Net Income and Adjusted EBITDA(1) Increase by More Than 100 Percent Over Prior Year Period

VANCOUVER, British Columbia – May 6, 2019 – Absolute (TSX: ABT) (“Absolute” or the “Company”), the leader in endpoint resilience, today announced its financial results for the three and nine month periods ended March 31, 2019. All dollar figures are unaudited and stated in U.S. dollars, unless otherwise indicated.

“Enterprises are expected to spend over $124 billion on IT security this year(2), much of it on endpoint controls, and yet, 70 percent of all breaches occur on the endpoint(3). The layering of multiple agents, the fragmentation, complexity and scale, can result in the vulnerability or decay of endpoint controls,” said Christy Wyatt, Chief Executive Officer at Absolute. “Absolute’s opportunity is tremendous, being uniquely positioned to help the modern enterprise with our persistence and resilience offerings which fill a critical gap in healing endpoints and maintaining compliance.”

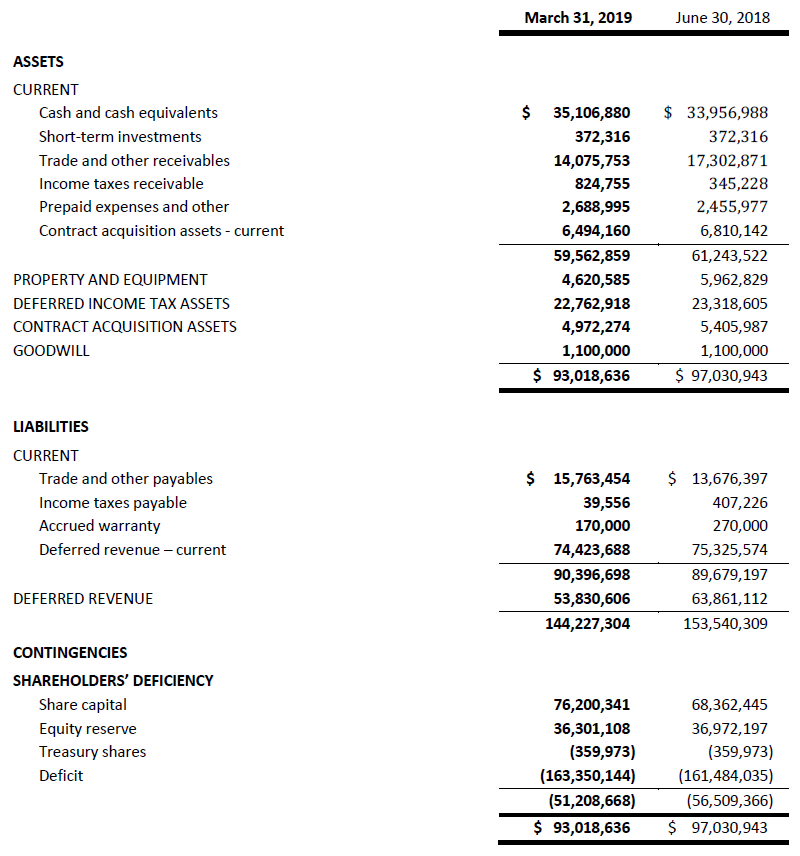

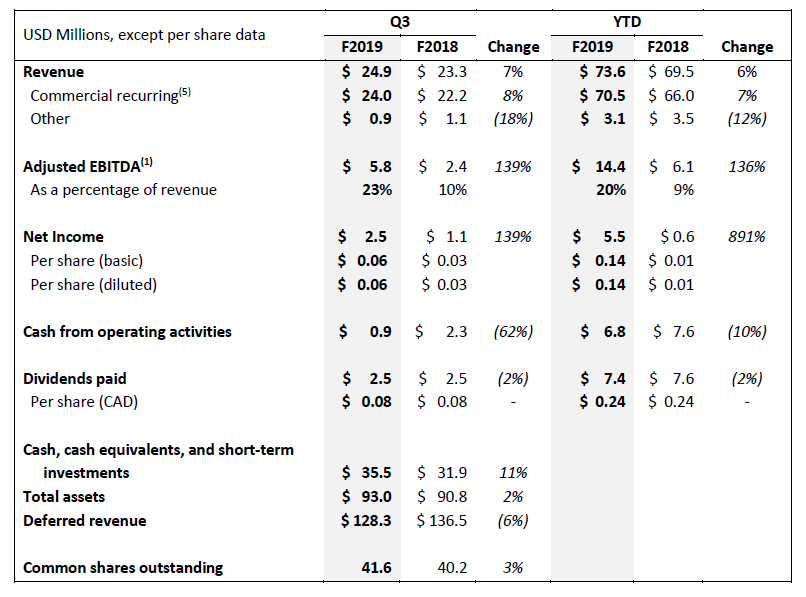

Key Financial Metrics

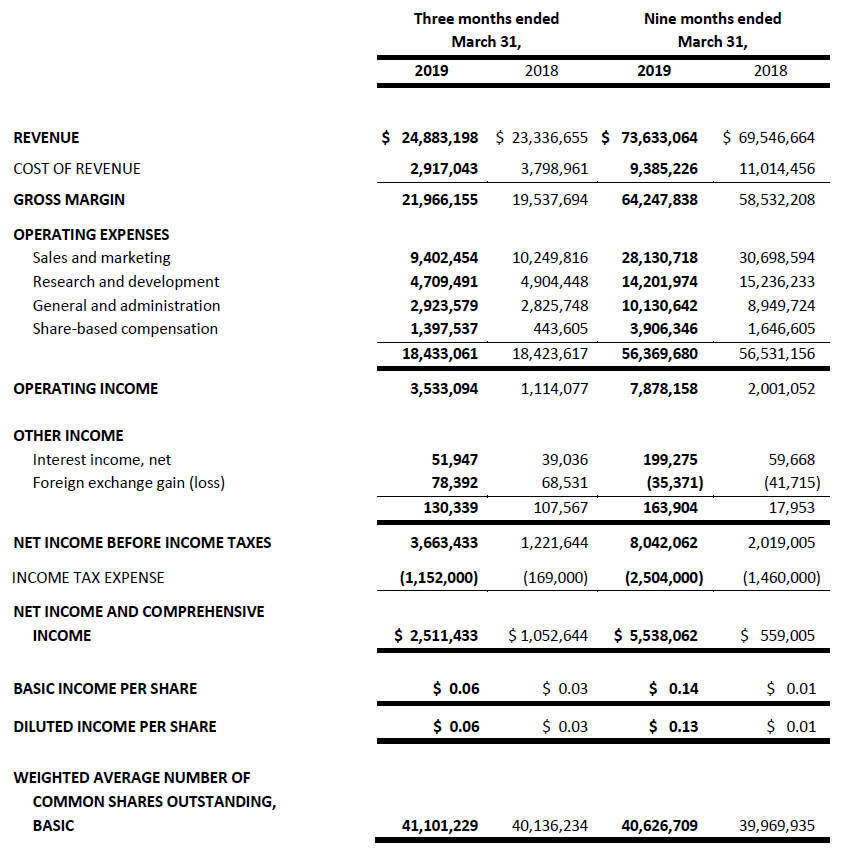

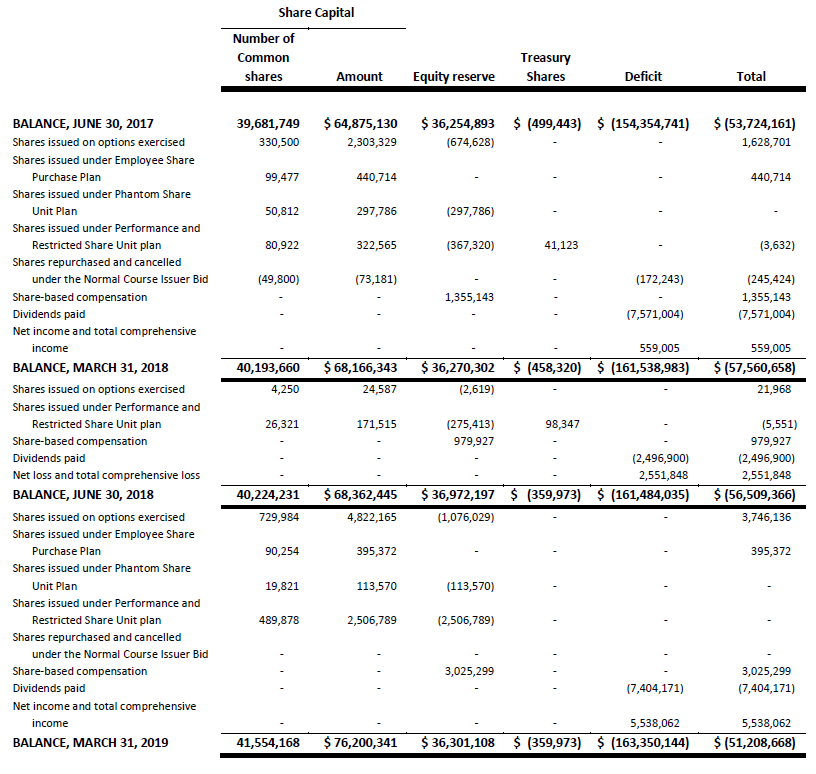

- Total revenue in Q3-F2019 was $24.9 million, representing a year-over-year increase of 7%. Year-to-date total revenue was $73.6 million, representing an increase of 6% over the prior year-to-date period.

- Commercial recurring revenue in Q3-F2019 was $24.0 million, representing a year-over-year increase of 8%. Year-to-date commercial recurring revenue was $70.5 million, representing an increase of 7% over the prior year-to-date period.

- Adjusted EBITDA in Q3-F2019 was $5.8 million, up 139% from $2.4 million in Q3-F2018. Adjusted EBITDA margin expanded to 23% in Q3-F2019 compared to 10% in the prior year period. Year-to-date Adjusted EBITDA was $14.4 million, representing an increase of 136% from $6.1 million in the prior year-to-date period. Year-to-date Adjusted EBITDA margin of 20% compares to 9% in the prior year-to-date period.

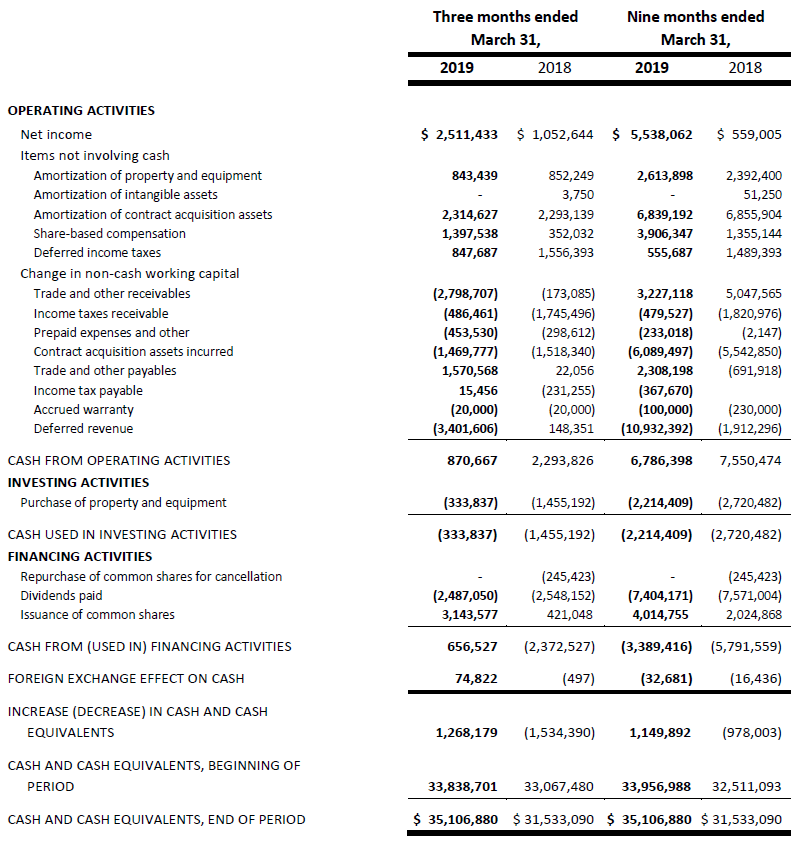

- Cash generated from operating activities in Q3-F2019 was $0.8 million, compared with $2.3 million in Q3-F2018. Year-to-date cash from operating activities was $6.8 million, compared with $7.6 million in the prior year-to-date period.

- The Annual Contract Value (“ACV”) Base at March 31, 2019 was $95.2 million, an increase of 5% year-over-year and relatively unchanged from the prior quarter. This performance was driven by a combination of incremental ACV from new customers of $1.1 million in Q3-F2019, compared to $0.8 million in Q3-F2018, and Net ACV Retention from existing customers of 99%, compared to 100% a year ago.

- The Enterprise(4) sector portion of the ACV Base increased 9% year-over-year and was relatively unchanged sequentially. Enterprise customers represented 53% of the ACV Base at March 31, 2019.

- The Government(4) sector portion of the ACV Base increased 19% year-over-year and was up 2% sequentially. Government customers represented 12% of the ACV Base at March 31, 2019.

- The Education(4) sector portion of the ACV Base decreased 3% from the prior year and decreased 1% sequentially. Education customers represented 35% of the ACV Base at March 31, 2019.

- Absolute paid a quarterly dividend of CAD$0.08 per common share during Q3-F2019.

Organizational Developments

- In March 2019, Absolute announced the appointment of Dr. Nicko van Someren as the Company’s new Chief Technology Officer. Dr. van Someren has more than two decades of experience leading, developing and bringing to market disruptive security technologies. He previously served as Chief Security Officer and Chief Information Officer at nanopay, a financial services technology company where he was responsible for all security and IT operations. Dr. van Someren has also served as Chief Technology Officer at the Linux Foundation, Good Technology (now a part of BlackBerry) and nCipher (recently acquired by Entrust Datacard), as well as the Chief Security Architect at Juniper Networks, and also serves as an advisor to numerous startups and security businesses.

- In February 2019, Absolute was recognized as a leader in the G2 Crowd Grid® Winter 2019 Report for Endpoint Management. The report spotlights top-reviewed endpoint management solutions that enable companies to manage and secure endpoint infrastructure and ensure their endpoint protection software is present and healthy. All reviewers gave either four-star or five-star ratings for the Absolute platform, recognizing Absolute for Best Overall Endpoint Management Software, Best Mid-Market Endpoint Management Software and Best Customer Relationships. The rankings for Absolute indicate very high customer satisfaction with 97% of reviewers providing an average rating of 4.6 out of 5 stars and 91% confirming they would recommend Absolute.

- In February 2019, Absolute was again selected for the British Columbia’s Top Employers of the Year list. The BC’s Top Employers of the Year annual ranking recognizes those organizations that serve as an example within their industry, offering exceptional benefits and professional development opportunities for staff while achieving and sustaining business growth. Absolute was also selected as a BC Top Employer in 2018.

Summary of Key Financial Metrics

Notes:

- “Adjusted EBITDA” is used as a profitability measure. Please refer to the “Non-IFRS Measures” section of our Q3-F2019 MD&A for further discussion on this measure.

- Gartner forecasts worldwide information security spending to exceed 124 billion in 2019.

- IDC says 70% of breaches originate on the endpoint.

- In Q1-F2019, we modified the allocation of some customer accounts between industry verticals, primarily the allocation of some quasi-governmental organizations from the Enterprise vertical to the Government vertical, which was previously included in a “Public” vertical. This reallocation was applied retrospectively, and has resulted in a revision to previously reported ACV Base and ACV Base growth figures for those verticals in historical periods. Please refer to the “Annual Contract Value Base” section of our Q3-F2019 MD&A.

- Commercial recurring revenue represents revenue derived from Cloud Services (as defined in our Q3-F2019 MD&A) and recurring managed professional services, both of which are included as part of our ACV Base. Other revenue represents revenue derived from non-recurring professional services and ancillary product lines, including consumer products.

F2019 Corporate Outlook

The Company is updating its outlook for F2019 as follows:

- The Company is narrowing its expectation for revenue from between $96.0 million and $99.0 million to between $97.5 million and $99.0 million;

- The Company is increasing its expectation for Adjusted EBITDA from between 16% and 19% of revenue to between 18% and 20% of revenue;

- The Company is decreasing its expectation for cash from operating activities from between 10% and 14% of revenue to between 8% and 12% of revenue; and

- The Company is decreasing its expectation for F2019 capital expenditures from between $3.5 million and $4.0 million to between $3.0 million and $3.5 million.

The foregoing expectations constitute forward-looking information and financial outlook and are qualified in their entirety by the cautionary statement below.

Quarterly Dividend

On April 19, 2019, the Company declared a quarterly dividend of CAD$0.08 per share on its common shares, payable in cash on May 29, 2019 to shareholders of record at the close of business on May 8, 2019.

Quarterly Filings

Management’s Discussion and Analysis (“MD&A”) and Interim Condensed Consolidated Financial Statements and the notes thereto for Q3-F2019 can be obtained today from Absolute’s corporate website at www.absolute.com. The documents will also be available under Absolute’s profile at www.sedar.com.

Notice of Conference Call

Absolute will hold a conference call to discuss its Q3-F2019 results on Monday, May 6, 2019, at 5:00 p.m. ET (2:00 p.m. PT). All interested parties can join the call by dialing 647-427-7450 or 888-231-8191. Please dial in 15 minutes prior to the call to secure a line. The conference call will be archived for replay until Monday, May 13, 2019, at midnight ET. To access the archived conference call, please dial 416-849-0833 or 1-855-859-2056 and enter the reservation code 4608779.

A live audio webcast of the conference call will be available at www.absolute.com and https://bit.ly/2UopV4B. Please connect at least 15 minutes prior to the conference call to ensure adequate time for any software download that may be required to join the webcast. An archived replay of the webcast will be available on the Company’s website for 90 days

Non-IFRS Measures and Definitions

Throughout this press release, the Company refers to a number of measures that the Company believes are meaningful in the assessment of the Company’s performance. All these metrics are nonstandard measures under International Financial Reporting Standards (“IFRS”), and are unlikely to be comparable to similarly titled measures reported by other companies. Readers are cautioned that the disclosure of these items is meant to add to, and not replace, the discussion of financial results or cash flows from operations as determined in accordance with IFRS. For a discussion of the purpose of these non-IFRS measures, please refer to the Company’s Q3-F2019 MD&A.

These measures, as well as their method of calculation or reconciliation to IFRS measures, are as follows:

-

ACV Base, Net ACV Retention and ACV from New Customers

As the majority of the Company’s customer contracts are sold under multiyear term licenses, there is a significant lag between the timing of the billing and the associated revenue recognition. As a result, the Company focuses on the aggregate annualized value of its subscriptions under contract, measured by Annual Contract Value, as an indicator of its future revenues.

The ACV Base measures the amount of recurring annual revenue Absolute will receive from its commercial customers under contract at a point in time, and therefore is an indicator of the Company’s future revenue streams. Net ACV Retention measures the percentage increase or decrease in the Commercial ACV Base at the end of a period for the customers that made up the Commercial ACV Base at the beginning of the same period. This metric provides insight into the effectiveness of Absolute’s customer retention and expansion functions. ACV from New Customers measures the addition to the Commercial ACV Base from sales to new commercial customers during the quarter.

We believe that increases in the amount of ACV from New Customers, and improvement in the Company’s Net ACV Retention, will grow our Commercial ACV Base and, in turn, our future revenues.

-

Adjusted EBITDA

Management believes that analyzing operating results exclusive of significant noncash items or items not controllable in the period provides a useful measure of the Company’s performance. The term “Adjusted EBITDA” refers to earnings before deducting interest and investment gains (losses), income taxes, amortization of intangible assets and property and equipment, foreign exchange gain or loss, share-based compensation, and restructuring and reorganization charges and post-retirement benefits. The items excluded in the determination of Adjusted EBITDA are share-based compensation, amortization of intangibles, amortization of property and equipment, and restructuring and reorganization charges and certain post-retirement benefits.

-

Adjusted Operating Expenses

A number of significant noncash or nonrecurring expenses are reported in the Company’s Cost of Revenue and Operating Expenses. Management believes that analyzing these expenses exclusive of these noncash or nonrecurring items provides a useful measure of the cash invested in the operations of its business. The items excluded in the determination of Adjusted Operating Expenses are share-based compensation, amortization of intangible assets, amortization of property and equipment, and restructuring and reorganization charges and certain post-retirement benefits. For a description of the reasons these items are adjusted, please refer to the “Non-IFRS Measures” section of the Q3-F2019 MD&A.