Continued Momentum in Enterprise and Government Sector Sales Combined with Strong Operating Cash Generation

VANCOUVER, British Columbia – November 12, 2019 – Absolute (TSX: ABT) (“Absolute” or the “Company”), the leader in endpoint resilience, today announced its financial results for the three months ended September 30, 2019. All dollar figures are stated in U.S. dollars, unless otherwise indicated.

First Quarter Fiscal 2020 Financial Highlights

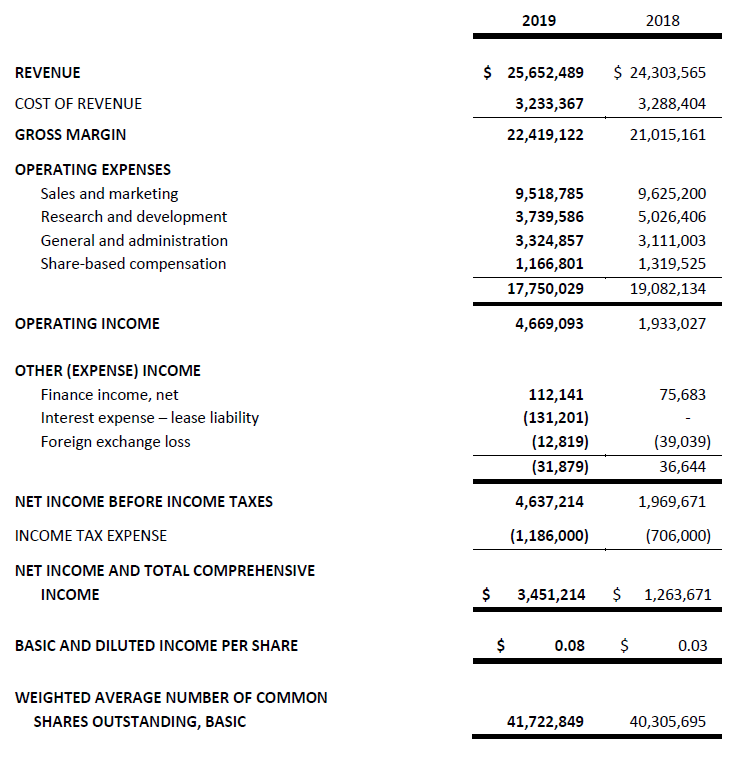

- Total revenue in Q1-F2020 was $25.7 million, representing a year-over-year increase of 6%.

- The Annual Contract Value Base(1) (“ACV Base”) at September 30, 2019 was $99.1 million, representing an increase of 7% over the prior year balance and a sequential increase of 1% over Q4-F2019.

- The Enterprise sector portion of the ACV Base increased by 11% annually and by 3% sequentially. Enterprise sector customers represented 56% of the ACV Base at September 30, 2019.

- The Government sector portion of the ACV Base increased by 13% annually and by 3% sequentially. Government sector customers represented 12% of the ACV Base at September 30, 2019.

- The Education sector portion of the ACV Base decreased by 2% annually and decreased by 2% sequentially. Education sector customers represented 32% of the ACV Base at September 30, 2019.

- Incremental ACV from New Customers was $1.1M in Q1-F2020, compared to $1.0 million in Q1-F2019.

- Net ACV Retention from existing customers was 100% in Q1-F2020, compared with 101% in Q1-F2019.

- Adjusted EBITDA in Q1-F2020 was $7.1 million, or 28% of revenue. Adjusted EBITDA – pre-IFRS 16 was $6.6 million, or 26% of revenue, compared to $4.1 million, or 17% of revenue, in Q1-F2019.

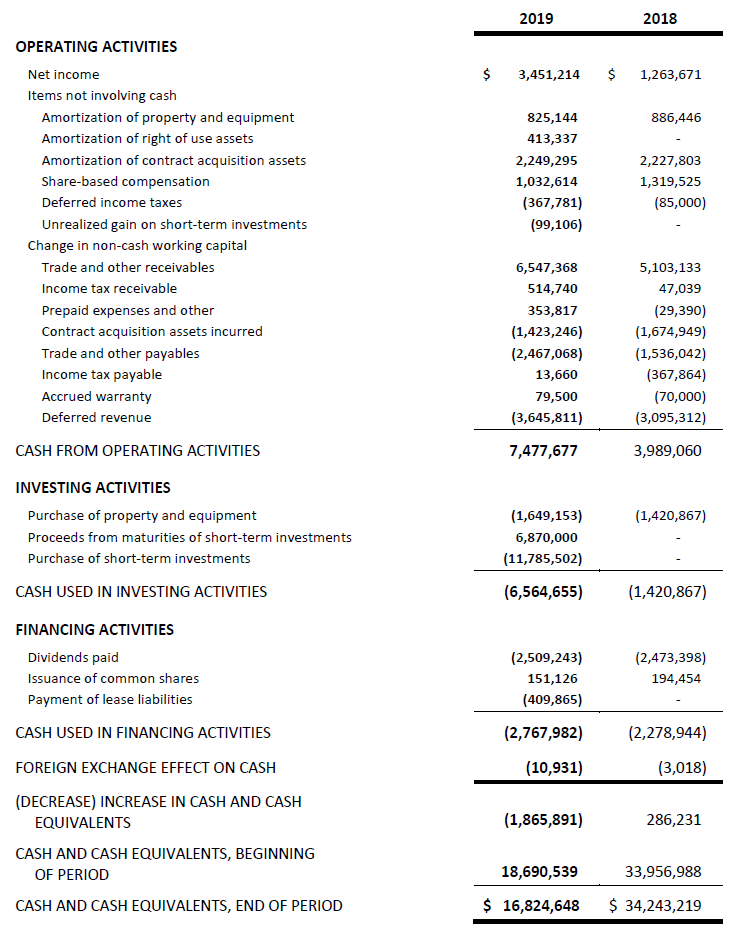

- Cash generated from operating activities in Q1-F2020 was $7.5 million. Cash from operating activities – pre-IFRS 16 in Q1-F2020 was $7.1 million, compared to $4.0 million in Q1-F2019.

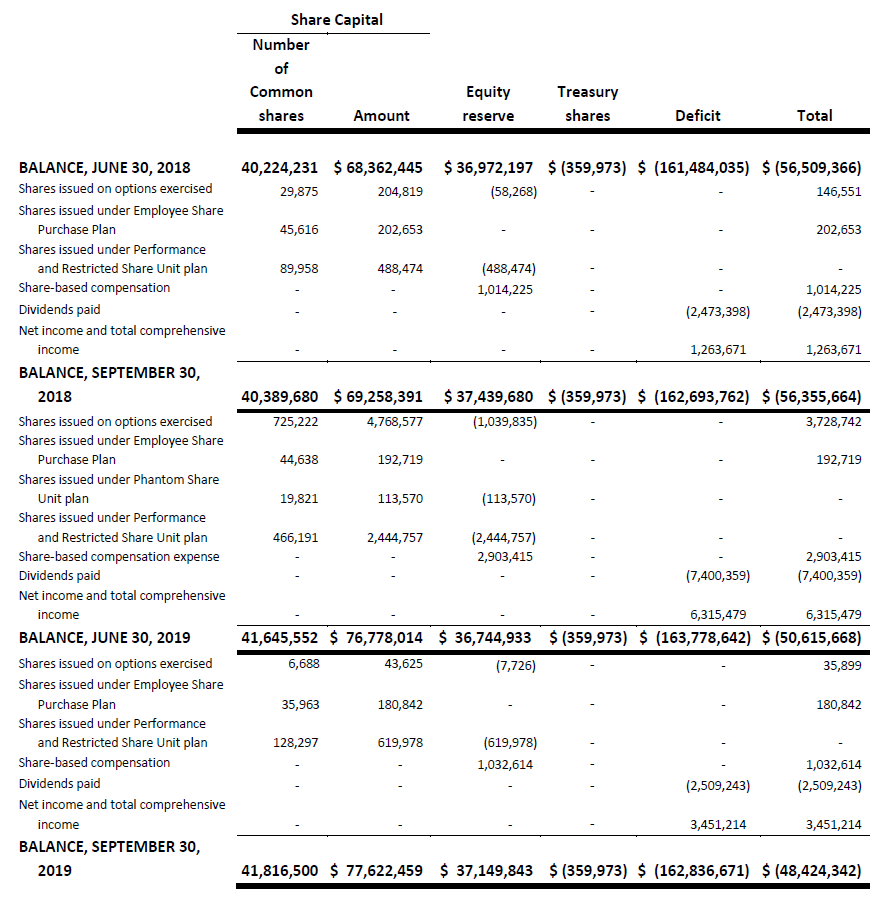

- Absolute paid a quarterly dividend of CAD$0.08 per common share during Q1-F2020.

“Q1 was a solid start to the fiscal year; we are pleased with our results, which continue to be accentuated by double-digit growth across enterprise and government businesses and healthy profit margins,” said Christy Wyatt, CEO at Absolute. “As the endpoint continues to be the attack vector of emphasis, we continue to innovate and extend the foundational capabilities of the Absolute platform to deliver a more sophisticated set of solutions. This is enabling our customers to make a fundamental shift, from thinking simply about traditional endpoint security to building true enterprise resiliency.”

Quarterly Developments

- In July 2019, we released significant updates to our Enterprise Resilience Edition, simplifying security policy deployments and remote management of device fleets. The new release provides customers with increased operational efficiency, on-demand support through live chat, and automated ability to apply and adjust security policies across computing devices. The release also extended the self-healing capabilities of Application Persistence to the latest versions of Ivanti® Management Suite.

- In August 2019, we announced the appointment of Lynn Atchison to our Board of Directors. Ms. Atchison also joined the Audit Committee of the Board. Ms. Atchison is a seasoned technology executive with more than three decades of financial and operational leadership. Most recently, Ms. Atchison was the CFO of Spredfast, a provider of enterprise social media management software. Prior to that, she served as the CFO of the online vacation rental marketplace HomeAway. She also currently serves on the boards of Q2 Software, Convey, and RealMassive, in addition to being a member of original steering committee for Women@Austin and an Advisory Board Member of Philanthropitch.

- In September 2019, Absolute was recognized as a leader in the G2 Fall 2019 Grid® Report for Endpoint Management Software. The report highlights top-reviewed endpoint management solutions that enable companies to manage and secure endpoint infrastructure and ensure their endpoint protection software is present and healthy. Ninety eight percent of reviewers gave either four-star or five-star ratings for the Absolute platform and 93 percent of total reviewers said they were likely to recommend Absolute.

- In September 2019, we introduced a significant redesign of the Absolute console with a new visually-rich, flexible dashboard that includes customizable widgets, reports and alerts. This UI enhancement enables IT and security teams to detect under-utilized devices, quickly spot vulnerabilities, and take immediate action to neutralize risks.

- Subsequent to Q1-F2020, we announced the introduction of a new research report titled, “Cybersecurity and Education: The State of the Digital District in 2020,” focused on the state of IT security, staff and student safety, and endpoint device health in K-12 organizations. The report’s findings highlight the crisis the education sector is facing as schools grapple with high levels of risk exposure – driven in large part by complex IT environments and digitally savvy student populations – that have made them a prime target for cybercriminals and ransomware attackers.

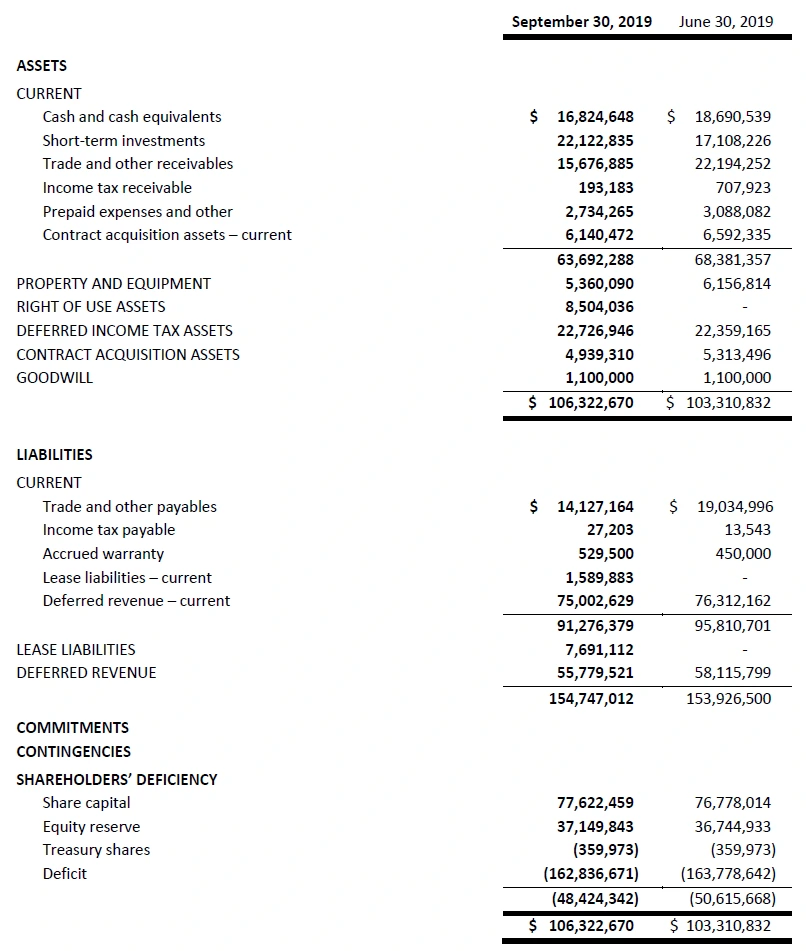

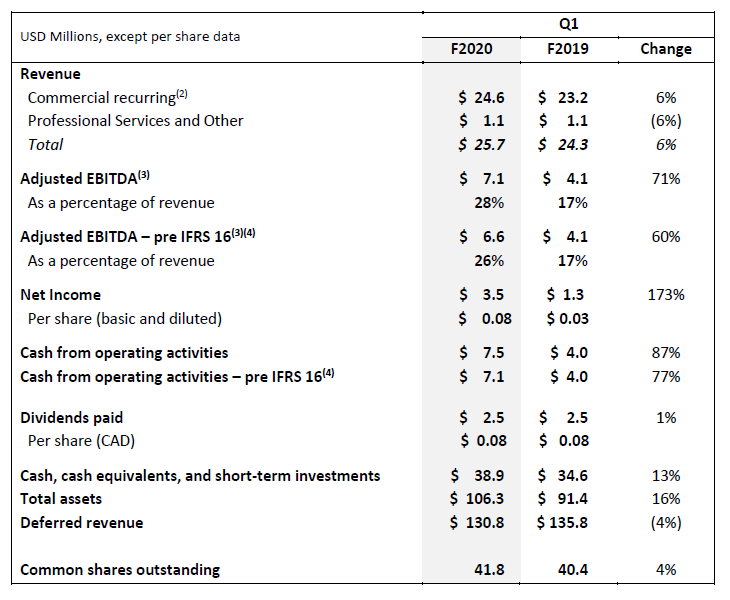

Summary of Key Financial Metrics

Notes:

- Please refer to the “Non-IFRS Measures and Definitions” section of this press release for a further discussion on this measure.

- Commercial recurring revenue represents revenue derived from Cloud Services (as defined below) and recurring managed professional services, both of which are included as part of our ACV Base. Other revenue represents revenue derived from non-recurring professional services and ancillary product lines, including consumer products.

- Throughout this document, “Adjusted EBITDA” is used as a profitability measure. Please refer to the “Non-IFRS Measures and Definitions” section of this press release for further discussion on this measure.

- The Company adopted IFRS 16, “Leases”, effective July 1, 2019 using the modified retrospective approach (please refer to the “New Accounting Pronouncements” section of the Q1-F2020 MD&A and to Note 2(e) in the notes to the Q1-F2020 Condensed Consolidated Financial Statements). Accordingly, financial information presented for fiscal 2019 has not been adjusted for the impact of the adoption of IFRS 16. Figures presented that include the title “pre-IFRS 16” represent operating results had IFRS 16 not been adopted, and provide a meaningful comparative to similar operating results for F2019.

F2020 Corporate Outlook

The Company’s outlook for F2020 is unchanged and is as follows:

- Revenue is expected to be between $103 million and $106 million, representing 4% to 7% annual growth.

- Adjusted EBITDA is expected to be between 18% and 22% of revenue.

- Cash from operating activities is expected to be between 16% and 22% of revenue.

- Capital expenditures are expected to be between $3.5 million and $4.0 million.

The Company’s forecast for Adjusted EBITDA and cash from operating activities incorporates the impact of IFRS 16, “Leases”, which was adopted July 1, 2019. IFRS 16 is expected to positively impact both F2020 Adjusted EBITDA and cash from operating activities by approximately $2.0 million as a result of amortization of right of use assets and from increased interest expense. See “New Accounting Pronouncements” in the Company’s September 30, 2019 MD&A.

The foregoing expectations constitute forward-looking information and financial outlook and are qualified in their entirety by the cautionary statement below.

Quarterly Dividend

On October 21, 2019, the Company declared a quarterly dividend of CAD$0.08 per share on its common shares, payable in cash on November 29, 2019 to shareholders of record at the close of business on November 8, 2019.

Quarterly Filings

Management’s Discussion and Analysis (“MD&A”) and Consolidated Financial Statements and the notes thereto for the fiscal period ended September 30, 2019 can be obtained today from Absolute’s corporate website at www.absolute.com. The documents will also be available under Absolute’s profile at www.sedar.com.

Notice of Conference Call

Absolute will hold a conference call to discuss its Q1-F2020 financial results on Tuesday, November 12, 2019, at 5:00 p.m. ET (2:00 p.m. PT). All interested parties can join the call by dialing 647-427-7450 or 1-888-231-8191. Please dial in 15 minutes prior to the call to secure a line. The conference call will be archived for replay until Tuesday, November 19, 2019, at midnight ET. To access the archived conference call, please dial 416-849-0833 or 1-855-859-2056 and enter the reservation code 8457438.

A live audio webcast of the conference call will be available at www.absolute.com and http://bit.ly/2X8uIKp. Please connect at least 15 minutes prior to the conference call to ensure adequate time for any software download that may be required to join the webcast. An archived replay of the webcast will be available on the Company’s website for 90 days.

Non-IFRS Measures and Definitions

Throughout this press release, the Company refers to a number of measures that the Company believes are meaningful in the assessment of the Company’s performance. All these metrics are nonstandard measures under International Financial Reporting Standards (“IFRS”), and are unlikely to be comparable to similarly titled measures reported by other companies. Readers are cautioned that the disclosure of these items is meant to add to, and not replace, the discussion of financial results or cash flows from operations as determined in accordance with IFRS. For a discussion of the purpose of these non-IFRS measures, please refer to the Company’s MD&A for the period ended June 30, 2019.

These measures, as well as their method of calculation or reconciliation to IFRS measures, are as follows:

-

ACV Base, Net ACV Retention and ACV from New Customers

As the majority of the Company’s customer contracts are sold under multiyear term licenses, there is a significant lag between the timing of the billing and the associated revenue recognition. As a result, the Company focuses on the aggregate annualized value of its subscriptions under contract, measured by Annual Contract Value, as an indicator of its future revenues.

The ACV Base measures the amount of recurring annual revenue Absolute will receive from its commercial customers under contract at a point in time, and therefore is an indicator of the Company’s future revenue streams. Net ACV Retention measures the percentage increase or decrease in the Commercial ACV Base at the end of a period for the customers that made up the Commercial ACV Base at the beginning of the same period. This metric provides insight into the effectiveness of Absolute’s customer retention and expansion functions. ACV from New Customers measures the addition to the Commercial ACV Base from sales to new commercial customers during the quarter.

We believe that increases in the amount of ACV from New Customers, and improvement in the Company’s Net ACV Retention, will grow our Commercial ACV Base and, in turn, our future revenues.

-

Adjusted EBITDA and Adjusted EBITDA – pre-IFRS 16

Management believes that analyzing operating results exclusive of significant noncash items or items not controllable in the period provides a useful measure of the Company’s performance. The term “Adjusted EBITDA” refers to earnings before deducting interest and investment gains (losses), income taxes, amortization of intangible assets and property and equipment, foreign exchange gain or loss, share-based compensation, and restructuring and reorganization charges and post-retirement benefits. The items excluded in the determination of Adjusted EBITDA are share-based compensation, amortization of intangibles, amortization of property and equipment, and restructuring and reorganization charges and certain post-retirement benefits.

Management believes that presenting F2020 Adjusted EBITDA on a pre-IFRS 16 basis will provide a meaningful comparative to F2019 Adjusted EBITDA.