corporate and international. Computrace now is becoming a recognized layer of best practice for governance, risk management and compliance. Absolute Manage is now positioned as a visionary in the Gartner Magic Quadrant and our innovative Mobile Device solutions have entered a rapid growth phase. Correspondingly, we delivered 32% growth in international sales, a 7% sales increase for our theft management offerings and a 67% improvement in sales for our device management and data security solutions.”

Mr. Livingston continued: “Over the past three years, we have built a solid sales foundation that is highly productive. We believe that increased sales capacity and continued product innovation will allow us to fully capitalize on the large market opportunity in front of us. Accordingly, in the fourth quarter of fiscal 2012 we increased our spend levels in sales and marketing and research and development, and we expect to maintain this spending level with further modest increases through fiscal 2013. This positions us to increase growth in the second half of fiscal 2013 and into fiscal 2014, as we bring these teams up to speed. We are confident that we have entered fiscal 2013 with the right products, strategy and resources in place to deliver another year of growth.”

F2012 Year-End and Q4 Financial Review

Absolute’s F2012 year-end and Q4 results are the Company’s fourth set of consolidated financial statements prepared in U.S. dollars and under IFRS. For more detailed information regarding the Company’s transition to IFRS, including a reconciliation of the Company’s F2011 year-end and Q4 results as originally reported in Canadian Generally Accepted Accounting Principles (CGAAP) to IFRS, please refer to the Company’s financial statements and MD&A filings on SEDAR at www.sedar.com.

F2012 Sales Contracts grew 12% to $88.7 million from $79.1 million in F2011. The year-over-year increase reflects strong Commercial sales, which grew 19% to $81.5 million from $68.3 million in F2011. For Q4-F2012, Sales Contracts were $23.8 million, up 5% from $22.8 million for Q4-F2011. Q4-F2012 commercial sales were $22.7 million, up 8% from $21.1 million in Q4-F2011.

Commercial Sales Contracts for Absolute’s flagship theft management products(5) (previously referred to as “theft recovery”) were $57.4 million for F2012. This was up 7% from $53.8 million in F2011, demonstrating continued demand for the Company’s unique theft management and investigative response services. For Q4-F2012, Commercial Sales Contracts for theft management products were $15.6 million, in line with Q4-F2011.

F2012 Commercial Sales Contracts from Absolute’s device management and data security products(6) (previously referred to as “non-theft management”) were $24.1 million. This was up 67% compared to $14.5 million for F2011 as a result of robust demand, particularly for Absolute Manage and Mobile Device Management offerings. For Q4-F2012, Commercial Sales Contracts from Absolute’s device management and data security products were $7.1 million, up 30% from $5.5 million for Q4-F2011.

Driven by strong commercial sales in all of the Company’s target regions outside of North America, international Sales Contracts increased 32% to $10.6 million in F2012, up from $8.0 million in F2011. International Sales Contracts were $1.9 million for Q4-F2012, up 37% from $1.4 million in Q4-F2011.

For F2012, Sales Contracts for consumer solutions were $7.2 million, or 8% of Sales Contracts, compared to $10.8 million, or 14% of Sales Contracts, in F2011. The year-over-year decrease was primarily due to two factors, one: the planned reduction of a low margin, high volume OEM bundle program; two: a decline in retail sales in Q4-F2012 as the Company transitioned to new in-store gift card programs, which it launched subsequent to year-end. For Q4-F2012, Sales Contracts for consumer solutions were $1.1 million, or 5% of Sales Contracts, compared to $1.7 million, or 7% of Sales Contracts, in Q4-F2011.

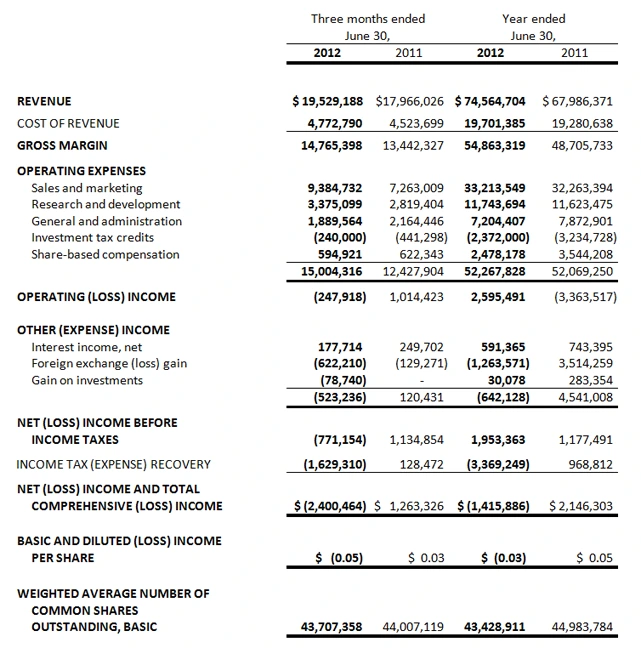

Revenue for F2012 was $74.6 million, a 10% increase from $68.0 million in F2011. For Q4-F2012, revenue was $19.5 million, up 9% from $18.0 million in Q4-F2011. Indicative of the Company’s Software-as-a-Service (SaaS) business model, revenue primarily represents the amortization of deferred revenue balances from recurring term license sales. For F2012, 78% of revenue was related to the drawdown of deferred revenue balances accumulated to the end of the prior fiscal year.

Adjusted Operating Expenses(3) for F2012 were $64.1 million. This was up 3% from $62.5 million in F2011, as the Company made strategic investments in the business, particularly in Research and Development and Sales and Marketing to support high-growth areas of the business, the majority of which were reflected in Q4-F2012. Adjusted Operating Expenses for Q4-F2012 were $17.9 million, up 19% from $15.0 million for Q4-F2011.

Absolute generated Adjusted Operating Income(4) of $10.4 million in F2012, up 89% from an Adjusted Operating Income of $5.5 million in F2011. For Q4-F2012, Adjusted Operating Income was $1.7 million, down 44% from $3.0 million for Q4-F2011, reflecting the Company’s increased investments in the quarter.

Absolute recorded a net loss of $1.4 million in F2012, compared to net income of $2.1 million in F2011. The Company’s annual net income results were significantly affected by foreign exchange gains and losses and income tax charges, with the Company recording a combined $4.6 million charge for foreign exchange losses and income taxes in F2012 compared to a combined net gain of $4.5 million in F2011. Absolute generated a net loss of $2.4 million for Q4-F2012 compared to net income of $1.3 million for Q4-F2011.

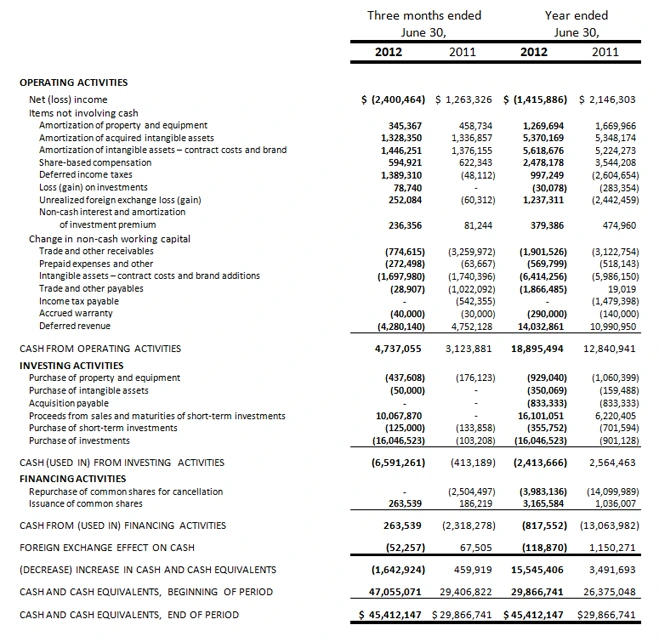

Cash from operating activities was $18.9 million for F2012, up 47% from $12.8 million in F2011. Cash from operating activities for Q4-F2012 increased 52% to $4.7 million from $3.1 million in Q4-F2011.

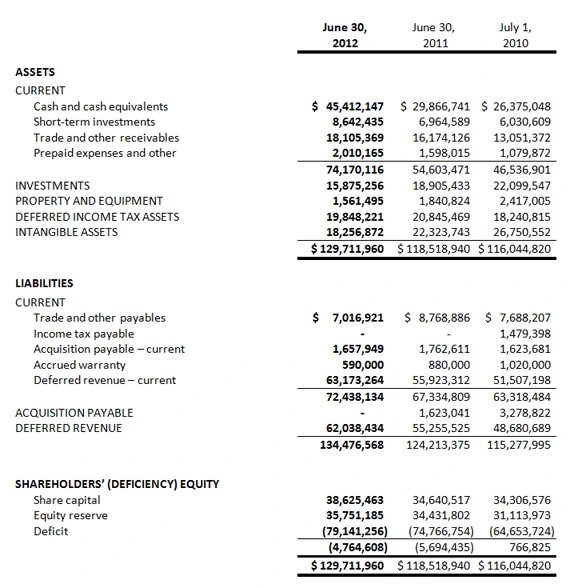

At June 30, 2012, Absolute had cash, cash equivalents and investments of $69.9 million compared to $55.7 million at June 30, 2011.

Annual Filings

Management’s discussion and analysis (“MD&A”), consolidated financial statements and notes thereto for F2012 can be obtained today from Absolute’s corporate website at www.absolute.com. The documents will also be available at www.sedar.com.

Notice of Conference Call

Absolute Software will hold a conference call to discuss the Company’s F2012 Year-End and Q4 results on Monday, August 13, 2012 at 2:00 p.m. PT (5:00 p.m. ET). All interested parties can join the call by dialing 647-427-7450, or 1-888-231-8191. Please dial-in 15 minutes prior to the call to secure a line. The conference call will be archived for replay until Monday, August 20, 2012 at midnight.

A live audio webcast of the conference call will be available at www.absolute.com and www.newswire.ca. Please connect at least 15 minutes prior to the conference call to ensure adequate time for any software download that may be required to join the webcast. An archived replay of the webcast will be available for 365 days at www.newswire.ca. To access the archived conference call, please dial 416-849-0833, or 1-855-859-2056 and enter the reservation code 15665192.

Non-IFRS Measures and Definitions

Throughout this press release, we refer to a number of measures which we believe are meaningful in the assessment of the Company’s performance. All these metrics are non-standard measures under International Financial Reporting Standards (“IFRS”), and are unlikely to be comparable to similarly titled measures reported by other companies. Readers are cautioned that the disclosure of these items is meant to add to, and not replace, the discussion of financial results or cash flows from operations as determined in accordance with IFRS. For a discussion of the purpose of these non-IFRS measures, please refer to the Company’s Fiscal 2012 MD&A on SEDAR at www.SEDAR.com.

These measures, as well as their method of calculation or reconciliation to IFRS measures, are as follows:

1) Sales Contracts

See the “Subscription Business Model” section of the MD&A for a detailed discussion of why we believe Sales Contracts (also known as “bookings”) provide a meaningful performance metric. Sales Contracts are included in deferred revenue (see Note 10 of the Notes to the Consolidated Financial Statements), and result from invoiced sales of our products and services.

2) Basic and diluted Cash from Operating Activities per share

As a result of the nature of our revenues (please refer to “Subscription Business Model” in the MD&A), we use Cash from Operating Activities as a measure of profitability. Accordingly, we believe that Cash from Operating Activities per share is a meaningful indicator of profitability per share. Cash from Operating Activities per share is calculated by dividing Cash from Operating Activities by the average number of shares outstanding for the period (basic), or using the treasury stock method (diluted).

3) Adjusted Operating Expenses

A number of significant non-cash expenses are reported in our Cost of Revenue and Operating Expenses. Management believes that analyzing these expenses exclusive of these non-cash items provides a useful measure of the cash invested in the operations of its business. The non-cash items excluded in the determination of Adjusted Operating Expenses are share-based compensation and amortization of acquired intangible assets. For a description of the reasons these items are adjusted, please refer to the Fiscal 2012 MD&A.

4) Adjusted Operating Income (Loss)

Management believes that analyzing operating results exclusive of significant non-cash items provides a useful measure of the Company’s performance. Adjusted Operating Income (Loss) refers to IFRS operating income excluding charges for share-based compensation and amortization of acquired intangible assets.

5) Theft Management products (previously referred to as “theft recovery” products)

Management defines the Company’s theft management product line as Computrace products that include an investigations and recovery services component.

6) Device Management and Data Security products (previously referred to as “Non-Theft recovery” products)

Management defines the Company’s device management and data security product line as are defined as our Absolute Manage and Absolute Secure Drive products, as well as Computrace products that do not include an investigations and recovery services component (for example, Absolute Track and Computrace Data Protection).