Vancouver, Canada: August 17, 2015 – Absolute® Software Corporation (TSX: ABT), the industry standard for persistent endpoint security and data risk management solutions for computers, laptops, tablets and smartphones, today announced its financial results for the three and twelve months ended June 30, 2015. All financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”) and are reported in U.S. dollars.

Q4-F2015 Overview:

Annual Contract Value and Billings

- Commercial ACV (“Annual Contract Value”) Base increased 2% sequentially, as quarterly Net ACV Retention(4) from existing customers was 102% and an additional $0.5 million of ACV was added through new customer acquisition

- Total Billings of $29.0 million, representing a year-over-year decrease of 6% compared to $30.7 million in Q4-F2014. The decrease was associated with lower commercial Billings from new customers and international markets, which were impacted by management’s reorganization of the sales force

- Absolute DDS Billings decreased 7% compared to Q4-F2014 while Endpoint Management and Service Billings were consistent with the prior year period

Operations

- Substantially concluded the reorganization of the North American sales organization, and completed the revised product and market positioning and new brand strategy

- Appointed new sales leadership for each of the Asia-Pacific and EMEA regions

- Appointed Art Coviello, former chairman of RSA and executive vice president of EMC, as an Advisor

- Paid a $2.6 million dividend (CAD$0.07 per common share) during the quarter

Technology

- Announced an agreement with Dell to embed Absolute Persistence® technology in Android-powered Dell devices

F2015 Overview:

Annual Contract Value and Billings

- Commercial ACV (“Annual Contract Value”) Base increased 2% sequentially, as quarterly Net ACV Retention(4) from existing customers was 102% and an additional $0.5 million of ACV was added through new customer acquisition

- Total Billings of $29.0 million, representing a year-over-year decrease of 6% compared to $30.7 million in Q4-F2014. The decrease was associated with lower commercial Billings from new customers and international markets, which were impacted by management’s reorganization of the sales force

- Absolute DDS Billings decreased 7% compared to Q4-F2014 while Endpoint Management and Service Billings were consistent with the prior year period

Operations

- Substantially concluded the reorganization of the North American sales organization, and completed the revised product and market positioning and new brand strategy

- Appointed new sales leadership for each of the Asia-Pacific and EMEA regions

- Appointed Art Coviello, former chairman of RSA and executive vice president of EMC, as an Advisor

- Paid a $2.6 million dividend (CAD$0.07 per common share) during the quarter

Technology

- Announced an agreement with Dell to embed Absolute Persistence® technology in Android-powered Dell devices

F2015 Overview:

Annual Contract Value and Billings

- Commercial ACV Base increased 5% as quarterly Net ACV Retention from existing customers averaged 101% and an additional $3.1 million of ACV was added through new customer acquisition

- Total Billings of $101.3 million, representing 4% year-over-year growth, with commercial Billings increasing 6% year-over-year

- Absolute DDS Billings increased 6% year-over-year and Endpoint Management and Service Billings increased 2% year-over-year

Operations

- Clarified and articulated a revised corporate strategy with a singular focus on the Company’s largest and most differentiated market opportunity, endpoint security. Aligned corporate resources around this strategy and set in place a plan to divest non-core assets

- Reorganized the North American sales force to increase focus and return on investment. This included the creation of distinct retention and new business acquisition teams; concentrating field resources around major metropolitan areas and targeted industry verticals of corporate and healthcare; and creating a leveraged inside and outside team structure

- Improved the leadership strength of the organization through the appointment of industry veterans to the board of directors, senior leadership team, product management, sales and development functions

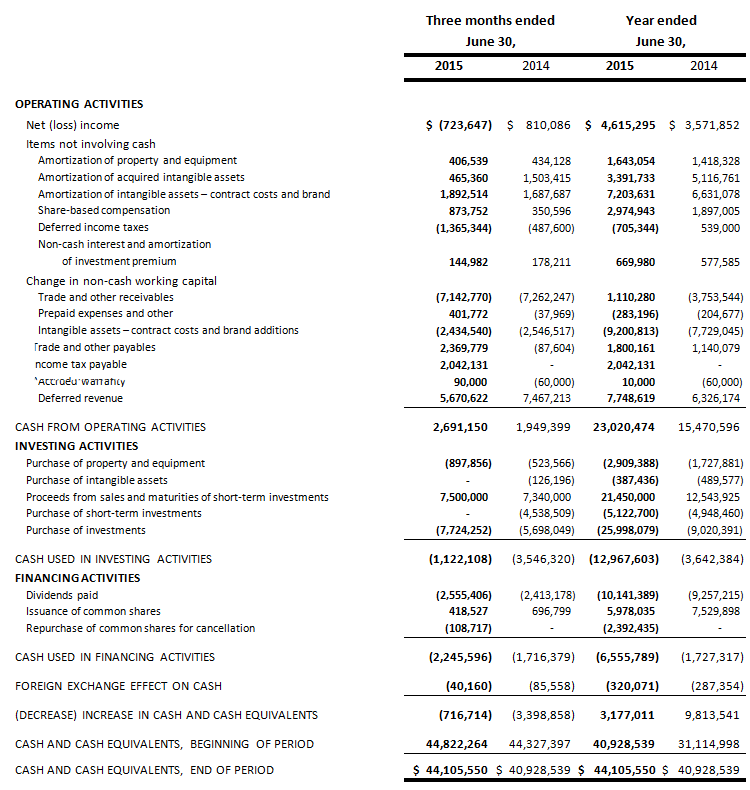

- Achieved $23.0 million in Cash from Operating Activities, a 49% year-over-year increase, and paid $10.1 million (CAD$0.27 per common share) in dividends

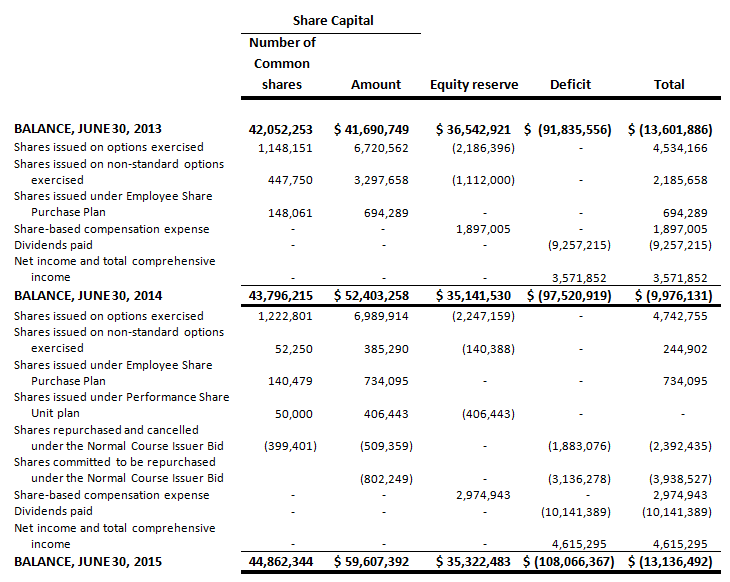

- Repurchased 399,400 common shares pursuant to our Normal Course Issuer Bid for a total investment of $2.4 million

Technology

- Released Absolute DDS Event Calling, which allows customers to receive immediate alerts based on user-defined criteria

- Expanded Persistence® technology to new device models with existing OEM partners HP, Panasonic and Getac

- Partnered with worldwide mobile device manufacturers, Prestigio and YEZZ, and Latin American manufacturers Positivo and Lanix to embed Persistence® technology

- Launched the device freeze offline policy for Absolute DDS customers, allowing users to set a timer so that a device will self-secure if it remains offline for a specific period of time

- Extended Absolute DDS Mobile Theft Management service to Chromebooks to provide theft prevention and recovery services to North American K12 organizations for this new form factor

- Launched a closed beta of the next generation Absolute DDS architecture, which includes enhanced reporting and new endpoint data detection features

“Fiscal 2015 was an important and transformational year for Absolute," said Mr. Geoff Haydon, chief executive officer, Absolute. “Our objectives were to focus investment on products where Absolute has a unique position, improve sales productivity, increase our new customer acquisition capacity, expand our position within targeted geographic and vertical markets, and put Absolute on a path to lead one of the most exciting and lucrative segments in information technology; the security of endpoint devices and the information they contain.

"In Q4 we successfully completed the execution of several key strategic initiatives. These include the clarification of our product strategy and brand, the reorganization of our North American sales force, and the appointment of sales leadership internationally within EMEA and Asia Pacific,” added Mr. Haydon. "Despite the materiality of the changes that occurred across the business in Fiscal 2015, Absolute delivered growth in all key financial metrics.

"Our board of directors recognizes the strength of Absolute's opportunity,” continued Mr. Haydon. “As a reflection of their confidence, they have resolved to allocate CAD$50 million to repurchase Absolute common shares in Q1-F2016. Additionally, the board has indicated their intent to increase the quarterly dividend going forward from CAD$0.07 to CAD$0.08 per common share, commencing with the next quarterly dividend to be declared. The combination of our current cash and investment position, and our expectation of continued strong operating cash flows, allows us to execute these capital initiatives while still enabling our ability to invest in future growth.”

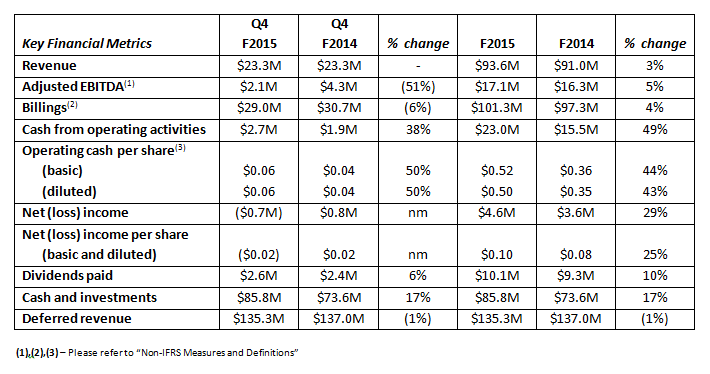

Q4-F2015 and F2015 Financial Review

Commercial Annual Contract Value Base(4)

Commercial ACV base increased 2% sequentially in Q4-F2015 and increased 5% for the fiscal year. The increase was driven by existing customer Net ACV Retention of 102% combined with new customer ACV of $0.5 million in Q4-F2015. For F2015, existing customer quarterly Net ACV Retention averaged 101% and new customer ACV was $3.1 million.

Billings

Q4-F2015 Billings of $29.0 million represented a decrease of 6% compared to Q4-F2014, reflecting a decrease in new customer acquisitions. The Company generated 7% of Q4-F2015 Billings from new customers compared to 17% in Q4-F2014. F2015 record Billings of $101.3 million represented an increase of 4% over the prior year. For F2015, 11% of Billings originated from new customers, compared to 20% in the prior year. The decrease in new customer billings was correlated with short term disruptions from the reorganization of the North American sales force.

Billings to commercial customers represented 97% of Q4-F2015 Billings, consistent with the prior year period, and represented 96% of F2015 Billings compared to 95% in the prior year. Q4-2015 Billings to the education and government verticals increased 3% compared to the prior year and increased 10% in F2015 compared to F2014. Q4-F2015 Billings to the corporate and healthcare verticals decreased 20% year-over-year and were unchanged for F2015 as compared to the prior year. The performance of the corporate and healthcare verticals, a targeted growth market, is associated with the decrease in Billings to new customers.

North American commercial Billings decreased 6% to $25.3 million in Q4-F2015 and increased 9% to $86.5 million for F2015. Commercial Billings outside North America were down 9% to $2.7 million for the quarter and down 17% to $11.1 million for F2015. International commercial sales represented 9% of total commercial Billings for the quarter and 11% of total commercial Billings for F2015.

Billings of Absolute Data and Device Security (“Absolute DDS”), formerly known as Computrace, were $24.5 million in Q4-F2015, representing a decrease of 7% year-over-year and were $85.6 million for F2015, representing a 6% year-over-year increase. Billings for Endpoint Management and Service (Absolute Manage and Absolute Service) products and services were $3.6 million in Q4-F2015, which was unchanged from the prior year period. For F2015, commercial Billings for Endpoint Management and Service products and services increased 2% to $11.9 million.

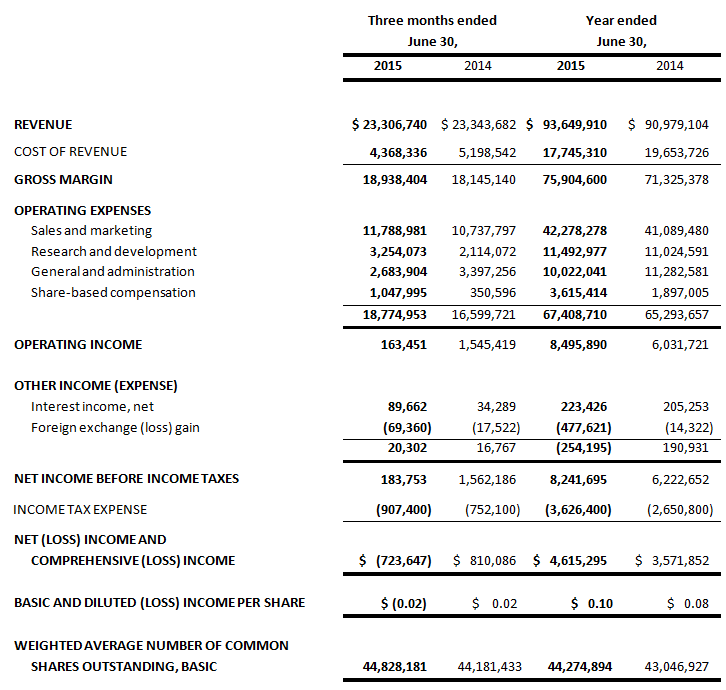

Revenue

Revenue in Q4-F2015 was $23.3 million, in line with $23.3 million in Q4-F2014, reflecting increased revenues from the Company’s DDS products, which were offset by a decrease in revenue from Consumer products and lower professional services revenue. Q4-F2015 Billings included 96% recurring licenses and services (term licenses and annual maintenance contracts) versus 94% in Q4-F2014. F2015 revenue was $93.6 million, up 3% compared to the same period in F2014. F2015 Billings included 95% recurring licenses and services (term licenses and annual maintenance contracts) versus 94% in F2014. Indicative of the Company’s prepaid Software-as-a-Service (“SaaS”) business model, revenue primarily represents the amortization of deferred revenue balances from recurring term license sales from both the current and prior periods.

Adjusted Operating Expenses(5)

Adjusted Operating Expenses for Q4-F2015 were $21.2 million, up 11% from $19.1 million in Q4-F2014, reflecting increased marketing program expenditures and an increase in employee headcount from 413 at June 30, 2014 to 444 at June 30, 2015. In the prior year period, the Company also benefited from a $0.9 million adjustment to its previously recorded investment tax credit estimates within R&D, due to the acceptance of historical claims. For F2015, Adjusted Operating Expenses were $76.5 million, a 2% increase from $74.7 million in the same period of F2014, reflecting overall increased employee headcount, which was offset by foreign exchange savings. Adjusted Operating Expenses represented 91% of revenue in Q4-F2015 compared to 82% in Q4-F2014 and represented 82% of revenue for F2015 compared to 82% for F2014.

Adjusted EBITDA(1) & Net Income

Absolute generated Adjusted EBITDA of $2.1 million in Q4-F2015, down from $4.3 million in Q4-F2014. For F2015, Adjusted EBITDA was $17.1 million, a 5% increase over $16.3 million for F2014.

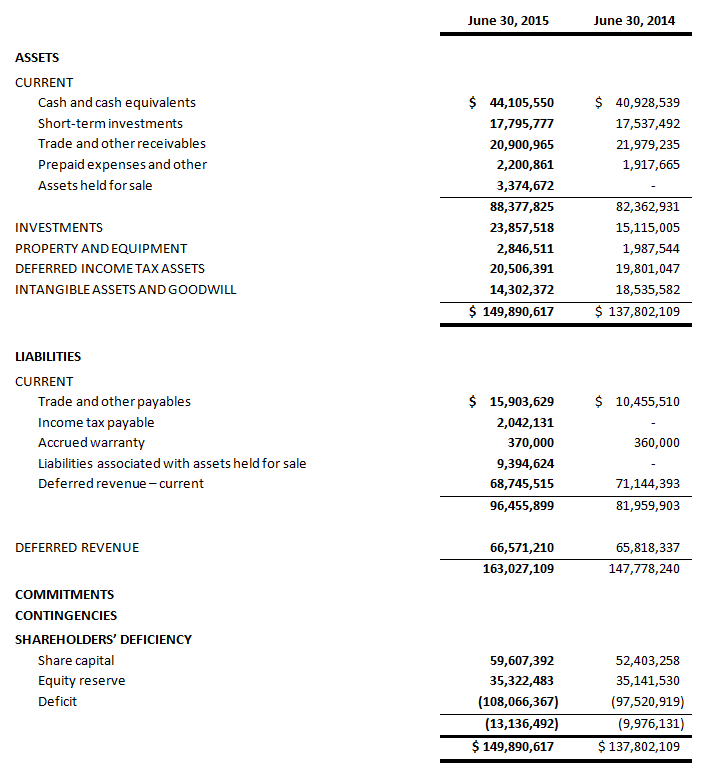

Absolute recorded a net loss of $0.7 million, or $0.02 per share, in Q4-F2015, compared to net income of $0.8 million, or $0.02 per share, in Q4-F2014, primarily reflecting higher Adjusted Operating Expenses during the current year period. F2015 net income was $4.6 million, or $0.10 per share, up from $3.6 million, or $0.08 per share, for F2014.

Corporate Outlook

Management remains confident in the market opportunity for Absolute. For F2016, the Company expects to grow its Commercial ACV base, revenue and Billings, as related to Absolute DDS. In F2016, the Company plans to expand its presence in the enterprise market, particularly in the healthcare and financial services verticals; launch new products and features, such as DDS for Healthcare and integration with third-party SIEM systems; and establish additional partnerships with leading security service providers where Absolute’s unique Persistence technology enables enhanced service and provides additional growth opportunities. The Company therefore plans to invest incrementally in research and development and sales and marketing to support this growth. Cash generated from operating activities, excluding income tax-related items, is expected to remain relatively consistent with F2015.

Quarterly Dividend

The Company’s Board of Directors previously declared a dividend of C$0.07 per common share on July 15, 2015, payable on August 27, 2015 to shareholders of record at the close of business on August 6, 2015.

Quarterly Filings

Management’s discussion and analysis (“MD&A”) and consolidated financial statements and the notes thereto for F2015 can be obtained today from Absolute’s corporate website at www.absolute.com. The documents will also be available at www.sedar.com.

Notice of Conference Call

Absolute will hold a conference call to discuss the Company’s Q4 and F2015 results on Monday, August 17, 2015 at 5:00 p.m. ET. All interested parties can join the call by dialing 647-427-7450, or 1-888-231-8191. Please dial-in 15 minutes prior to the call to secure a line. The conference call will be archived for replay until Monday, August 24, 2015 at midnight. To access the archived conference call, please dial 416-849-0833, or 1-855-859-2056 and enter the reservation code 91945987.

A live audio webcast of the conference call will be available at www.absolute.com and http://bit.ly/1MoGWFp. Please connect at least 15 minutes prior to the conference call to ensure adequate time for any software download that may be required to join the webcast. An archived replay of the webcast will be available on the Company’s website for 90 days.

Non-IFRS Measures and Definitions

Throughout this press release, we refer to a number of measures which we believe are meaningful in the assessment of the Company’s performance. All these metrics are non-standard measures under International Financial Reporting Standards (“IFRS”), and are unlikely to be comparable to similarly titled measures reported by other companies. Readers are cautioned that the disclosure of these items is meant to add to, and not replace, the discussion of financial results or cash flows from operations as determined in accordance with IFRS. For a discussion of the purpose of these non-IFRS measures, please refer to the Company’s Fiscal 2015 MD&A on SEDAR at www.SEDAR.com.

These measures, as well as their method of calculation or reconciliation to IFRS measures, are as follows:

1) Adjusted EBITDA

Management believes that analyzing operating results exclusive of significant non-cash items or items not controllable in the period provides a useful measure of the Company’s performance. The term Adjusted EBITDA refers to earnings before deducting interest and investment gains (losses), income taxes, amortization of acquired intangible assets and property and equipment, foreign exchange gain or loss, share-based compensation, and restructuring charges and post-retirement benefits. The items excluded in the determination of Adjusted EBITDA are share-based compensation, amortization of acquired intangibles, amortization of property and equipment, and restructuring charges and certain post-retirement benefits.

2) Billings

See the “Subscription Business Model” section of the MD&A for a detailed discussion of why the Company believes Billings (formerly referred to as “Sales Contracts”) provide a meaningful performance metric. Billings are included in deferred revenue (see Note 10 of the Notes to the Consolidated Financial Statements), and result from invoiced sales of our products and services.

3) Basic and diluted Cash from Operating Activities per share

As a result of the nature of our revenues (please refer to “Subscription Business Model” in the MD&A), the Company uses Cash from Operating Activities as a measure of profitability. Accordingly, Absolute believes that Cash from Operating Activities per share is a meaningful indicator of profitability per share. Cash from Operating Activities per share is calculated by dividing Cash from Operating Activities by the weighted average number of shares outstanding for the period (basic), or the fully diluted number of shares using the treasury stock method (diluted).

4) Commercial ACV Base and Net ACV Retention

See the “Subscription Business Model” section of the MD&A for a detailed discussion of why we believe Commercial ACV Base and Net ACV Retention provide meaningful performance metrics. Commercial ACV Base measures the amount of recurring annual revenue we will receive from our commercial customers under contract at a point in time, and therefore is an indicator of our future revenue streams. Net ACV Retention measures the percentage increase or decrease in the Commercial ACV Base at the end of a period for the customers that comprised the Commercial ACV Base at the beginning of the same period. This metric provides insight into the effectiveness of our customer retention and expansion functions.

5) Adjusted Operating Expenses

A number of significant non-cash or non-recurring expenses are reported in our Cost of Revenue and Operating Expenses. Management believes that analyzing these expenses exclusive of these non-cash or non-recurring items provides a useful measure of the cash invested in the operations of its business. The items excluded in the determination of Adjusted Operating Expenses are share-based compensation, amortization of acquired intangible assets, amortization of property and equipment, and restructuring charges and certain post-retirement benefits. For a description of the reasons these items are adjusted, please refer to the Fiscal 2015 MD&A.