Commercial Sales Contracts increase 14%, and cash from operations increases 63%

Vancouver, Canada: November 3, 2014 – Absolute® Software Corporation (TSX: ABT), the industry standard for persistent endpoint security and management solutions for desktops, laptops, tablets and smartphones, today announced its financial results for the three months ended September 30, 2014. All financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”) and are reported in U.S. dollars.

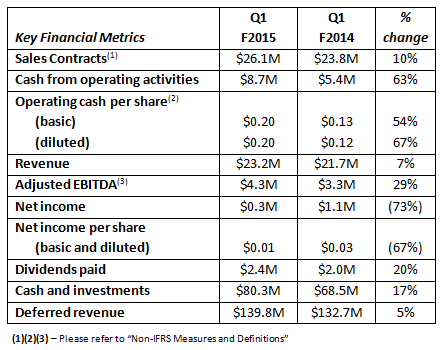

Q1-F2015 Highlights:

Sales Contracts

- Total Sales Contracts of $26.1 million, representing 10% year-over-year growth

- Commercial Sales Contracts of $24.8 million, representing 14% year-over-year growth

- 13% year-over-year growth in Device Management and Data Security product sales

- 15% year-over-year growth in Theft Management product sales

Operations and Corporate

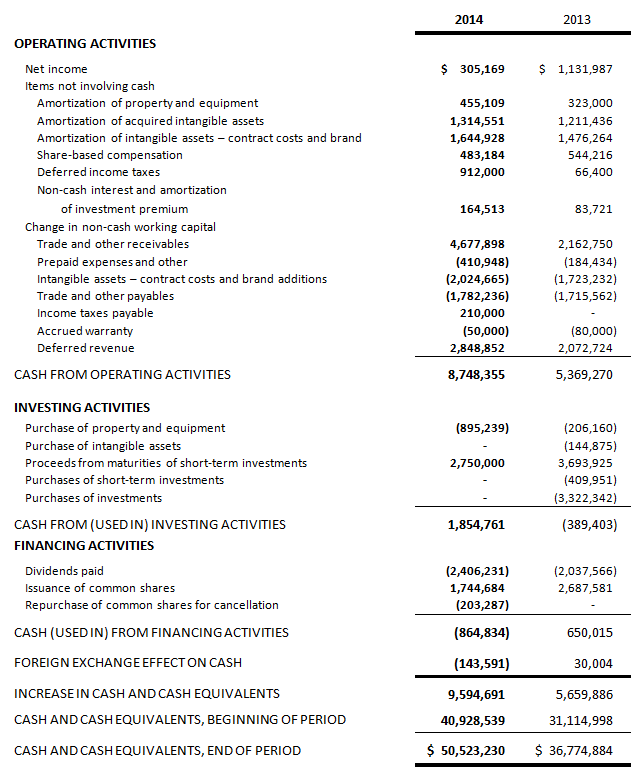

- $8.7 million in Cash from Operations compared to $5.4 million in Q1-F2014

- $2.4 million (CAD$0.06 per common share) dividend paid during the quarter

- Normal Course Issuer Bid approved to enable up to 3.8 million common shares to be repurchased

Technology

- Achieved the highest rating in cross-platform support in Gartner, Inc.’s Critical Capabilities for Client Management Tools report

- Released Computrace Event Calling, which allows customers to receive immediate alerts based on user-defined criteria

- Released Absolute Manage 6.6, which provided zero-day support for iOS 8

- Absolute Manage recognized as a Strong Performer in the Forrester Wave™: Enterprise Mobile Management

“A comprehensive device and information security plan is becoming a critical requirement for organizations of all types. In the first quarter of fiscal 2015, this growing priority contributed to solid sales growth in our commercial markets. We continue to make significant gains within highly regulated industries, as well as in the education vertical, where we are fortifying and expanding a very strong market position,” said Geoff Haydon, CEO of Absolute. “Our 63% increase in cash from operations reflects the strength of our business model; providing us with the resources required to execute against our growth opportunities, while still returning capital to shareholders through our continued dividend and share buyback programs.”

“Operationally, we’re executing on our committed fiscal 2015 course of action, and tightening our focus throughout the business,” continued Mr. Haydon. “We have narrowed our sights on select industry vertical markets and geographic regions. As part of this focus, we will be launching an initiative to drive increased awareness in those chosen target verticals. Within our sales organization, we have taken steps to focus incentives and align our structure to unlock further potential and to drive more productive new business development. Looking forward, we believe we are on track to achieve our financial and operational goals for fiscal 2015.”

Q1-F2015 Financial Review

Invoiced sales to commercial customers increased 14% in Q1-F2015 compared to Q1-F2014. Invoiced sales in Q1-F2015 were positively impacted by significant growth in the education and healthcare verticals, which were partially offset by declines in the corporate and government verticals. The decline in the corporate vertical was largely due to a seasonal focus on education opportunities, as the growth in this vertical was exceptionally strong in the previous quarter. The combined education and government verticals increased 27% year over year, while the combined corporate and healthcare verticals decreased 2% year over year.

Commercial Sales Contracts for Absolute’s Theft Management products(5) were $17.3 million in Q1-F2015, representing an increase of 15% from $15.0 million in Q1-F2014. Q1-F2015 Commercial Sales Contracts from Absolute’s Device Management and Data Security products(6) were $7.5 million, up 13% from $6.6 million in Q1-F2014. Growth in this latter category during the quarter was primarily driven by increased sales of Computrace Data Protection.

Sales Contracts for consumer solutions were $1.3 million (5% of total Sales Contracts), down from $2.1 million (9% of total Sales Contracts), in Q1-F2014.

Q1-F2015 Sales Contracts for North America increased 12% as compared to the same period in F2014 and represented 87% of total Sales Contracts, compared to 85% of total Sales Contacts in the prior year. International sales decreased 4% over Q1-F2014 and represented 13% of total Sales Contracts. The decrease from the prior year reflects a large Computrace sale in the Asia Pacific region in Q1-F2014.

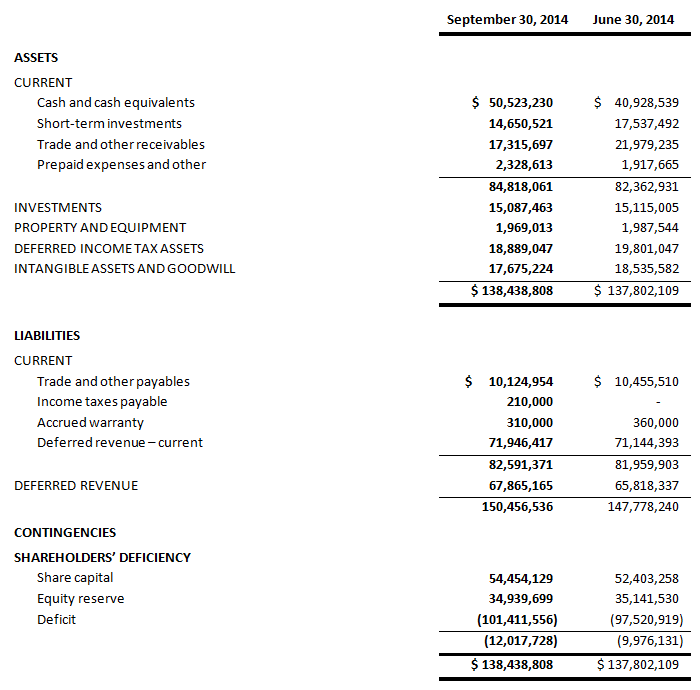

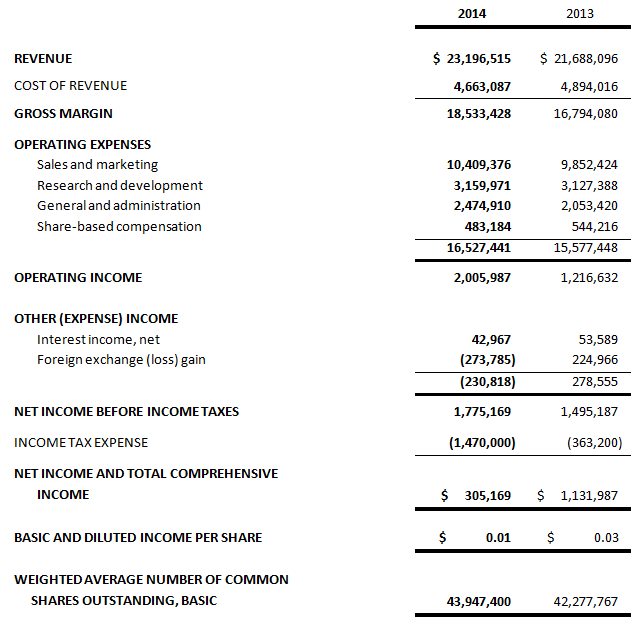

Revenue in Q1-F2015 was $23.2 million, a 7% increase from $21.7 million in Q1-F2014. Indicative of the Company’s Software-as-a-Service (SaaS) business model, revenue primarily represents the amortization of deferred revenue balances from recurring term license sales.

Adjusted Operating Expenses(3) for Q1-F2015 were $18.9 million, up 3% from $18.4 million in Q1-F2014. The change reflects an increase to sales and marketing and general and administrative expenditures, which were offset in part by lower cost of revenue.

Absolute generated Adjusted EBITDA(4) of $4.3 million in Q1-F2015, up 29% from $3.3 million in Q1-F2014.

Absolute recorded net income of $0.3 million, or $0.01 per share, in Q1-F2015, compared to net income of $1.1 million, or $0.03 per share, in Q1-F2014. On a year-over-year comparison basis, the Company’s net income was impacted in Q1-F2015 by a foreign exchange loss of $0.3 million, compared to a foreign exchange gain of $0.2 million in Q1-F2014, and income tax expense of $1.5 million, compared to income tax expense of $0.4 million in Q1-2014.

Quarterly Dividend

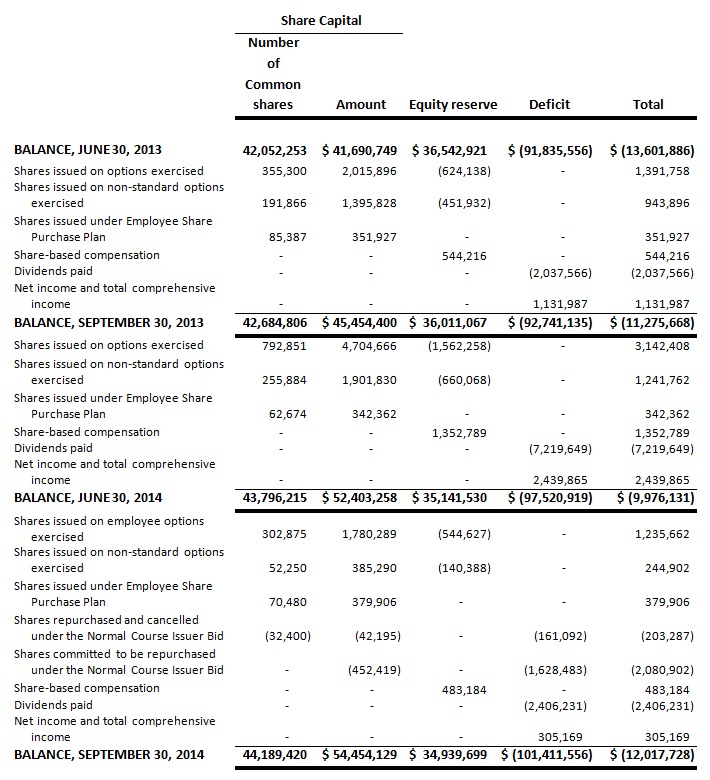

Given the Company’s strong financial position, the Board of Directors approved a change in the Company's dividend policy. The quarterly dividend will increase from $0.06 to $0.07 per common share. The $0.07 per share dividend is scheduled to be paid on November 28, 2014 to those persons who were shareholders of record at the close of business on November 7, 2014.

Corporate Outlook

Management remains confident in Absolute’s market opportunity. For F2015, management expects Sales Contracts and cash from operating activities to increase over F2014 levels.

Quarterly Filings

Management’s discussion and analysis (“MD&A”), condensed consolidated financial statements and the notes thereto for Q1-F2015 can be obtained today from Absolute’s corporate website at www.absolute.com. The documents will also be available at www.sedar.com.

Notice of Conference Call

Absolute Software will hold a conference call to discuss the Company’s Q1-F2015 results on Monday, November 3, 2014 at 2:00 p.m. PT (5:00 p.m. ET). All interested parties can join the call by dialing 647-427-7450, or 1-888-231-8191. Please dial-in 15 minutes prior to the call to secure a line. The conference call will be archived for replay until Monday, November 10, 2014 at midnight. To access the archived conference call, please dial 416-849-0833, or 1-855-859-2056 and enter the reservation code 23269140.

A live audio webcast of the conference call will be available at www.absolute.com and http://bit.ly/1onfAp7. Please connect at least 15 minutes prior to the conference call to ensure adequate time for any software download that may be required to join the webcast. An archived replay of the webcast will be available for 365 days.

Non-IFRS Measures and Definitions

Throughout this press release, we refer to a number of measures which we believe are meaningful in the assessment of the Company’s performance. All these metrics are non-standard measures under International Financial Reporting Standards (“IFRS”), and are unlikely to be comparable to similarly titled measures reported by other companies. Readers are cautioned that the disclosure of these items is meant to add to, and not replace, the discussion of financial results or cash flows from operations as determined in accordance with IFRS. For a discussion of the purpose of these non-IFRS measures, please refer to the Company’s Q1 Fiscal 2015 MD&A on SEDAR at www.SEDAR.com.

These measures, as well as their method of calculation or reconciliation to IFRS measures, are as follows:

1) Sales Contracts

See the “Subscription Business Model” section of the MD&A for a detailed discussion of why we believe Sales Contracts (also known as “bookings”) provide a meaningful performance metric. Sales Contracts are included in deferred revenue (see Note 7 of the Notes to the Consolidated Financial Statements), and result from invoiced sales of our products and services.

2) Basic and diluted Cash from Operating Activities per share

As a result of the nature of our revenues (please refer to “Subscription Business Model” in the MD&A), we use Cash from Operating Activities as a measure of profitability. Accordingly, we believe that Cash from Operating Activities per share is a meaningful indicator of profitability per share. Cash from Operating Activities per share is calculated by dividing Cash from Operating Activities by the weighted average number of shares outstanding for the period (basic), or the fully diluted number of shares using the treasury stock method (diluted).

3) Adjusted Operating Expenses

A number of significant non-cash or non-recurring expenses are reported in our Cost of Revenue and Operating Expenses. Management believes that analyzing these expenses exclusive of these non-cash or non-recurring items provides a useful measure of the cash invested in the operations of its business. The items excluded in the determination of Adjusted Operating Expenses are share-based compensation, amortization of acquired intangible assets, amortization of property and equipment, and restructuring charges and certain post-retirement benefits. For a description of the reasons these items are adjusted, please refer to the Q1 Fiscal 2015 MD&A.

4) Adjusted EBITDA

Management believes that analyzing operating results exclusive of significant non-cash items provides a useful measure of the Company’s performance. The term Adjusted EBITDA refers to earnings before deducting interest and investment gains (losses), income taxes, amortization of acquired intangible assets and property and equipment, foreign exchange gain or loss, share-based compensation, and restructuring charges and post-retirement benefits. The non-cash items excluded in the determination of Adjusted EBITDA include share-based compensation, amortization of acquired intangibles, amortization of property and equipment, and restructuring charges and certain post-retirement benefits.

5) Theft Management products

Management defines the Company’s theft management product line as Computrace products that include an investigations and recovery services component.

6) Device Management and Data Security products

Management defines the Company’s device management and data security product line as Absolute Manage and Absolute Service products, as well as Computrace products that do not include an investigations and recovery services component (for example, Absolute Track and Computrace Data Protection).