Accelerating annual revenue growth of 16% driven by strong ARR growth of 17%

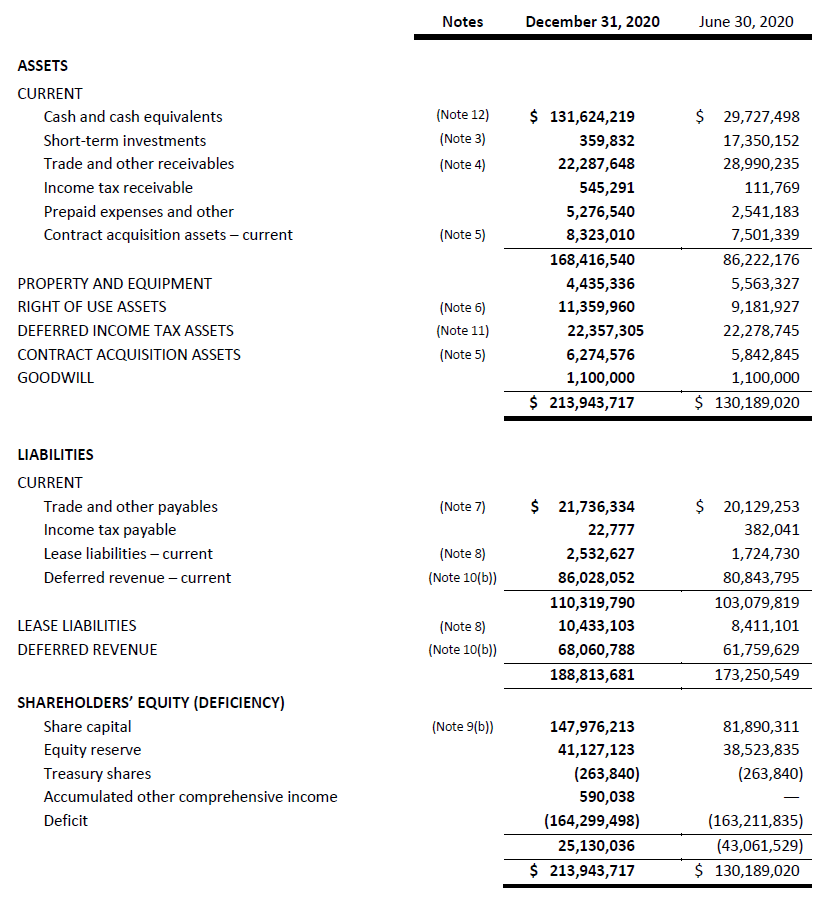

VANCOUVER, British Columbia – February 9, 2021 – Absolute Software Corporation (“Absolute” or the “Company”) (TSX: ABST) (NASDAQ: ABST), a leader in Endpoint Resilience™ solutions, today announced its financial results for its second quarter fiscal 2021 ended December 31, 2020. All dollar figures are stated in U.S. dollars, unless otherwise indicated.

“As we all approach the one-year milestone in our remote working and distance learning journeys, the massive market opportunity for Absolute remains clear and in focus,” said Christy Wyatt, President and Chief Executive Officer at Absolute Software. “Our strong fiscal Q2 results reflect increased demand for the Absolute Resilience platform, the only firmware-based solution across over half a billion devices that enables customers to always know where their endpoints are, take deep control and security actions on those devices, and help their security controls repair themselves.“

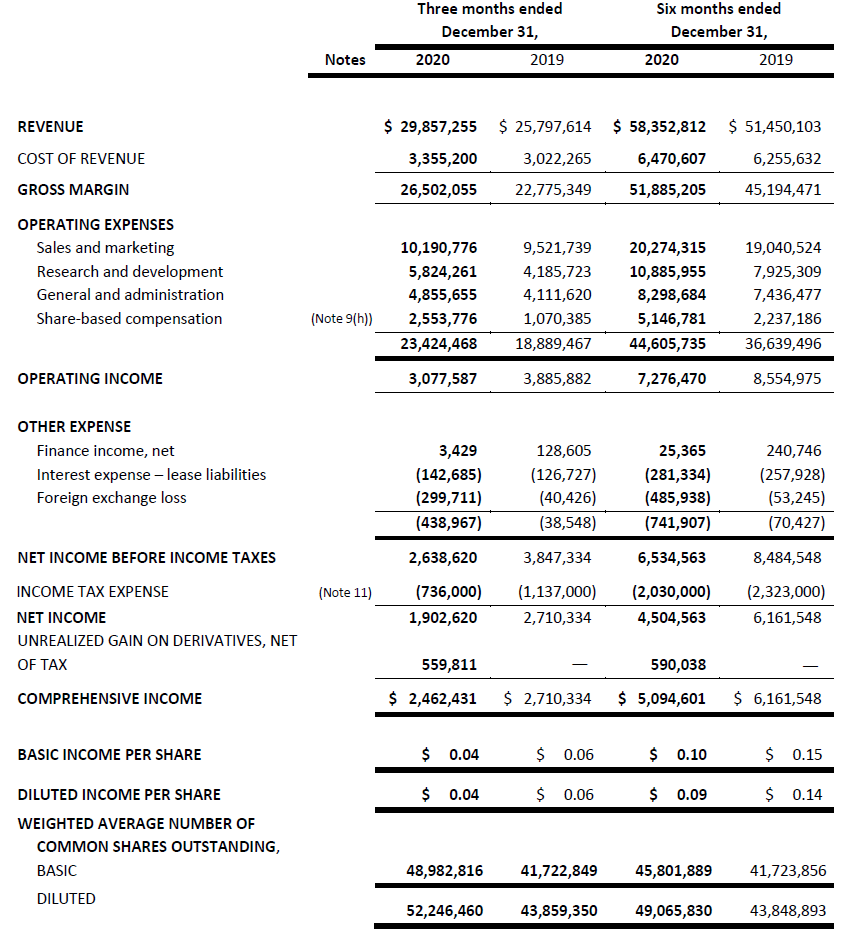

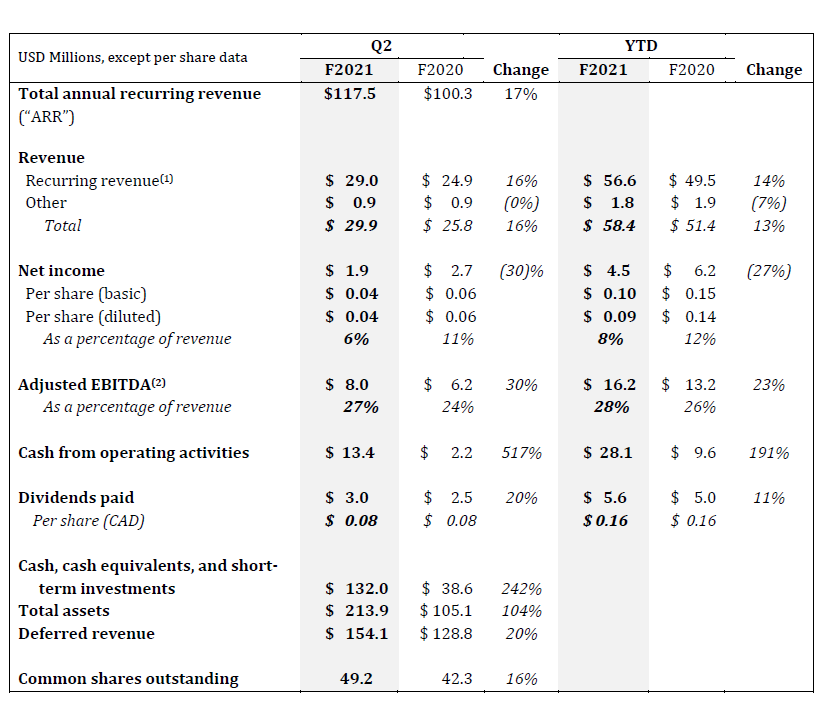

Second Quarter Fiscal 2021 (“Q2 F2021”) Financial Highlights

- Total revenue in Q2 F2021 was $29.9 million, representing an increase of 16% over Q2 F2020 revenue.

- Total ARR(1) at December 31, 2020 was $117.5 million, representing an increase of 17% over the prior year. The Enterprise & Government portions of Total ARR increased by 12% annually over Q2 F2020 and represented 66% of Total ARR at December 31, 2020; the Education sector portion of Total ARR increased by 30% annually over Q2 F2020 and represented 34% of Total ARR at December 31, 2020.

- Adjusted EBITDA(1) in Q2 F2021 was $8.0 million, or 27% of revenue, up from $6.2 million, or 24% of revenue, in Q2 F2020.

- New Logo ARR(1)(2) was $1.5 million in Q2 F2021, compared to $1.3 million in Q2 F2020.

- Net Dollar Retention(1)(3) from existing customers was 109% in Q2 F2021, compared to 100% in Q2 F2020.

- Net income in Q2 F2021 was $1.9 million, compared to 2.7 million in Q2 F2020.

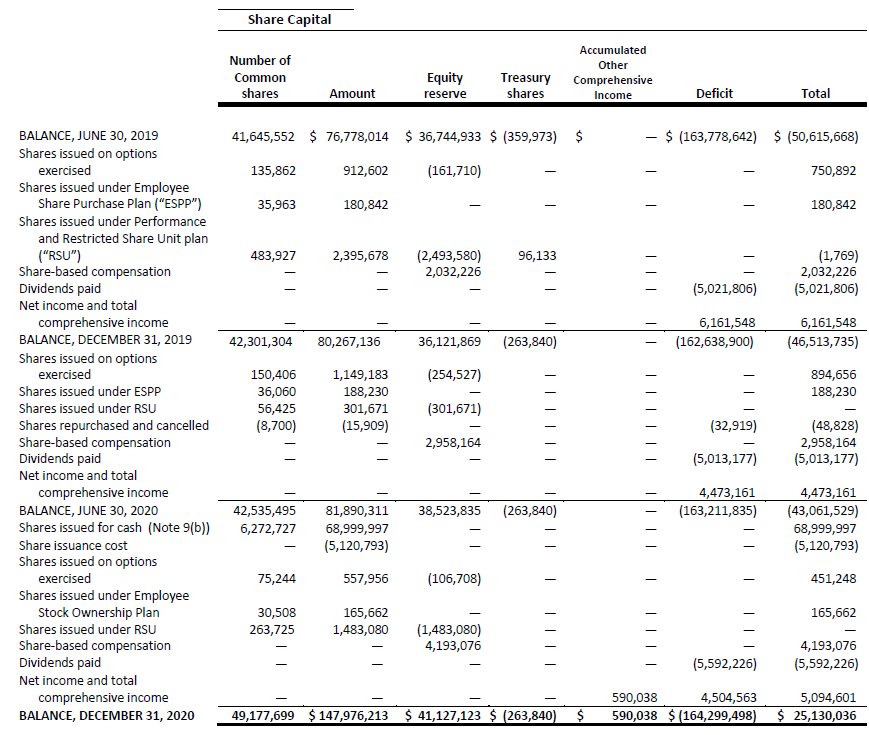

- Absolute paid a quarterly dividend of CAD$0.08 per common share during Q2 F2021.

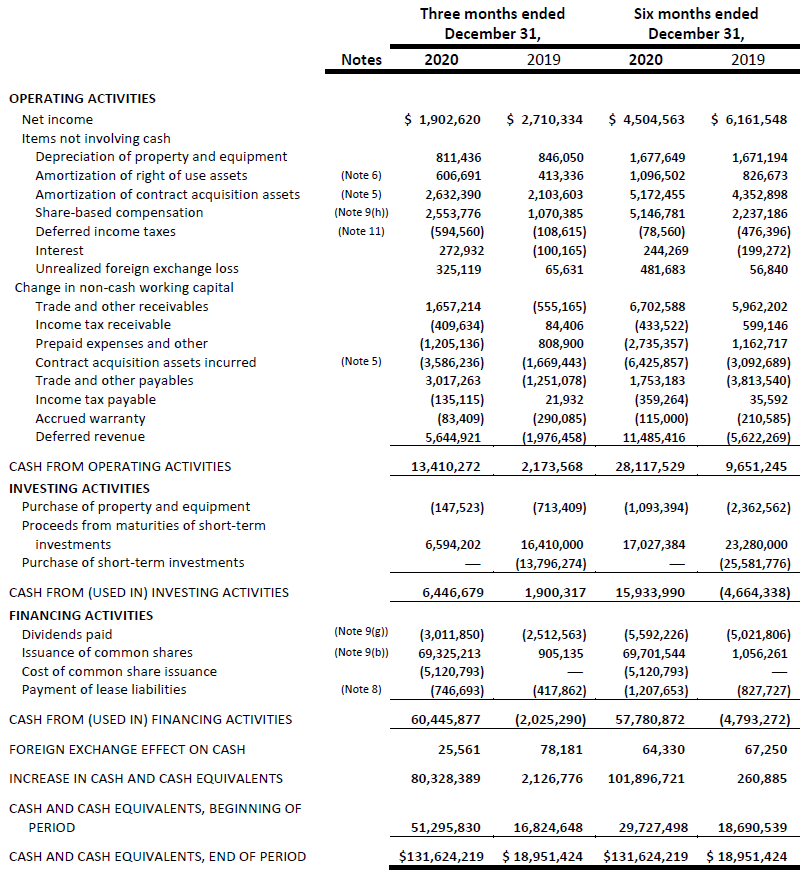

- Cash generated from operating activities in Q2 F2021 was $13.4 million, compared to $2.2 million in Q2 F2020.

- Refer to the “Non-IFRS Measures and Key Metrics” section of the Q2 F2021 MD&A for further discussion of this measure.

- Beginning in Q2 F2021, we have changed the nomenclature of Total ARR from sales to new customers during a period from “ARR from New Customers” to “New Logo ARR”. There has been no change in the method by which this measure is calculated.

- Beginning in Q2 F2021, we have changed the nomenclature of the percentage increase or decrease in Total ARR from existing customers for a given period from “Net ARR Retention” to “Net Dollar Retention” and changed the measurement period from quarterly to annual, as we believe the annual metric is more aligned with business performance measures and industry norms. The measure calculated under the previously used methodology for Q2 F2020 was 104%.

Selected Quarterly Information

Notes:

- Recurring revenue represents revenue derived from cloud services and managed services, both of which are included as part of Total ARR (as defined below). Other revenue represents revenue derived from non-recurring professional services and ancillary product lines, including consumer products. See the Q2 F2021 MD&A for full disclosure regarding these measures.

- Throughout this document, Adjusted EBITDA (as defined below) is used as a profitability measure. Please refer to the “Non-IFRS Measures and Key Metrics” section of the Q2 F2021 MD&A for further discussion on this and other non-IFRS measures.

Q2 F2021 & Recent Business Highlights

Product and service highlights:

- In October, we launched a new Absolute Control® mobile app, designed to help customers secure endpoint devices and protect sensitive data while on the go. The user-friendly app extends the power of the Absolute console, enabling IT and security teams to easily locate lost or stolen devices, check the health of critical endpoint security agents, and take swift action to lock a device if it is determined to be at risk.

- In November, we announced new software inventory capabilities and web usage analytics that provide IT and security teams with advanced insights into software and web usage across their distributed endpoint device fleets.

- We continued adding to our Application Persistence™ portfolio of self-healing applications, including Netskope® Cloud Access Security Broker (CASB), Next-Gen Secure Web Gateway (NG-SWG) and Palo Alto Networks® GlobalProtect™ security platform, enabling them to be monitored and autonomously repair themselves, so they remain installed, healthy, and undeletable.

Business and organizational developments:

- In October, we completed a public offering of our common shares (“Common Shares”) in the United States and Canada for gross proceeds of approximately $69 million and a corresponding cross-listing of the Common Shares on the Nasdaq Global Market Exchange. Our Common Shares now trade on both the Toronto Stock Exchange and Nasdaq under the symbol “ABST.”

- In October, Christy Wyatt, Absolute’s President and Chief Executive Officer was named ‘New CEO of the Year’ by The Globe and Mail's Report on Business magazine, based on her significant impact on the Company and its strategy in less than three years of tenure in her role.

- In November, Steven Gatoff joined Absolute as Chief Financial Officer. Mr. Gatoff brings to Absolute over 25 years of financial expertise and leadership, and a distinctive track record of driving value creation for software companies. His responsibility includes all global finance, accounting, financial reporting, audit, tax, investor relations, and capital planning functions at Absolute.

- In November, we announced Sound Physicians, a physician-led operator of medical clinics across the U.S., relies on the Absolute Resilience™ platform to secure remote endpoints that routinely process and store sensitive patient data protected by the Health Insurance Portability and Accountability Act (HIPAA).

- In December, we were awarded the Cyber Catalyst℠ designation by Marsh & McLennan – who facilitates an independent evaluation of over 90 solutions by leading cyber insurers. This designation is significant as it emphasizes Absolute’s critical capabilities and our ability to provide the highest level of protection against today’s top cyber risks - and offers customers significant discounts on cyber insurance when Absolute is deployed in their environments.

- In December, we were notified by the FedRAMP Joint Authorization Board that we have been prioritized to pursue a Provisional Authority to Operate for the Absolute Resilience platform. This enhances our opportunity to accelerate our growth in the US federal market over the coming years – and demonstrates our commitment to ensuring the highest levels of cloud security across all government agencies.

- In December, we were named a Leader in the Winter 2021 Grid® Report for Endpoint Management published by G2, a leading business solutions review website. This marks the sixth consecutive quarter Absolute has been identified as one of the top Endpoint Management solution providers based on high levels of customer satisfaction among G2’s verified users.

Partner and other highlights included:

- Absolute was added to the HealthTrust Group Purchasing Organization offering that Lenovo and CDW sales teams are leveraging in healthcare sector.

- Dell’s Blueprint for Success program, originally launched in Q1 with a focus on education, has now been expanded to cover state and local governments and healthcare.

- Additional software bundles were launched with HP in North America and EMEA, supporting consumers as well as WFH, remote workers and BYOD users.

- Absolute increased partner engagement in Q2 via our new Partner Program, which in turn led to increased activity in our channel pipeline.

F2021 Financial Outlook

The Company is updating its previously disclosed financial outlook for the full year fiscal 2021 as follows:

- The Company is raising its outlook on revenue from $116 million to $118 million (representing 11% to 13% annual growth) to $117 million to $119 million (representing 12% to 14% annual growth).

- The Company is raising the lower end of its outlook on Adjusted EBITDA from 21% to 24% of revenue to 22% to 24% of revenue.

- The Company is also raising the lower end of its outlook on cash from operating activities margin from 25% to 34% of revenue to 26% to 34% of revenue.

- The Company is maintaining its outlook for capital expenditures and expect them to be between $3.0 million and $4.0 million.

The foregoing outlook and expectations constitute forward-looking statements and financial outlook and are qualified in their entirety by the “Forward-Looking Statements” cautionary statement below.

Quarterly Dividend

On January 20, 2021, we declared a quarterly dividend of CAD$0.08 per share on our Common Shares, payable in cash on February 26, 2021 to shareholders of record at the close of business on February 12, 2021.

Quarterly Filings and Related Quarterly Financial Information

Management’s Discussion and Analysis (“MD&A”) and Consolidated Financial Statements and the notes thereto for the fiscal period ended December 31, 2020 can be obtained today from Absolute’s corporate website at www.absolute.com. The documents will also be available under Absolute’s SEDAR profile at www.sedar.com and on EDGAR at www.sec.gov. Additionally, the Company has published on the Investor Relations section of its website (www.absolute.com/company/investors/) an Q2 F2021 Earnings Presentation and a dashboard of Selected Operating and Financial Metrics.

Conference Call

Absolute Software will hold a conference call to discuss its Q2 F2021 financial results on Tuesday, February 9, 2021, at 5:00 p.m. ET (2:00 p.m. PT) after the financial markets close.

The call will be accessible by dialing 647-427-7450 or 1-888-231-8191. A live audio webcast of the conference call will also be available via the Absolute Investor Relations website.

The conference call will be archived for replay until Tuesday, February 16, 2021. To access the archived conference call, please dial 416-849-0833 or 1-855-859-2056 and enter the reservation code 4639198. An archived replay of the webcast will be available for 90 days.

Non-IFRS Measures and Key Metrics

Throughout this press release, the Company refers to a number of measures and metrics that the Company believes are meaningful in the assessment of the Company’s performance. Many of these metrics are non-standard measures under International Financial Reporting Standards (“IFRS”), do not have any standardized meaning under IFRS, and are unlikely to be comparable to similarly titled measures reported by other companies. Readers are cautioned that the disclosure of these items is meant to add to, and not replace, the discussion of financial results or cash flows from operations as determined in accordance with IFRS. For more complete discussion of these non-IFRS measures, please refer to the Q2 F2021 MD&A.

These measures and metrics, and their method of calculation or reconciliation to IFRS measures, are as follows:

-

Total ARR, Net Dollar Retention, and New Logo ARR

As the majority of our customer contracts are sold under prepaid multi-year term licenses, there is typically a significant lag between the timing of the invoice and the associated revenue recognition. As a result, we focus on the aggregate annual recurring revenue of our subscriptions under contract and generating revenue, measured by Annual Recurring Revenue (“ARR”), as an indicator of our future recurring revenues. We believe that increases in the amount of New Logo ARR, and improvement in our Net Dollar Retention, will accelerate the growth of Total ARR and, in turn, our future revenues.

Total ARR is a key metric and measures the amount of annual recurring revenue we will receive from our customers under contract at a point in time, and therefore is an indicator of our future revenue streams. Total ARR will change over a period through the retention, attrition and expansion of existing customers and the acquisition of new customers. As Total ARR is measured at a point in time, there is no similar measure under IFRS against which it can be reconciled.

Net Dollar Retention (previously “Net ARR Retention”) is a key metric and measures the percentage increase or decrease in Total ARR at the end of a year for customers that comprised Total ARR at the beginning of the year. This metric provides insight into the effectiveness of our activities to retain and expand the ARR of our existing customers.

New Logo ARR (previously “ARR from New Customers”) is a key metric and measures the addition to Total ARR from sales to new customers during a period.

-

Adjusted Operating Expenses

A number of significant non-cash expenses are reported in our Cost of Revenue and Operating Expenses. In addition, restructuring and reorganization charges and post-retirement benefits are also reported in Operating Expenses. Management defines “Adjusted Operating Expenses” as IFRS Cost of Revenue, Sales and Marketing, Research and Development, and General and Administration expenses adjusted for these items, as we believe that analyzing these expenses exclusive of these items provides a useful measure of the cash invested in operating the ongoing business. The non-cash items include share-based compensation, amortization of intangible assets, and depreciation of property and equipment and amortization of right of use assets.

Specifically, management adjusts for the following items in computing its Adjusted Operating Expenses:

- Share-based compensation: Our compensation strategy includes the use of share-based awards to attract and retain key employees, executives and directors. It is principally aimed at aligning their interests with those of our shareholders and at long-term employee retention, rather than to motivate or reward operational performance for any particular period. Thus, share-based compensation expense varies for reasons that are generally unrelated to operational decisions and performance in any particular period.

- Amortization of Intangible Assets: We believe that amortization of intangible assets is not necessarily reflective of current period operational activities. In particular, the amortization of acquired technologies and customer relationships relates to items arising from pre-acquisition activities. These are costs that are determined at the time of an acquisition or when other intangible assets are acquired. While it is continually reviewed for potential impairment, amortization of the cost is a static expense, one that is typically not affected by operations during any particular period.

- Depreciation of Property and Equipment and Amortization of Right of Use Assets: We believe that depreciation / amortization of property and equipment and right of use assets is not necessarily reflective of current period operational activities. In particular, the costs associated with these assets relate to operational decisions made in prior periods. Depreciation / amortization of these costs is a static expense, one that is typically not affected by operations during any particular period.

- Restructuring or Reorganization Charges and Post-Retirement Benefits: We believe that costs incurred in certain significant post-retirement benefits afforded to executives upon departure from the Company, are not necessarily reflective of current period operational activities. In particular, these items relate to decisions which will impact future operating periods. The magnitude of these expenses is typically determined by contractual law, common law, or by statute, and is unaffected by operations and performance in any particular period.

- Non-recurring Items: We believe that costs that are non-recurring, unusual or non-operating in nature, such as non-recurring, unusual or non-operating tax, legal, restructuring and other one-time corporate expenses, are not necessarily reflective of current period operational activities.

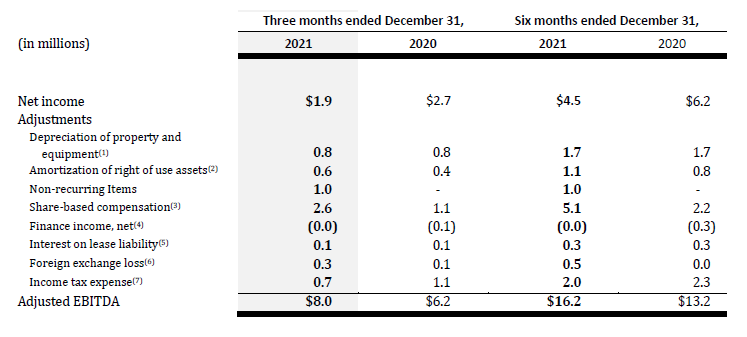

The following table provides a reconciliation of our Net Income to Adjusted EBITDA:

Notes:

- Depreciation of property and equipment per the Statement of Cash Flows.

- Amortization of right of use assets per the Statement of Cash Flows.

- Share-based compensation per the Statement of Operations.

- Finance income, net per the Statement of Operations.

- Interest on lease liability per the Statement of Operations.

- Foreign exchange loss per the Statement of Operations.

- Income tax expense per the Statement of Operations.