Year ends with strong momentum as Absolute delivers record quarterly Sales Contracts

Vancouver, Canada: August 12, 2013 – Absolute® Software Corporation (“Absolute” or the “Company”) (TSX: ABT), the industry standard for persistent endpoint security and management solutions for computers, laptops and ultra-portable devices today announced its financial results for the three months and year ended June 30, 2013. All financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”) and reported in U.S. dollars.

Q4 F2013 Highlights:

- Achieved record Sales Contracts of $26.2 million

- Sales Contracts grew in every market vertical, driving a total year-over-year increase of 10%

- Commercial Sales Contracts increased by 10%

- Device Management and Data Security Sales Contracts increased by 15% while sales of Theft Management products increased 8%

- International Sales Contracts increased by 46%, driven by strong demand in the education vertical

- Cash from Operating Activities was $3.2 million

- Paid a quarterly dividend of $2.0 million, or CAD$0.05 per common share

- Announced a global partnership with Samsung Electronics to provide enterprise mobility management and theft protection to GALAXY S4 mobile devices

- Launched first-to-market Mobile Theft Management for Apple iPad® and iPad Mini devices

- Launched first-to-market consumer theft recovery solution for Android Smartphones

- Enhanced data protection portfolio with the acquisition of data security and data loss prevention assets from Palisade Systems

- Announced positive movement in the Visionaries Quadrant of the Gartner Magic Quadrant for Client Management Tools and achieved positioning in the Niche Quadrant of the Gartner Magic Quadrant for Mobile Device Management Software. Absolute is now one of only four vendors who are positioned in both of these Magic Quadrants

Fiscal 2013 Highlights:

- Total Sales Contracts were flat year-over-year

- Commercial Sales Contracts increased by 1%

- Device Management and Data Security Sales Contracts increased by 23% while sales of Theft Management products decreased by 8%

- International Sales Contracts increased by 2%

- Cash from Operating Activities was $17.5 million, down from $18.9 million

- Initiated a quarterly dividend policy and paid quarterly dividends totaling $4.1 million

- Announced a $3.5 million Computrace sale to a Fortune 100 healthcare industry customer

- Extended Absolute’s persistent technology to Samsung’s flagship GALAXY smartphone and tablet platforms, and to Dell, HP, Lenovo, Panasonic and Fujitsu tablet platforms

- Broadened management product line with the acquisition of LiveTime Software, a SaaS and on-premise IT Service Management provider

- Announced the appointment of Thomas Kenny to the role of Executive Vice President and General Manager of Global Sales and Marketing

- Awarded a new patent for a “Persistent Servicing Agent” that includes services such as remote data deletion

“In fiscal 2013, we made two acquisitions, enhanced our product portfolio and achieved important strategic initiatives with Apple and Samsung. This demonstrates that we continue to successfully transition from a legacy PC services business to a uniquely positioned PC, tablet and smartphone security and management services company,” said John Livingston, CEO of Absolute. “Reflecting this transition, our Q4 financial results show that we ended the year with strong momentum throughout the business. We delivered growth in each of our commercial markets, in both our theft management and device management and data security product groups, and in international markets. In fiscal 2014, our focus is to maintain this momentum and to execute on our sales plan to drive further growth.”

F2013 Year-End and Q4 Financial Review

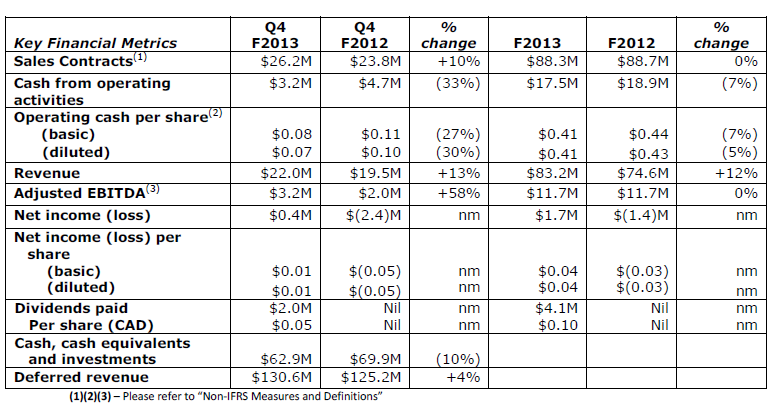

F2013 Sales Contracts remained relatively flat at $88.3 million compared to $88.7 million in F2012. For Q4-2013, Sales Contracts were $26.2 million, up 10% from $23.8 million in Q4-F2012.

Commercial Sales Contracts for Absolute’s flagship theft management products were $52.8 million for F2013. This was down 8% from $57.3 million in F2012. For Q4-F2013, commercial Sales Contracts for theft management products were $16.8 million, up 8% from $15.6 million in Q4-F2012.

F2013 commercial Sales Contracts from Absolute’s device management and data security products were $29.6 million. This was up 23% compared to $24.1 million for F2012. For Q4-F2013, commercial Sales Contracts from Absolute’s device management and data security products were $8.2 million, up 15% from $7.1 million in Q4-F2012.

International Sales Contracts remained relatively flat at $10.9 million in F2013 compared to $10.6 million in F2012. Driven by strong demand in the education vertical, international Sales Contracts were $2.8 million for Q4-F2013, up 46% from $1.9 million in Q4-F2012.

For F2013, Sales Contracts for consumer solutions were $5.9 million, or 7% of Sales Contracts, compared to $7.2 million, or 8% of Sales Contracts in F2012. For Q4-F2013, Sales Contracts for consumer solutions were $1.2 million, or 4% of Sales Contracts, compared to $1.1 million, or 5% of Sales Contracts in Q4-F2013.

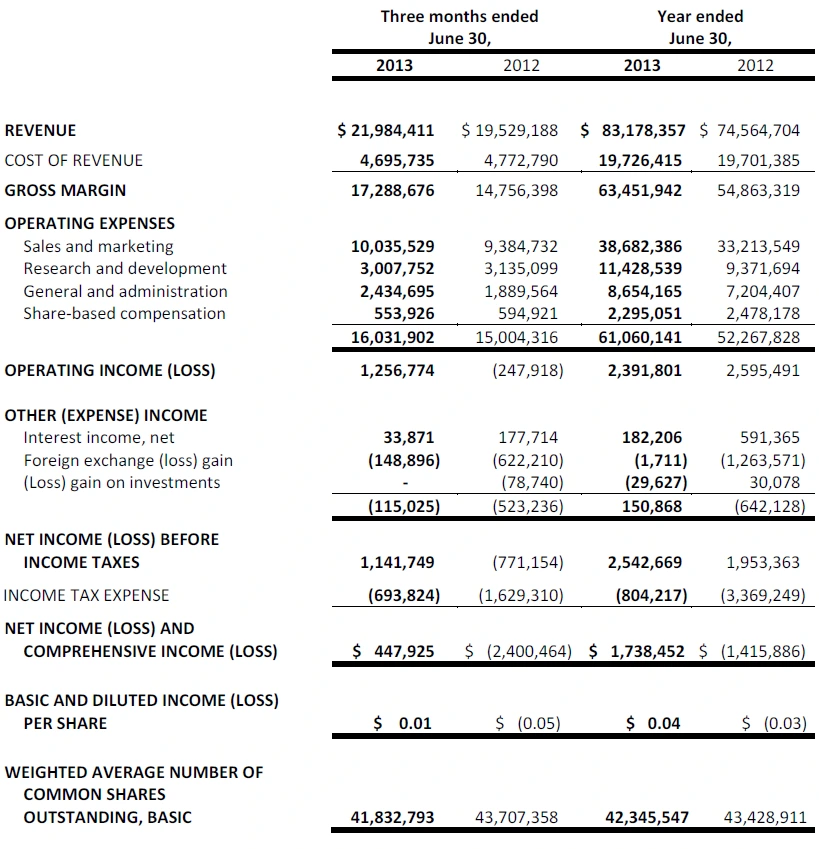

Revenue for F2013 was $83.2 million, a 12% increase from $74.6 million in F2012. For Q4-F2013, revenue was $22.0 million, up 13% from $19.5 million in Q4-F2012. Indicative of the Company’s Software-as-a-Service Model (“SaaS”) business model, revenue primarily represents the amortization of deferred revenue balances from recurring term license sales. For F2013, 76% of revenue was related to the drawdown of deferred revenue balances accumulated to the end of the prior fiscal year.

Adjusted Operating Expenses for F2013 were $71.4 million, up 14% from $62.9 million in F2012. The year-over-year change was primarily due to increased investment levels in sales and marketing and research and development that were initiated toward the end of F2012 to support the Company’s long term growth initiatives. Adjusted Operating Expenses for Q4-F2013 were $18.8 million, up 7% from $17.5 million in Q4-F2012.

Absolute generated Adjusted EBITDA of $11.7 million in F2013, which was flat compared to Adjusted EBITDA of $11.7 million in F2012. For Q4-F2013, Adjusted EBITDA was $3.2 million, up 58% from $2.0 million in Q4-F2012, reflecting a greater increase in revenue relative to expenses.

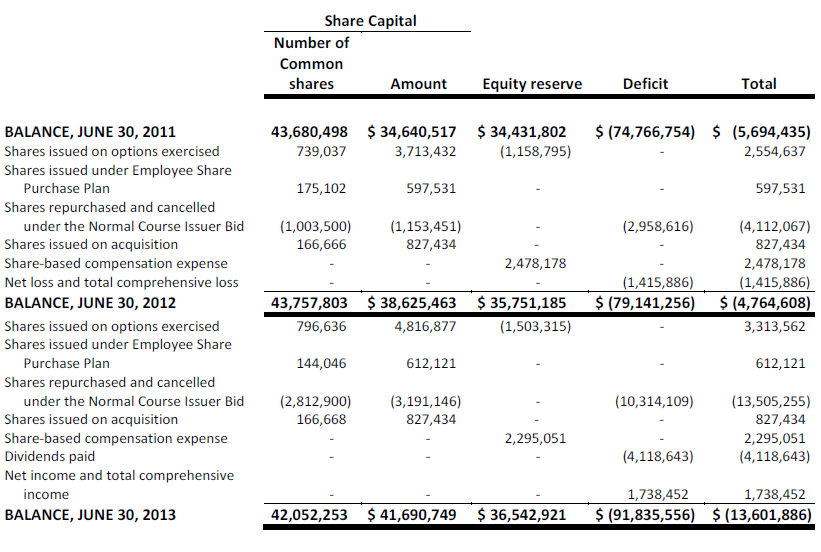

Absolute recorded net income of $1.7 million, or $0.04 per share, in F2013, compared to a net loss of $1.4 million, or $(0.03) per share, in F2012. Absolute generated net income of $0.4 million, or $0.01 per share, in Q4-F2013, compared to a net loss of $2.4 million, or $(0.05) per share, in Q4-F2012.

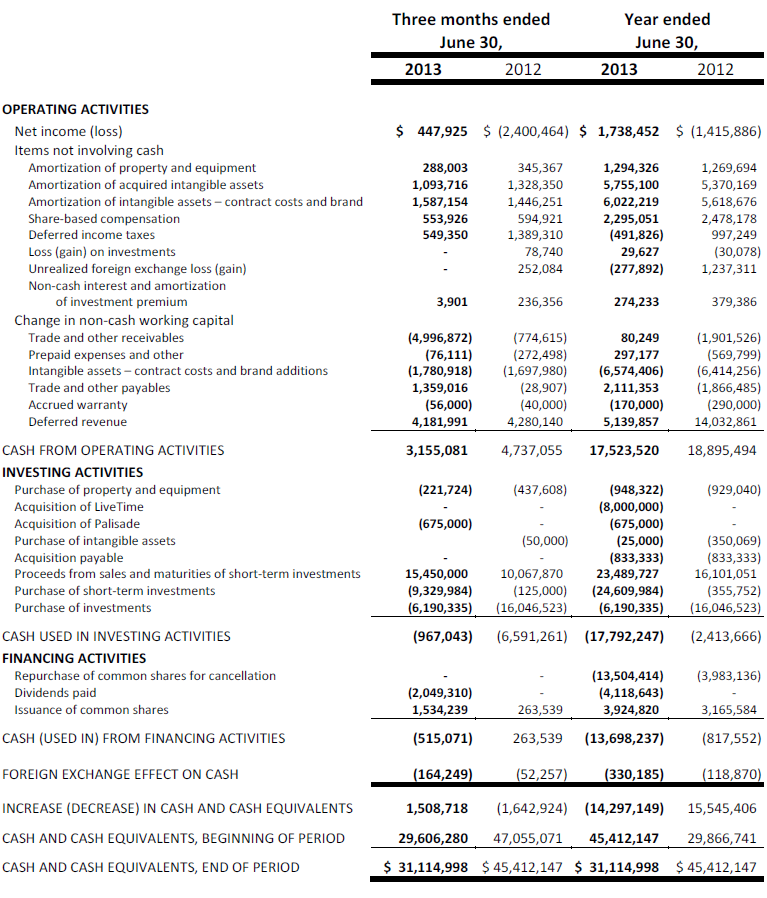

Cash from operating activities was $17.5 million for F2013, down 7% from $18.9 million in F2012. Cash from operating activities for Q4-F2013 decreased 33% to $3.2 million from $4.7 million in Q4-F2012.

In F2013, Absolute initiated a dividend policy of CAD$0.05 per share paid quarterly. During F2013, Absolute paid total dividends of $4.1 million compared to nil in F2012.

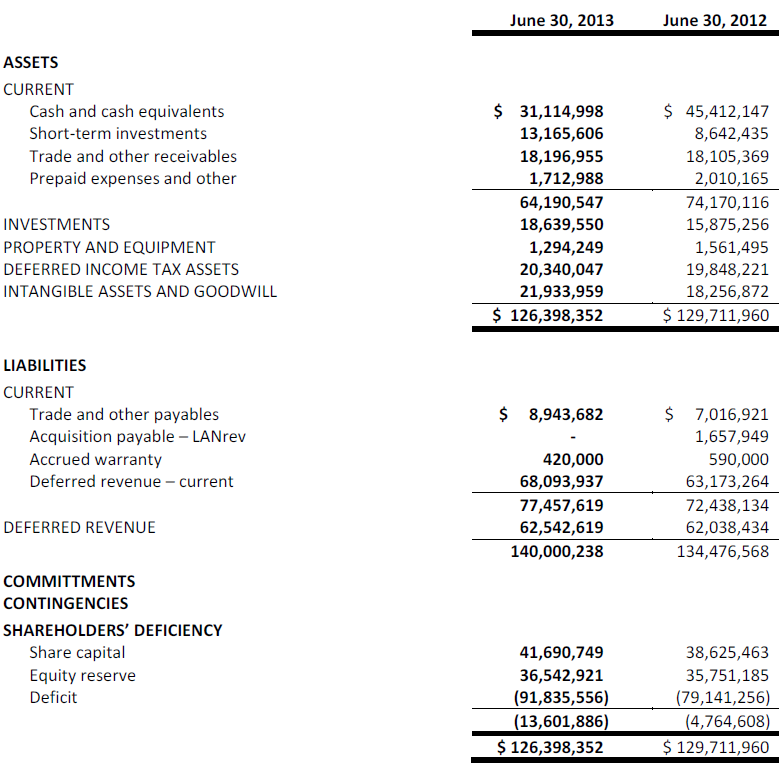

At June 30, 2013, Absolute had cash, cash equivalents and investments of $62.9 million compared to $69.9 million at June 30, 2012.

F2014 Outlook

We remain confident in the market opportunity for our solutions and intend to make continued investments, particularly in the key areas of sales and marketing and research and development, in order to fully capitalize on this opportunity. For F2014, we expect Sales Contracts to increase over F2013 levels and for cash generated from operating activities to grow modestly from F2013 levels.

Quarterly and Annual Filings

Management’s discussion and analysis (“MD&A”), consolidated financial statements and notes thereto for Q4 and fiscal 2013 can be obtained today from Absolute’s corporate website at www.absolute.com. The documents will also be available at www.sedar.com.

Notice of Conference Call

Absolute Software will hold a conference call to discuss the Company’s Q4 and fiscal 2013 results on Monday, August 12, 2013 at 2:00 p.m. PT (5:00 p.m. ET). All interested parties can join the call by dialing 416-764-8609 or 1-888-390-0605. Please dial-in 15 minutes prior to the call to secure a line. The conference call will be archived for replay until Monday, August 19, 2013 at midnight.

A live audio webcast of the conference call will be available at www.absolute.com and www.newswire.ca. Please connect at least 15 minutes prior to the conference call to ensure adequate time for any software download that may be required to join the webcast. An archived replay of the webcast will be available for 365 days at www.newswire.ca. To access the archived conference call, please dial 416-764-8677 or 1-888-390-0541 enter the reservation code 030822.

Non-IFRS Measures and Definitions

Throughout this press release, we refer to a number of measures which we believe are meaningful in the assessment of the Company’s performance. All these metrics are non-standard measures under International Financial Reporting Standards (“IFRS”), and are unlikely to be comparable to similarly titled measures reported by other companies. Readers are cautioned that the disclosure of these items is meant to add to, and not replace, the discussion of financial results or cash flows from operations as determined in accordance with IFRS. For a discussion of the purpose of these non-IFRS measures, please refer to the Company’s Fiscal 2013 Q4 MD&A on SEDAR at www.SEDAR.com.

These measures, as well as their method of calculation or reconciliation to IFRS measures, are as follows:

1) Sales Contracts

See the “Subscription Business Model” section of the MD&A for a detailed discussion of why we believe Sales Contracts (also known as “bookings”) provide a meaningful performance metric. Sales Contracts are included in deferred revenue (see Note 11 of the Notes to the Consolidated Financial Statements), and result from invoiced sales of our products and services.

2) Basic and diluted Cash from Operating Activities per share

As a result of the nature of our revenues (please refer to “Subscription Business Model” in the MD&A), we use Cash from Operating Activities as a measure of profitability. Accordingly, we believe that Cash from Operating Activities per share is a meaningful indicator of profitability per share. Cash from Operating Activities per share is calculated by dividing Cash from Operating Activities by the average number of shares outstanding for the period (basic), or using the treasury stock method (diluted).

3) Adjusted Operating Expenses

A number of significant non-cash expenses are reported in our Cost of Revenue and Operating Expenses. Management believes that analyzing these expenses exclusive of these non-cash items provides a useful measure of the cash invested in the operations of its business. The non-cash items excluded in the determination of Adjusted Operating Expenses are share-based compensation, amortization of acquired intangible assets, and amortization of property and equipment. For a description of the reasons these items are adjusted, please refer to the Fiscal 2013 MD&A.

4) Adjusted EBITDA

Management believes that analyzing operating results exclusive of significant non-cash items provides a useful measure of the Company’s performance. The term Adjusted EBITDA refers to earnings before deducting interest and investment gains (losses), income taxes, amortization of acquired intangible asset and property and equipment, foreign exchange gain or loss, and share-based compensation. The non-cash items excluded in the determination of Adjusted EBITDA include share-based compensation, amortization of acquired intangibles, and amortization of property and equipment.

5) Theft Management products

Management defines the Company’s theft management product line as Computrace products that include an investigations and recovery services component.

6) Device Management and Data Security products

Management defines the Company’s device management and data security product line as are defined as our Absolute Manage and Absolute Secure Drive products, as well as Computrace products that do not include an investigations and recovery services component (for example, Absolute Track and Computrace Data Protection).