Growth Driven by Strength in North American Education and Corporate Markets

Vancouver, Canada: May 12, 2014 – Absolute® Software Corporation (“Absolute” or the “Company”) (TSX: ABT), the industry standard for persistent endpoint security and management solutions for computers, laptops and ultra-portable devices and the data they contain, today announced its financial results for the three- and nine-month periods ended March 31, 2014. All financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”) and are reported in U.S. dollars.

Q3-F2014 Highlights:

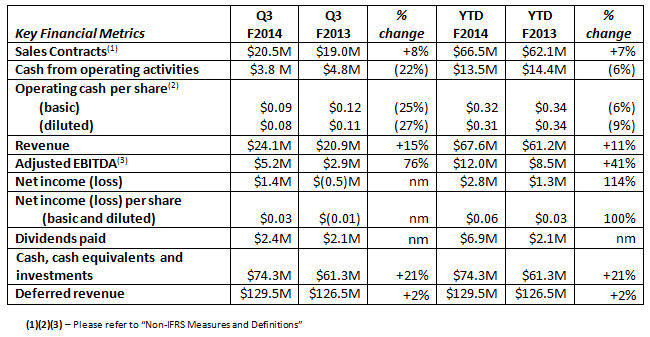

- Sales Contracts increased by 8% to $20.5 million compared to $19.0 million in Q3-F2013.

- Driven by strong growth in education and corporate verticals, Commercial Sales Contracts increased by 10% to $19.6 million compared to $17.8 million in Q3-F2013.

- Sales of Theft Management products increased by 2% compared to Q3-F2013, while sales of Device Management and Data Security products increased by 24% over the same period.

- International Sales Contracts increased by 5% compared to Q3-F2013.

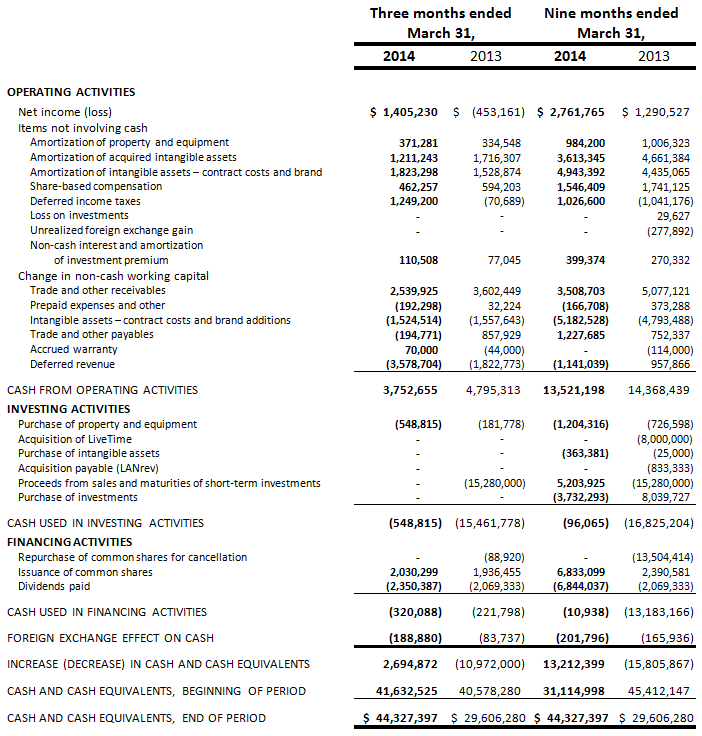

- Cash from Operating Activities was $3.8 million compared to $4.8 million in Q3-F2013.

- Paid a quarterly dividend of $2.4 million, or CAD$0.06 per common share.

- Achieved inclusion for the first time in Gartner, Inc.’s Magic Quadrant for Content-Aware Data Loss Prevention.

- Expanded embedded persistence technology into the firmware of additional Samsung Galaxy mobile devices including the Galaxy S5, NotePRO, and TabPRO.

- Released Absolute Manage 6.4.2, which included support for Apple’s streamlined Device Enrollment Program.

- Appointed Sal Visca, an experienced technology executive, to the Company’s Board of Directors.

“Strong performance in the North American education and corporate verticals drove our top-line growth in the quarter,” said Errol Olsen, interim CEO of Absolute. “Our device management and data security solutions delivered strong growth, led by sales of Absolute Manage and record performance of our MDM product. Looking forward, against the backdrop of a continued shift toward mobile computing, increasing requirements for data security and growing demand for simplified IT management, our product portfolio is uniquely positioned to address today’s top priorities for IT and security managers.”

Q3-F2014 and F2014 YTD Financial Review

Q3-F2014 Sales Contracts were $20.5 million, up 8% from $19.0 million in Q3-F2013. Sales Contract growth in Q3-F2014 reflected strength in the education and corporate vertical markets. F2014 year-to-date (“YTD”) Sales Contracts were $66.5 million, up 7% from $62.1 million for the same period in F2013. Of note, Q2-F2013 included a $3.5 million deal with a Fortune 100 healthcare customer. Excluding this significant sale, the underlying year over year growth rate for Sales Contracts was 14% compared to the prior YTD period.

Invoiced sales to commercial customers increased 10% in Q3-F2014 compared to Q3-F2013, and increased 9% for the YTD period. Commercial Sales Contracts for Absolute’s Theft Management products(5) were $11.7 million for Q3-F2014, representing an increase of 2% from $11.5 million in Q3-F2013. YTD Commercial Sales Contracts for theft management products were $39.5 million, up 10% from $36.0 million in YTD F2013.

Q3-F2014 Commercial Sales Contracts from Absolute’s Device Management and Data Security products(6) were $7.9 million, up 24% from $6.3 million in Q3-F2013. For the YTD period, Commercial Sales Contracts from device management and data security products were $22.9 million, up 7% from $21.3 million for the same period in F2013. Growth in this category during the quarter was driven by strong sales of Absolute Manage and Mobile Device Management (“MDM”) products.

International Sales Contracts were $3.1 million in Q3-F2014 (15% of total Sales Contracts), up 5% from $2.9 million in Q3-F2013 (15% of total Sales Contracts). YTD International Sales Contracts were $10.4 million (16% of total Sales Contracts), up 25% from $8.3 million (13% of total Sales Contracts) for the same period in F2013. The lower growth rate in Q3-F2014 relative to the first half of the year reflects the absence of any large individual sales in the quarter.

Sales Contracts for consumer solutions were $0.9 million (5% of total Sales Contracts), down 23% from $1.2 million (6% of total Sales Contracts), in Q3-F2013. YTD consumer Sales Contracts were $4.1 million (6% of total Sales Contracts), down 14% from $4.7 million (8% of total Sales Contracts), for the same period in F2013.

Revenue for Q3-F2014 was $24.1 million, a 15% increase from $20.9 million in Q3-F2013. Indicative of the Company’s Software-as-a-Service (SaaS) business model, revenue primarily represents the amortization of deferred revenue balances from recurring term license sales. YTD revenue was $67.6 million, an 11% increase from $61.2 million for the same period in F2013.

Adjusted Operating Expenses(3) for Q3-F2014 were $18.9 million, up 6% from $17.9 million in Q3-F2013. The increase was primarily attributable to additional sales and marketing and research and development headcount in F2014, which was partially offset by a decline in the Canadian dollar. YTD Adjusted Operating Expenses were $55.6 million, up 6% from $52.6 million for the same period in F2013.

Absolute generated Adjusted EBITDA(4) of $5.2 million in Q3-F2014, up 76% from $2.9 million in Q3-F2013. YTD Adjusted EBITDA was $12.0 million, up 41% from $8.5 million for the same period in F2013.

Absolute recorded net income of $1.4 million, or $0.03 per share, in Q3-F2014, compared to a net loss of $0.5 million, or $(0.01) per share, in Q3-F2013. YTD net income was $2.8 million, or $0.06 per share, compared to net income of $1.3M or $0.03 per share for the same period in F2013. The current YTD net income reflects the impact of higher IFRS operating income, less the impact of a reduction in the foreign exchange gain and income tax expense.

Cash from operating activities was $3.8 million for Q3-F2014, down 21% from $4.8 million in Q3-F2013. YTD cash from operating activities was $13.5 million, down 6% from $14.4 million for the same period in F2013. Cash from operating activities reflects the payment of $1.4 million of post-retirement benefits during Q3-F2014.

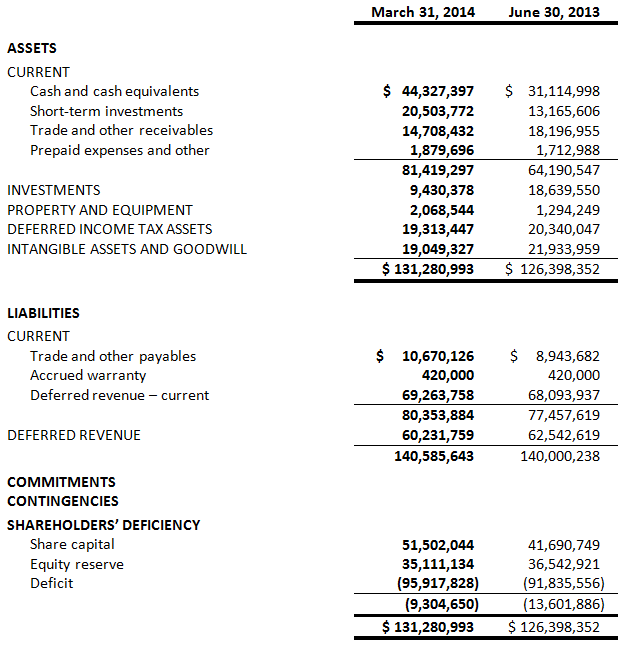

At March 31, 2014, Absolute had cash, cash equivalents and investments of $74.3 million compared to $62.9 million at June 30, 2013.

Corporate Outlook

Absolute remains confident in the market opportunity for its solutions. For F2014, management expects Sales Contracts to increase over F2013 levels and for cash generated from operating activities, excluding payments related to post-retirement benefits, to approximate F2013 levels.

The Company’s Board of Directors has initiated a process to recruit a permanent chief executive officer for the Company and has engaged an executive search firm to assist in its search.

Quarterly Filings

Management’s discussion and analysis (“MD&A”), consolidated financial statements and notes thereto for Q3-F2014 can be obtained today from Absolute’s corporate website at www.absolute.com. The documents will also be available at www.sedar.com.

Notice of Conference Call

Absolute Software will hold a conference call to discuss the Company’s Q3 F2014 results on Monday, May 12, 2014 at 2:00 p.m. PT (5:00 p.m. ET). All interested parties can join the call by dialing 647-427-7450, or 1-888-231-8191. Please dial-in 15 minutes prior to the call to secure a line. The conference call will be archived for replay until Monday, May 19, 2014 at midnight.

A live audio webcast of the conference call will be available at www.absolute.com and www.newswire.ca. Please connect at least 15 minutes prior to the conference call to ensure adequate time for any software download that may be required to join the webcast. An archived replay of the webcast will be available for 365 days at www.newswire.ca. To access the archived conference call, please dial 416-849-0833, or 1-855-859-2056 and enter the reservation code 40677510.

Non-IFRS Measures and Definitions

Throughout this press release, we refer to a number of measures which we believe are meaningful in the assessment of the Company’s performance. All these metrics are non-standard measures under International Financial Reporting Standards (“IFRS”), and are unlikely to be comparable to similarly titled measures reported by other companies. Readers are cautioned that the disclosure of these items is meant to add to, and not replace, the discussion of financial results or cash flows from operations as determined in accordance with IFRS. For a discussion of the purpose of these non-IFRS measures, please refer to the Company’s Fiscal 2013 Q4 MD&A on SEDAR at www.SEDAR.com.

These measures, as well as their method of calculation or reconciliation to IFRS measures, are as follows:

1) Sales Contracts

See the “Subscription Business Model” section of the MD&A for a detailed discussion of why we believe Sales Contracts (also known as “bookings”) provide a meaningful performance metric. Sales Contracts are included in deferred revenue (see Note 7 of the Notes to the Interim Consolidated Financial Statements), and result from invoiced sales of our products and services.

2) Basic and diluted Cash from Operating Activities per share

As a result of the nature of our revenues (please refer to “Subscription Business Model” in the MD&A), we use Cash from Operating Activities as a measure of profitability. Accordingly, we believe that Cash from Operating Activities per share is a meaningful indicator of profitability per share. Cash from Operating Activities per share is calculated by dividing Cash from Operating Activities by the weighted average number of shares outstanding for the period (basic), or the fully diluted number of shares using the treasury stock method (diluted).

3) Adjusted Operating Expenses

A number of significant non-cash or non-recurring expenses are reported in our Cost of Revenue and Operating Expenses. Management believes that analyzing these expenses exclusive of these non-cash or non-recurring items provides a useful measure of the cash invested in the operations of its business. The items excluded in the determination of Adjusted Operating Expenses are share-based compensation, amortization of acquired intangible assets, amortization of property and equipment, and restructuring charges and certain post-retirement benefits. For a description of the reasons these items are adjusted, please refer to the Fiscal 2013 and Q3-Fiscal 2014 MD&A.

4) Adjusted EBITDA

Management believes that analyzing operating results exclusive of significant non-cash items provides a useful measure of the Company’s performance. The term Adjusted EBITDA refers to earnings before deducting interest and investment gains (losses), income taxes, amortization of acquired intangible assets and property and equipment, foreign exchange gain or loss, share-based compensation, and restructuring charges and post-retirement benefits. The non-cash items excluded in the determination of Adjusted EBITDA include share-based compensation, amortization of acquired intangibles, and amortization of property and equipment.

5) Theft Management products

Management defines the Company’s theft management product line as Computrace products that include an investigations and recovery services component.

6) Device Management and Data Security products

Management defines the Company’s device management and data security product line as are defined as our Absolute Manage and Absolute Secure Drive products, as well as Computrace products that do not include an investigations and recovery services component (for example, Absolute Track and Computrace Data Protection).