Second Quarter Sales Contracts Increase 17% as Focused Innovation and Execution Deliver Sixth Consecutive Quarter of Double-digit Year-on-year Growth

Vancouver, Canada: February 8, 2012 – Absolute® Software Corporation (“Absolute” or the “Company”) (TSX: ABT), the global leader in firmware-embedded endpoint security and management solutions, today announced its financial results for the three- and six-month periods ended December 31, 2011. All financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”) and reported in U.S. dollars.

Q2 Fiscal 2012 Highlights

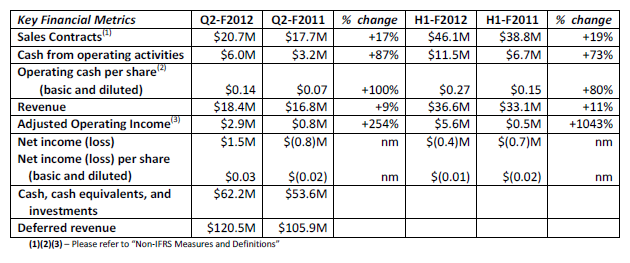

- Achieved 17% growth in Sales Contracts year-over-year while maintaining flat operating expenses.

- Generated $6.0 million in cash from operating activities, representing an 87% increase over Q2-F2011.

- Increased commercial Sales Contracts by 22% compared to Q2-F2011.

- Adjusted Operating Income was $2.9 million, a significant improvement from an Adjusted Operating Income of $0.8 million in Q2-F2011.

- International sales increased 98% to 21% of total Sales Contracts, compared to 13% of total Sales Contracts in Q2-F2011.

- Launched Absolute Manage 6.0, a major release with significant new features including:

- Windows imaging;

- Mobile Device Management (MDM) for Android and

- AbsoluteSafe, a solution for document control on iOS devices.

- Announced a Computrace® SaaS license sale covering more than 60,000 student laptops with the Queensland Government’s Department of Education and Training (DET) in Australia.

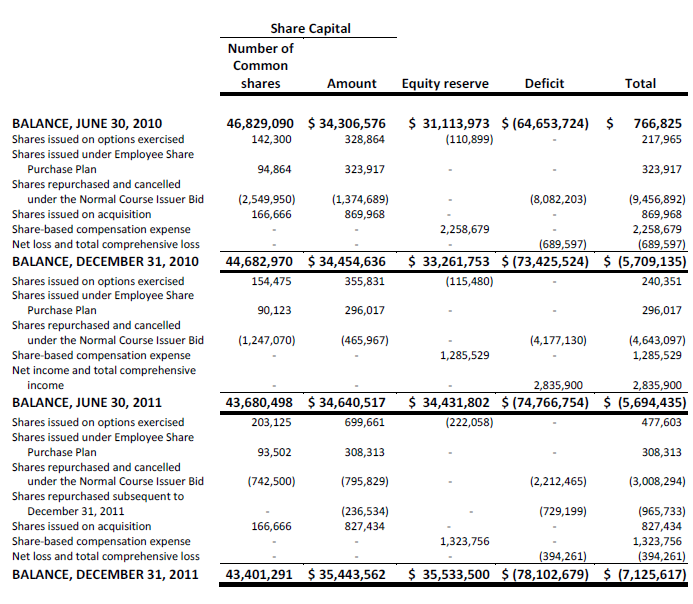

- Renewed Company’s Normal Course Issuer bid and repurchased 59,500 common shares in the quarter for a total cost of $0.2 million.

- Subsequent to quarter end, added to the Visionaries Quadrant of Gartner Inc.’s Client Management Tools Magic Quadrant.

“Our dedication to delivering market-leading solutions for tracking, managing and securing endpoint devices is translating into solid financial results,” said John Livingston, Chief Executive Officer of Absolute. “With innovative solutions that enable customers to easily and reliably manage and secure multiple devices, we are fulfilling an urgent market need and are driving demand for our entire suite of solutions. This unique approach is strengthening our overall competitive positioning and has led to Absolute being positioned as a Visionary in Gartner’s CMT Magic Quadrant. ”

Q2 F2012 Financial Review

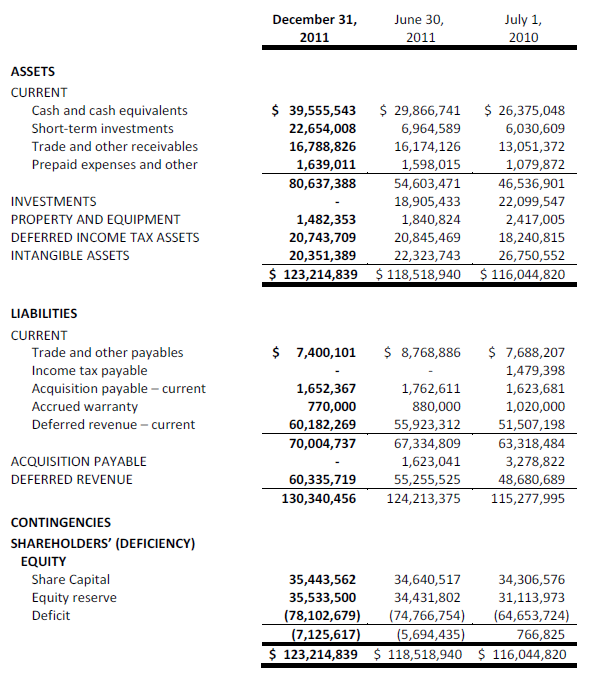

Absolute’s Q2-F2012 results are the Company’s second set of consolidated financial statements prepared in U.S. dollars and under IFRS. For more detailed information regarding the Company’s transition to IFRS, including a reconciliation of the Company’s Q2-F2011 results as originally reported in Canadian Generally Accepted Accounting Principles (CGAAP) to IFRS, please refer to the Company’s financial statements and MD&A filings on SEDAR at www.sedar.com.

Q2-F2012 Sales Contracts grew 17% to $20.7 million from $17.7 million in Q2-F2011. The increase was driven by strong commercial sales across all of the Company’s target market verticals – education, corporate, government and healthcare. Q2-F2012 Commercial sales were $18.7 million, up 22% over Q2-F2011. For H1-F2012, Sales Contracts were $46.1 million, up 19% from $38.8 million in H1-F2011. Commercial sales for H1-F2012 were $41.6 million, up 30% from $32.1 million in H1-F2011.

Commercial Sales Contracts for Absolute’s flagship theft recovery products(5) in Q2-F2012 were

$11.9 million, down 7% year-over-year, as Q2-F2011 benefited from atypically strong education sales in North America. For H1-F2012, Commercial Sales Contracts for theft recovery products were $29.0 million, up 6% from H1-F2011, demonstrating that long-term demand for the Company’s unique theft recovery and theft management services remains strong.

Commercial Sales Contracts from Absolute’s non-theft recovery products(6) (i.e. management, tracking and data protection) grew 181% to $6.8 million over Q2-F2011, as demand, particularly for Absolute Manage, MDM and the Company’s Computrace Data Protection offering, gained momentum. The Company believes this continues to serve as an indication of its success in diversifying sales and developing new product lines with long-term growth potential. For H1-F2012 Commercial Sales Contracts from Absolute’s non-theft recovery products were $12.6 million, up 162% from H1-F2011.

For Q2-F2012, Sales Contracts for consumer solutions were $2.1 million, or 10% of Sales Contracts, compared to $2.5 million, or 14% of Sales Contracts, in Q2-F2011. The year-over-year decline was primarily due to the planned reduction of a low margin high volume OEM bundle program. For H1-F2012, Sales Contracts for consumer solutions were $4.4 million, or 10% of Sales Contracts, compared to $6.7 million, or 17% of Sales Contracts.

On the international front, driven by strong commercial sales in all of the Company’s target regions outside of North America, Sales Contracts increased 98% to $4.4 million in Q2-F2012, or 21% of sales, up from $2.2 million, or 13% of sales, in Q2-F2011. International Sales Contracts were $6.6 million for H1-F2012, up 79% from $3.7 million in H1-F2011.

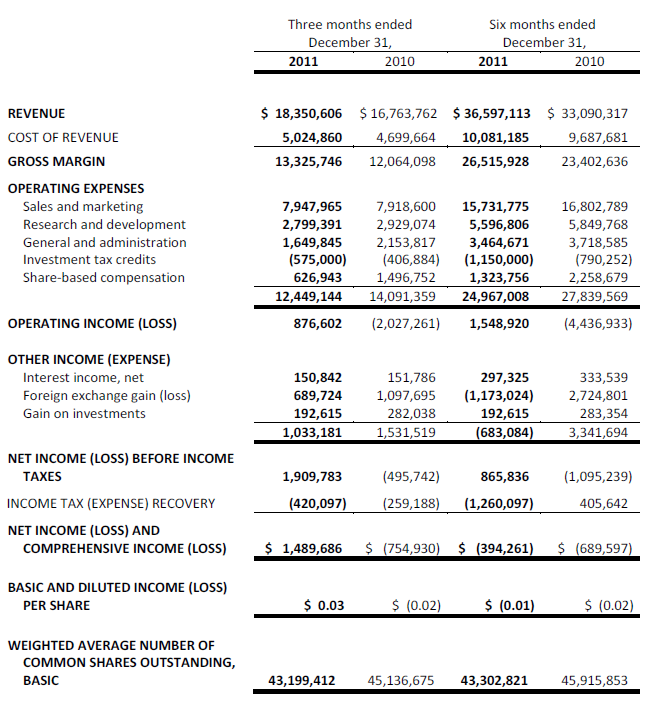

Revenue for Q2-F2012 was $18.4 million, an increase of 9% from $16.8 million in Q2-F2011. For H1-F2012, revenue was $36.6 million, up 11% from $33.1 million. Indicative of the Company’s Software-as-a-Service (SaaS) business model, revenue primarily represents the amortization of deferred revenue balances from recurring term license sales. During H1-F2012, 89% of revenue was related to the drawdown of deferred revenue balances accumulated to the end of the prior fiscal year.

Adjusted Operating Expenses(3) for Q2-F2012 were $15.5 million, a decrease of 3% from $16.0 million in Q2 F2011, predominantly reflecting the Company’s continued focus on driving growth while tightly managing expenses. Adjusted Operating Expenses for H1-F2012 were $31.0 million, down 5% from $32.6 million for H1-F2011.

Given the Company’s revenue growth and its ongoing focus on cost control, Absolute generated Adjusted Operating Income(4) of $2.9 million in Q2-F2012, up from an Adjusted Operating Income of $0.8 million in Q2-F2011. For H1-F2012, Adjusted Operating Income was $5.6 million compared to $0.5 million for H1-F2011.

Absolute recorded net income of $1.5 million in Q2-F2012, compared to a net loss of $0.8 million in Q2-F2011. The Company generated a net loss of $0.4 million for H1-F2012 compared to a net loss of $0.7 million for H1-F2011.

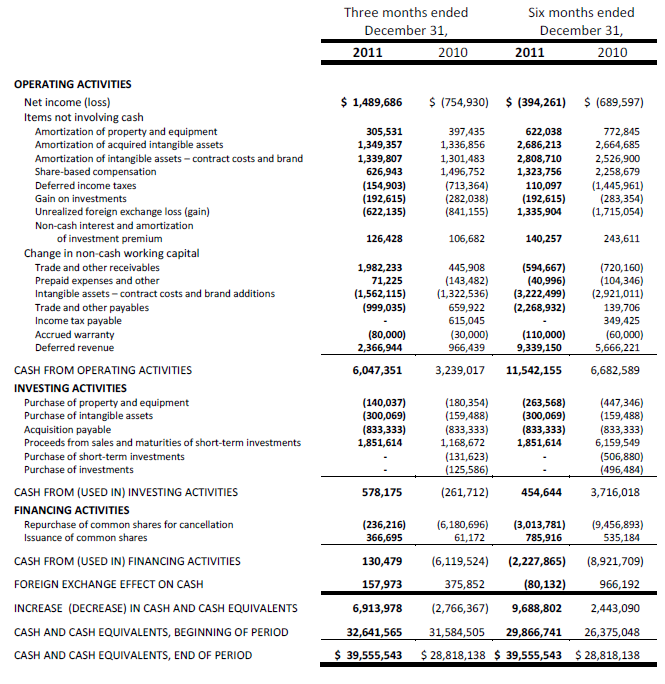

Cash from operating activities increased 87% year-over-year to $6.0 million compared to $3.2 million in Q2-F2011. Cash from operating activities for H1-F2012 increased 73% to $11.5 million from $6.7 million in H1-F2011. The increased cash flow reflects the Company’s improved operational performance, which produced growing sales contracts and reduced operating expenses.

Quarterly Filings

Management’s discussion and analysis (“MD&A”), consolidated financial statements and notes thereto for Q2-F2012 can be obtained today from Absolute’s corporate website at www.absolute.com. The documents will also be available at www.sedar.com.

Notice of Conference Call

Absolute Software will hold a conference call to discuss the Company’s Q2 F2012 results on Wednesday, February 8, 2012 at 2:00 p.m. PT (5:00 p.m. ET). All interested parties can join the call by dialing 647-427-7450, or 1-888-231-8191. Please dial-in 15 minutes prior to the call to secure a line. The conference call will be archived for replay until Wednesday, February 15, 2012 at midnight.

A live audio webcast of the conference call will be available at www.absolute.com and www.newswire.ca. Please connect at least 15 minutes prior to the conference call to ensure adequate time for any software download that may be required to join the webcast. An archived replay of the webcast will be available for 365 days at www.newswire.ca. To access the archived conference call, please dial 416-849-0833, or 1-855-859-2056 and enter the reservation code 47688192.

Non-IFRS Measures and Definitions

Throughout this press release, we refer to a number of measures which we believe are meaningful in the assessment of the Company’s performance. All these metrics are non-standard measures under International Financial Reporting Standards (“IFRS”), and are unlikely to be comparable to similarly titled measures reported by other companies. Readers are cautioned that the disclosure of these items is meant to add to, and not replace, the discussion of financial results or cash flows from operations as determined in accordance with IFRS. For a discussion of the purpose of these non-IFRS measures, please refer to the Company’s Second Quarter 2012 MD&A on SEDAR at www.SEDAR.com.

These measures, as well as their method of calculation or reconciliation to IFRS measures, are as follows:

1) Sales Contracts

See the “Subscription Business Model” section of the MD&A for a detailed discussion of why we believe Sales Contracts (also known as “bookings”) provide a meaningful performance metric. Sales Contracts are included in deferred revenue (see Note 9 of the Notes to the Interim Condensed Consolidated Financial Statements), and result from invoiced sales of our products and services.

2) Basic and diluted Cash from Operating Activities per share

As a result of the nature of our revenues (please refer to “Subscription Business Model” in the MD&A), we use Cash from Operating Activities as a measure of profitability. Accordingly, we believe that Cash from Operating Activities per share is a meaningful indicator of profitability per share. Cash from Operating Activities per share is calculated by dividing Cash from Operating Activities by the average number of shares outstanding for the period (basic), or using the treasury stock method (diluted).

3) Adjusted Operating Expenses

A number of significant non-cash expenses are reported in our Cost of Revenue and Operating Expenses. Management believes that analyzing these expenses exclusive of these non-cash items provides a useful measure of the cash invested in the operations of its business. The non-cash items excluded in the determination of Adjusted Operating Expenses are share-based compensation and amortization of acquired intangible assets. For a description of the reasons these items are adjusted, please refer to the Second Quarter Fiscal 2012 MD&A.

4) Adjusted Operating Income (Loss)

Management believes that analyzing operating results exclusive of significant non-cash items provides a useful measure of the Company’s performance. Adjusted Operating Income (Loss) refers to IFRS operating income excluding charges for share-based compensation and amortization of acquired intangible assets.

5) Theft recovery products

Management defines the Company’s theft recovery product line as all products that include a theft recovery component.

6) Non-theft recovery products

Management defines the Company’s non-theft recovery product line as its Absolute Manage, Absolute Track, Computrace Data Delete and Absolute Secure Drive products.