Reports 505% Increase in Net Income and 88% Increase in Adjusted EBITDA(1)

VANCOUVER, British Columbia – February 4, 2019 – Absolute (TSX: ABT) (“Absolute” or the “Company”), the endpoint visibility and control company, today announced financial results for the three and six month periods ended December 31, 2018. All dollar figures are unaudited and stated in U.S. dollars, unless otherwise indicated.

“I am very pleased to have joined Absolute at such an exciting time for the company as well as in the broader endpoint security market,” said Christy Wyatt, Chief Executive Officer at Absolute. “Endpoint resilience is an enterprise requirement that Absolute is uniquely positioned to address together with our strategic OEM partners. Our platform enables our unique resilience and intelligence capabilities that span across vendors and platforms to hundreds of millions of devices. These capabilities position us well for continued innovation to deliver against this critical customer need through focused execution.”

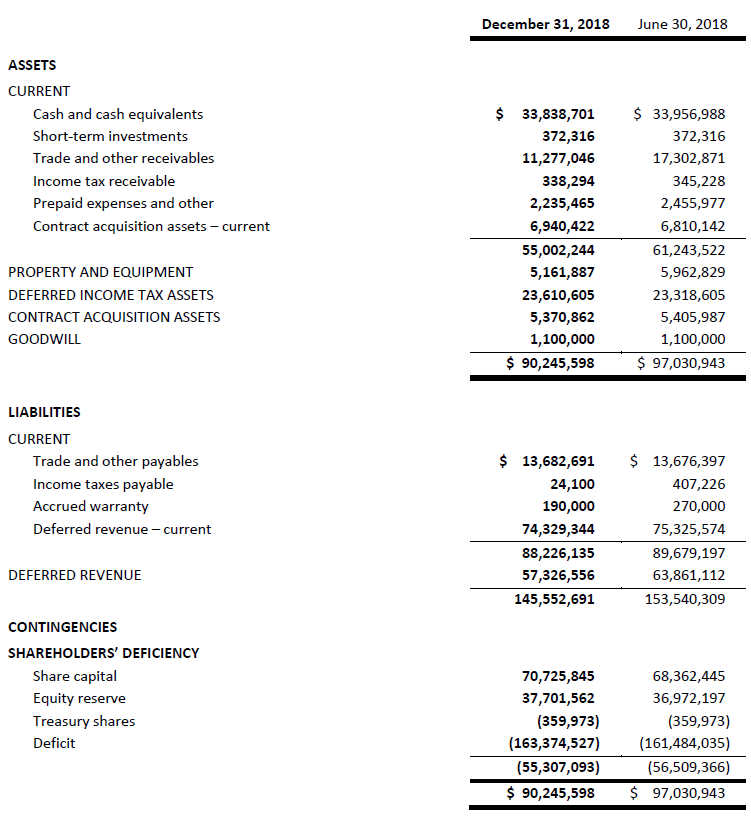

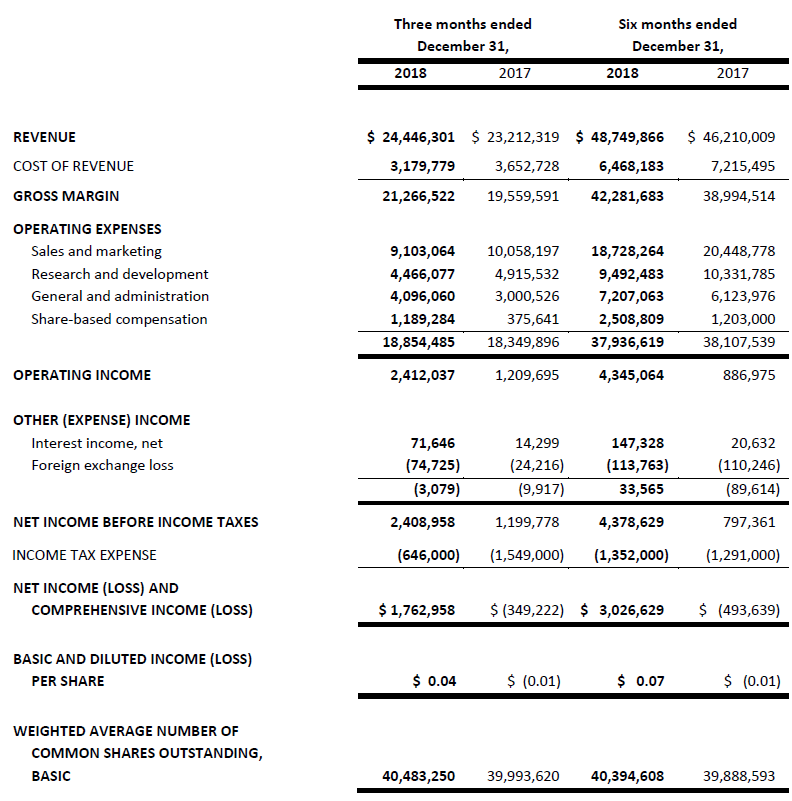

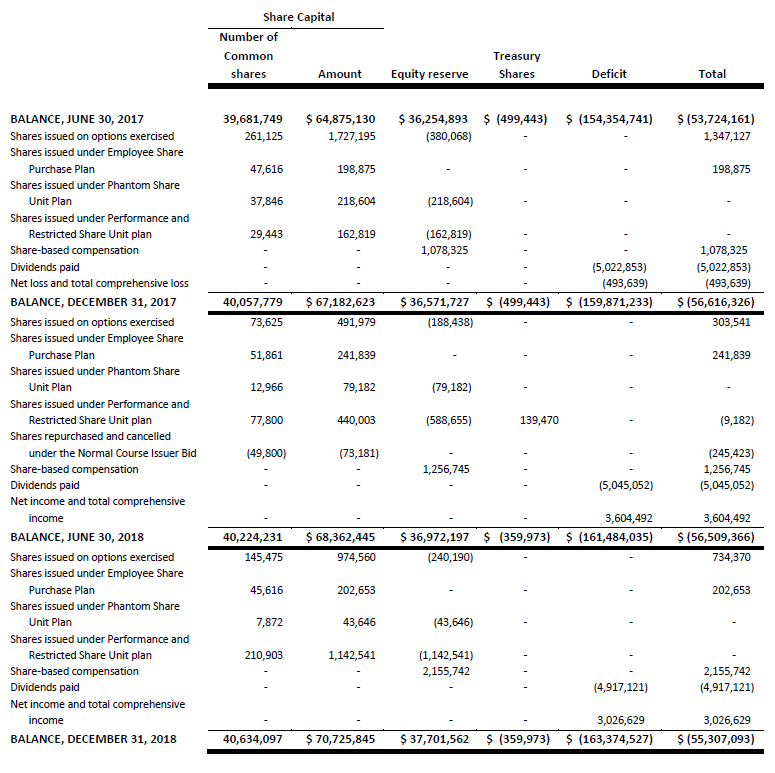

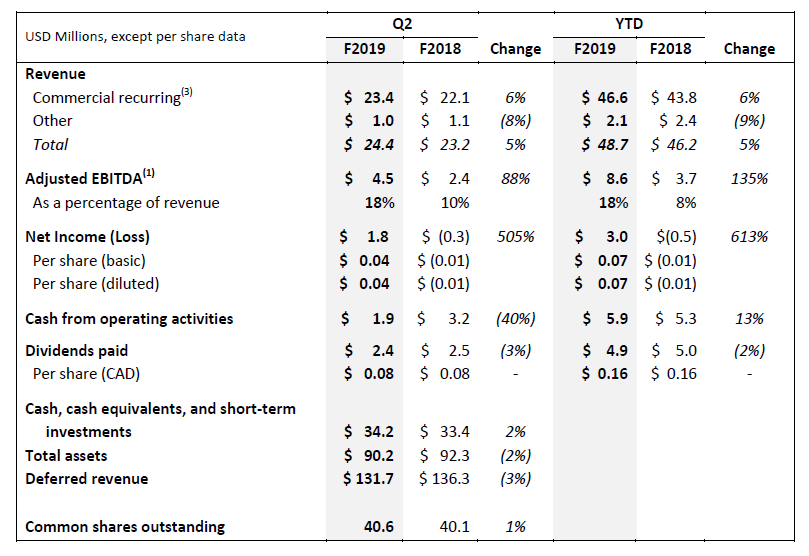

Key Financial Metrics

- Total revenue in Q2-F2019 was $24.4 million, representing a year-over-year increase of 5%. Year-to-date total revenue was $48.7 million, representing an increase of 5% over the prior year-to-date period.

- Commercial recurring revenue in Q2-F2019 was $23.4 million, representing a year-over-year increase of 6%. Year-to-date commercial recurring revenue was $46.6 million, representing an increase of 6% over the prior year-to-date period.

- The Annual Contract Value (“ACV”) Base at December 31, 2018, was $95.3 million, representing an increase of 6% year-over-year and 2% sequentially.

- The Enterprise(2) sector portion of the ACV Base increased 12% year-over-year and was up 3% sequentially. Enterprise customers represented 53% of the ACV Base at December 31, 2018.

- The Government(2) sector portion of the ACV Base increased 17% year-over-year and was up 4% sequentially. Government customers represented 12% of the ACV Base at December 31, 2018.

- The Education(2) sector portion of the ACV Base decreased 4% from the prior year and increased 1% sequentially. Education customers represented 35% of the ACV Base at December 31, 2018.

- Net ACV Retention from existing Absolute customers was 101% during Q2-F2019, compared with 100% in Q2-F2018.

- Incremental ACV from New Customers was $1.0 million in Q2-F2019 compared to $1.1 million in Q2-F2018.

- Adjusted EBITDA in Q2-F2019 was $4.5 million, or 18% of revenue, compared with $2.4 million, or 10% of revenue, in Q2-F2018. Year-to-date Adjusted EBITDA was $8.6 million, or 18% of revenue, compared with $3.7 million, or 8% of revenue, in the prior year-to-date period.

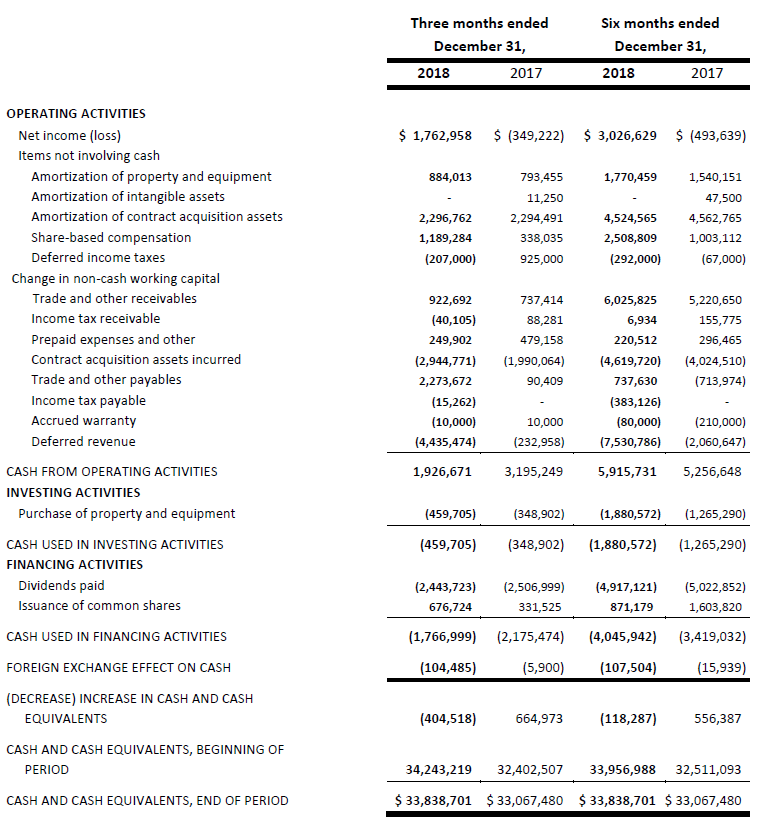

- Cash generated from operating activities in Q2-F2019 was $1.9 million compared with $3.2 million in Q2-F2018. Year-to-date cash from operating activities was $5.9 million compared with $5.3 million in the prior year-to-date period.

- Absolute paid a quarterly dividend of CAD$0.08 per common share during Q2-F2019.

Products and Organizational Developments

- In November 2018, Christy Wyatt was appointed as Chief Executive Officer, and subsequently joined the Board of Directors. Ms. Wyatt has a long history of scaling high-growth technology companies. Ms. Wyatt began her career as a software engineer and rose through the executive leadership ranks at a number of globally recognized technology companies. She has been named one of Inc. magazine’s Top 50 Women Entrepreneurs in America, CEO of the Year by Information Security Global Excellence Awards, and one of Fierce Wireless’s Most Influential Women in Wireless.

- In December 2018, we executed a site license agreement with one of the largest K-12 school districts in the U.S. to enforce safe and secure desktop, laptop and tablet usage amongst its students and staff.

- In December 2018, we completed Application Persistence for Dell Data Guardian and Dell Endpoint Security Suite Enterprise (“ESSE”), enabling Dell endpoint applications for data protection, advanced threat prevention and encryption to remain present and resilient. Application Persistence, which uses Absolute’s patented Persistence technology, monitors the health of applications across a device ecosystem and remediates those that have been compromised.

- In November 2018, we announced a new strategic partnership with VAIO Corporation to enhance endpoint security capabilities by integrating patented Absolute Persistence technology within the new VAIO Pro PA and VAIO A12 models. Together, VAIO and Absolute enable organizations to minimize risk and protect their data despite increasing mobility of remote workers and diminishing defense offered by the traditional network perimeter.

- In December 2018, we completed a new GDPR Compliance report identifying sensitive GDPR endpoint data that automatically scans for identifiers from all 31 European Economic Area (“EEA”) countries – providing last mile assurance for any lost or stolen devices, where proving absence of a breach is critical in the first 72 hours.

- In November 2018, the Absolute Reach Library was expanded with new query and remediation scripts, bringing the total number of scripts available to 44 at December 31, 2018. These scripts enable customers to further automate their endpoint management, hygiene, and vulnerability remediation across every endpoint, on and off the corporate network. The new scripts include automated workflows to conduct diagnostics across a fleet of endpoint devices, disable intrusive operating system processes, clear and restore tampered endpoint host files, reset administrative account passwords and modify administrative privileges.

- During Q2-F2019, the Company’s Board of Directors was reduced in size to six members.

Summary of Key Financial Metrics

Notes:

- “Adjusted EBITDA” is used as a profitability measure. Please refer to the “Non-IFRS Measures” section of our Q2-F2019 MD&A for further discussion on this measure.

- In Q1-F2019, we modified the allocation of some customer accounts between industry verticals, primarily the allocation of some quasi-governmental organizations from the Enterprise vertical to the Government vertical, which was previously included in the Public vertical. This reallocation was applied retrospectively, and has resulted in a revision to previously reported ACV Base and ACV Base growth figures for those verticals in historical periods. Please refer to the “Annual Contract Value Base” section of our Q2-F2019 MD&A.

- Commercial recurring revenue represents revenue derived from Cloud Services (as defined in our Q2-F2019 MD&A) and recurring managed professional services, both of which are included as part of our ACV Base. Other revenue represents revenue derived from non-recurring professional services and ancillary product lines, including consumer products.

F2019 Corporate Outlook

The Company is updating its outlook for F2019 as follows:

- The Company continues to expect revenue to be between $96.0 million and $99.0 million, representing 3% to 6% annual growth;

- The Company is increasing its expectation for Adjusted EBITDA from between 14% and 17% of revenue to between 16% and 19% of revenue;

- The Company continues to expect cash from operating activities to be between 10% and 14% of revenue; and

- The Company continues to expect capital expenditures to be between $3.5 million and $4.0 million.

The foregoing expectations constitute forward-looking information and financial outlook and are qualified in their entirety by the cautionary statement below.

Quarterly Dividend

On January 21, 2019, the Company declared a quarterly dividend of CAD$0.08 per share on its common shares, payable in cash on February 27, 2019 to shareholders of record at the close of business on February 6, 2019.

Quarterly Filings

Management’s Discussion and Analysis (“MD&A”) and Interim Condensed Consolidated Financial Statements and the notes thereto for Q2-F2019 can be obtained today from Absolute’s corporate website at www.absolute.com. The documents will also be available at www.sedar.com.

Notice of Conference Call

Absolute will hold a conference call to discuss the Company’s Q2-F2019 results on Monday, February 4, 2019, at 5:00 p.m. ET. All interested parties can join the call by dialing 647-427-7450 or 888-231-8191. Please dial in 15 minutes prior to the call to secure a line. The conference call will be archived for replay until Monday, February 11, 2019, at midnight ET. To access the archived conference call, please dial 416-849-0833 or 1-855-859-2056 and enter the reservation code 7889928.

A live audio webcast of the conference call will be available at www.absolute.com and https://bit.ly/2RDIhBq. Please connect at least 15 minutes prior to the conference call to ensure adequate time for any software download that may be required to join the webcast. An archived replay of the webcast will be available on the Company’s website for 90 days.

Non-IFRS Measures and Definitions

Throughout this press release, the Company refers to a number of measures that the Company believes are meaningful in the assessment of the Company’s performance. All these metrics are nonstandard measures under International Financial Reporting Standards (“IFRS“), and are unlikely to be comparable to similarly titled measures reported by other companies. Readers are cautioned that the disclosure of these items is meant to add to, and not replace, the discussion of financial results or cash flows from operations as determined in accordance with IFRS. For a discussion of the purpose of these non-IFRS measures, please refer to the Company’s Q2-F2019 MD&A on SEDAR at www.sedar.com.

These measures, as well as their method of calculation or reconciliation to IFRS measures, are as follows:

-

ACV Base, Net ACV Retention and ACV from New Customers

As the majority of the Company’s customer contracts are sold under multiyear term licenses, there is a significant lag between the timing of the billing and the associated revenue recognition. As a result, the Company focuses on the aggregate annualized value of its subscriptions under contract, measured by Annual Contract Value, as an indicator of its future revenues.

The ACV Base measures the amount of recurring annual revenue Absolute will receive from its commercial customers under contract at a point in time, and therefore is an indicator of the Company’s future revenue streams. Net ACV Retention measures the percentage increase or decrease in the Commercial ACV Base at the end of a period for the customers that made up the Commercial ACV Base at the beginning of the same period. This metric provides insight into the effectiveness of Absolute’s customer retention and expansion functions. ACV from New Customers measures the addition to the Commercial ACV Base from sales to new commercial customers during the quarter.

We believe that increases in the amount of ACV from New Customers, and improvement in the Company’s Net ACV Retention, will grow our Commercial ACV Base and, in turn, our future revenues.

-

Adjusted EBITDA

Management believes that analyzing operating results exclusive of significant noncash items or items not controllable in the period provides a useful measure of the Company’s performance. The term “Adjusted EBITDA” refers to earnings before deducting interest and investment gains (losses), income taxes, amortization of intangible assets and property and equipment, foreign exchange gain or loss, share-based compensation, and restructuring and reorganization charges and post-retirement benefits. The items excluded in the determination of Adjusted EBITDA are share-based compensation, amortization of intangibles, amortization of property and equipment, and restructuring and reorganization charges and certain post-retirement benefits.

-

Adjusted Operating Expenses

A number of significant noncash or nonrecurring expenses are reported in the Company’s Cost of Revenue and Operating Expenses. Management believes that analyzing these expenses exclusive of these noncash or nonrecurring items provides a useful measure of the cash invested in the operations of its business. The items excluded in the determination of Adjusted Operating Expenses are share-based compensation, amortization of intangible assets, amortization of property and equipment, and restructuring and reorganization charges and certain post-retirement benefits. For a description of the reasons these items are adjusted, please refer to the “Non-IFRS Measures” section of the Q2-F2019 MD&A.