Company posts strong ARR growth in Enterprise and Government, raises Revenue and Adjusted EBITDA guidance

VANCOUVER, British Columbia and SAN JOSE, Calif. – November 9, 2021 – Absolute Software Corporation (Nasdaq: ABST) (TSX: ABST), a leader in self-healing Zero Trust solutions, today announced its financial results for its first quarter fiscal 2022 ended September 30, 2021. All dollar figures are stated in U.S. dollars, unless otherwise indicated.

“Since the acquisition of NetMotion, we have been able to make significant progress on our product integration milestones, while also delivering continued innovation to our customers and recording some of our strongest growth numbers in several quarters,” said Christy Wyatt, Absolute Software’s President and CEO. “In the work-from-anywhere world we now live in, we’re seeing strong demand for our products and services. There is meaningful opportunity ahead for us as we bring our unique offerings to the high-growth SASE and Zero Trust markets, as organizations navigate the challenges of enabling and securing their entire workforce. We are well-positioned to deliver the resiliency, connectivity, and intelligence they need to succeed in this new environment.”

The company also announced today the launch of Absolute Application-Persistence-as-Service (APaaS), empowering Independent Software Vendors (ISVs) and system manufacturers to leverage Absolute’s firmware-embedded, self-healing device connection to strengthen the health and resiliency of their mission-critical applications. Read the press release here.

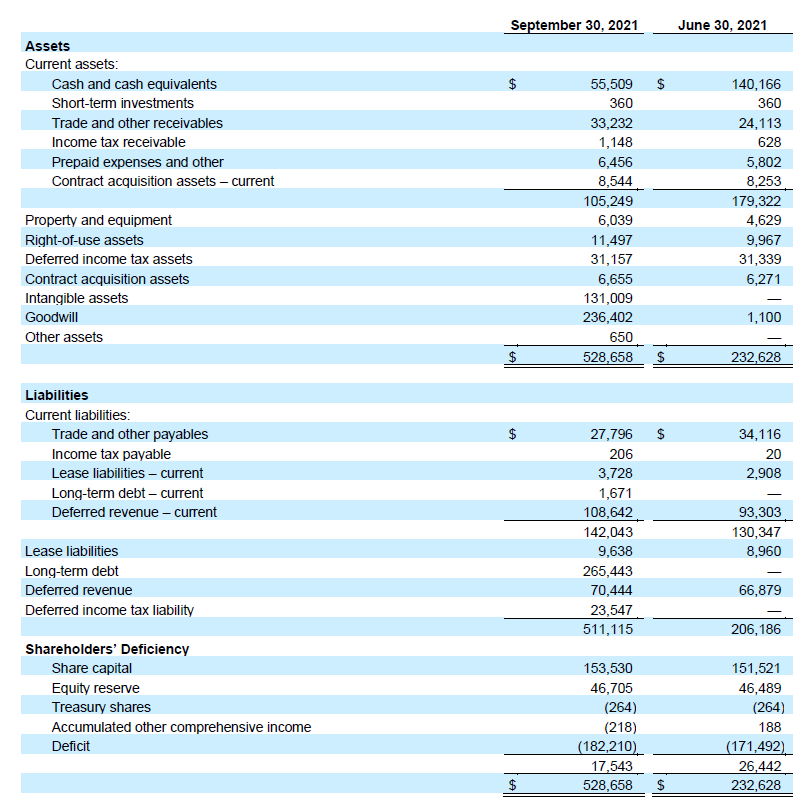

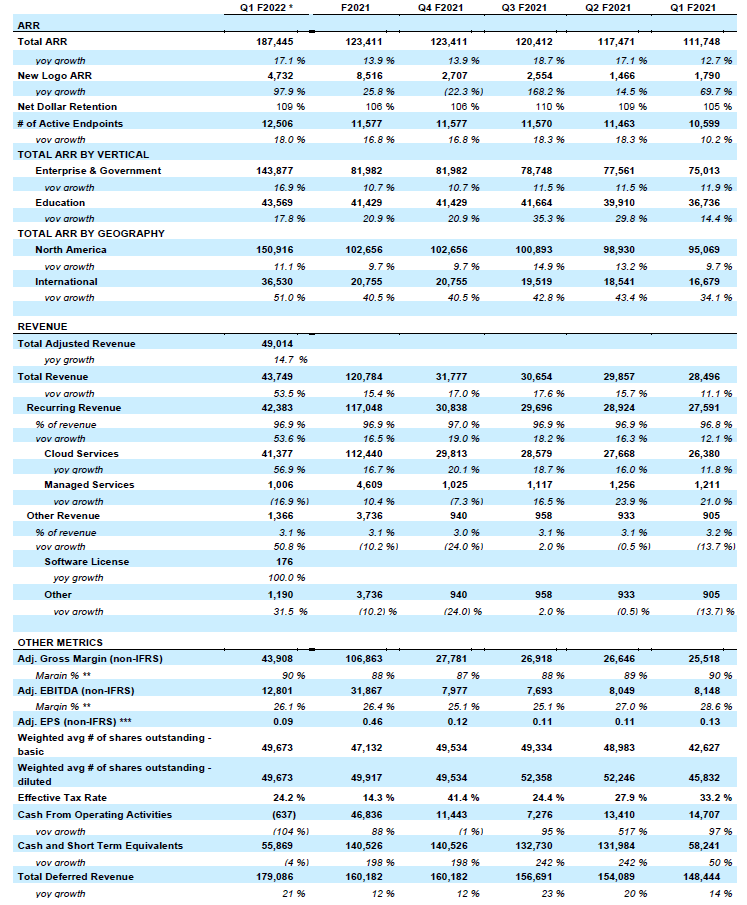

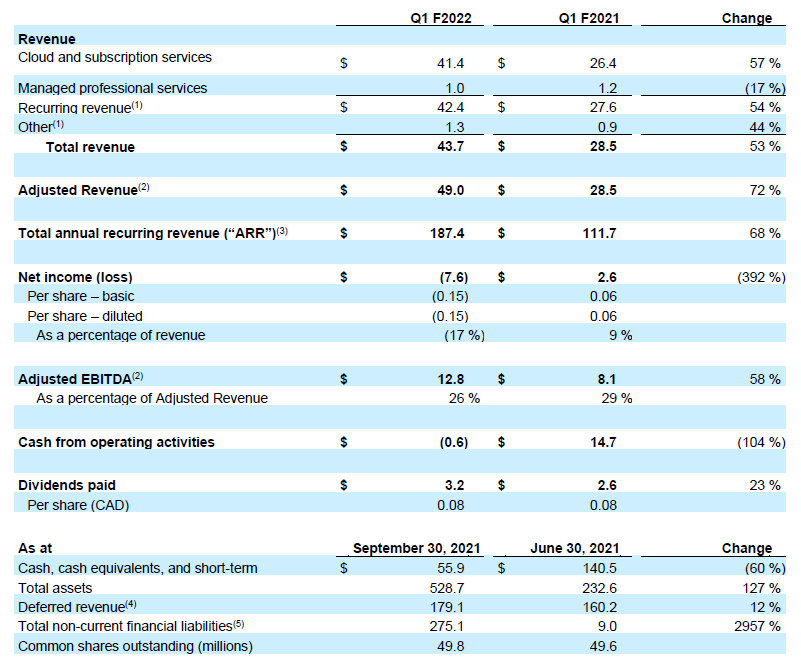

First Quarter (“Q1”) Fiscal 2022 (“F2022”) Financial Highlights

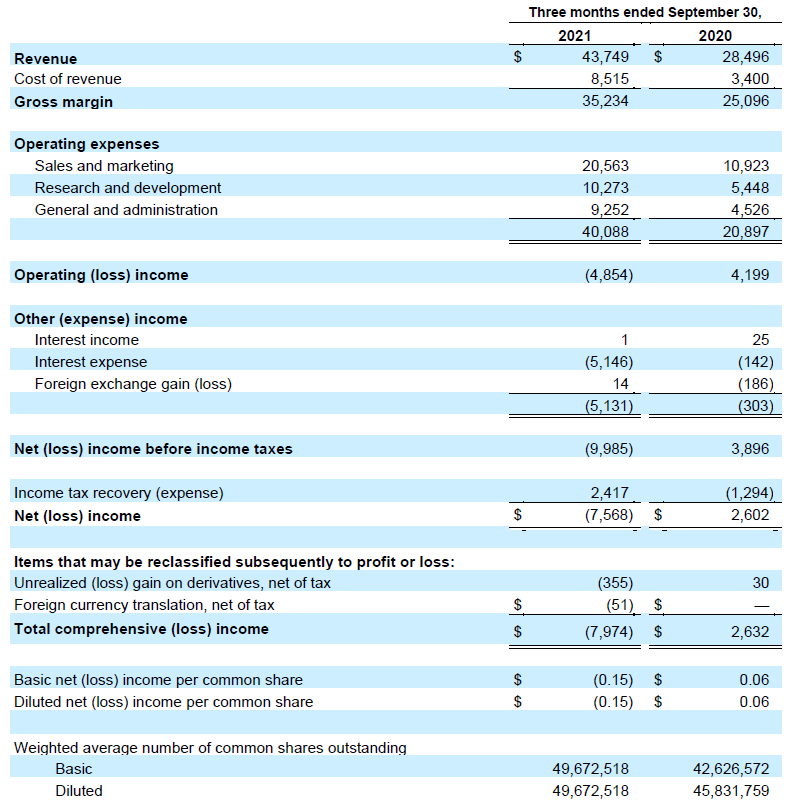

- Revenue in Q1 F2022 was $43.7 million, representing an increase of 53% compared to Q1 of fiscal year 2021 (“Q1 F2021”). 76% of the total increase from Q1 F2021 was attributed to NetMotion and 24% was attributed to Absolute’s existing business.

- Adjusted Revenue(1) in Q1 F2022 was $49.0 million, representing an increase of 72% compared to Q1 F2021 reported revenue, and an increase of 15% compared to Q1 F2021 revenue on an as-if combined basis without factoring in acquisition related adjustments(2).

- Net loss in Q1 F2022 was $7.6 million, compared to net income of $2.6 million in Q1 F2021.

- Total ARR(4) at September 30, 2021 was $187.4 million, representing an increase of 68% over the prior year reported ARR, and increase of 17% compared to an as-if combined basis for Q1 F2021(3).

- The Enterprise & Government portions of Total ARR increased by 92% over the prior year, and 17% compared to an as-if combined basis for Q1 F2021(3). The Enterprise & Government portion represented 77% of Total ARR at September 30, 2021.

- The Education sector portion of Total ARR increased by 19% year over year, and 18% compared to an as-if combined basis for Q1 F2021(3). The Education sector portion represented 23% of Total ARR at September 30, 2021.

- New Logo ARR(4)(5) was $4.7 million in Q1 F2022, compared to $1.8 million in Q1 F2021. New Logo ARR increased by 98% compared to an as-if combined basis for Q1 F2021.

- Net Dollar Retention(4)(6) was 109% in Q1 F2022, compared to 105% in Q1 F2021.

- Adjusted EBITDA(1) in Q1 F2022 was $12.8 million or 26% of Adjusted Revenue(1), compared to $8.1 million or 29% of Adjusted Revenue in Q1 F2021.

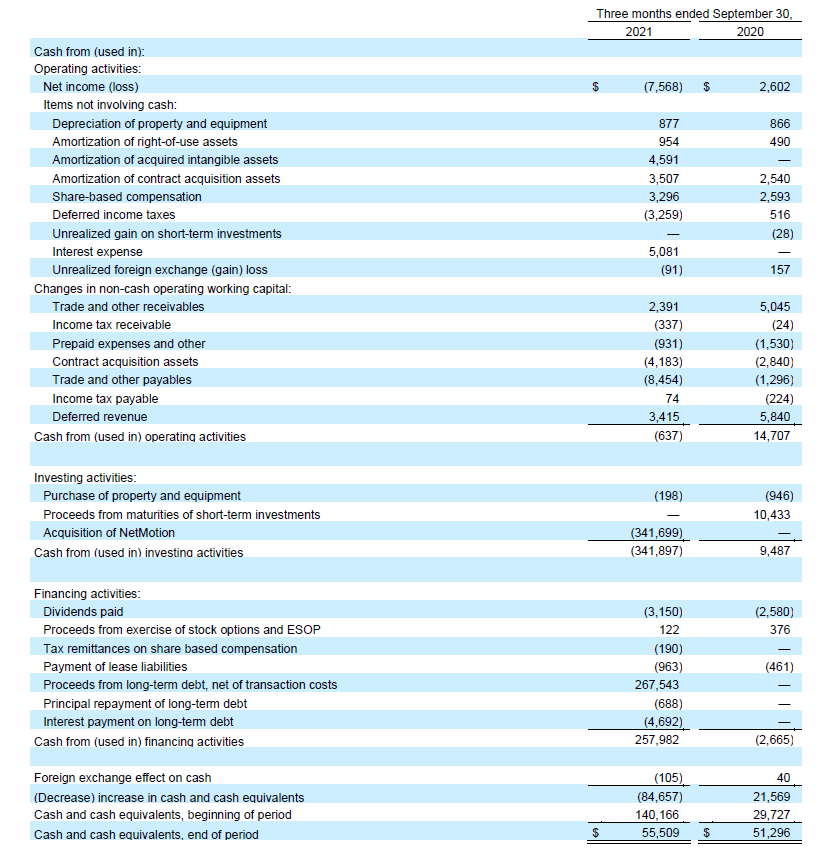

- Cash used in operating activities was $0.6 million in Q1 F2022 compared to cash from operating activities of $14.7 million in Q1 F2021. Decrease in cash is primarily due to $8.7 million of acquisition and integration costs, and approximately $5 million relating to shorter average contract terms compared to the prior year.

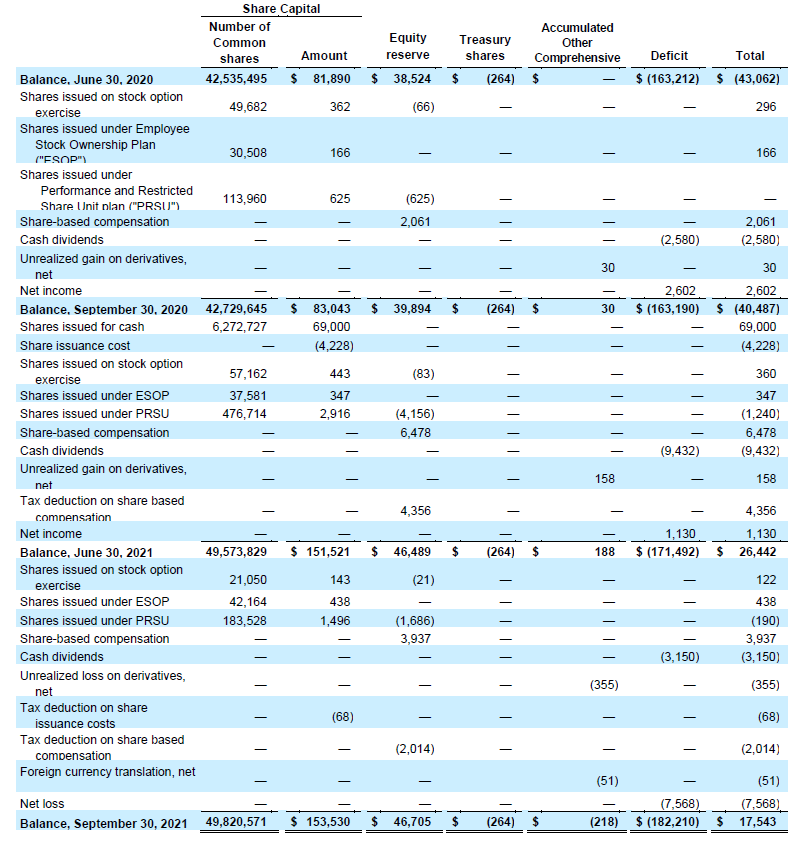

- A quarterly dividend of CAD$0.08 per outstanding common share was paid during Q1 F2022.

Notes:

- Adjusted Revenue, Adjusted EBITDA, and Adjusted EBITDA as percentage of Adjusted Revenue are non-IFRS measures. Refer to the “Use of non-IFRS measures and key metrics” section of the Q1 F22 MD&A for further discussion of these measures.

- Q1 F21 revenue on an as-if combined basis includes the combined revenue of Absolute and NetMotion for Q1 F21. Revenue attributable to Absolute is reported under IFRS and revenue attributable to NetMotion is reported under US GAAP. The amount does not include US GAAP to IFRS adjustments, which are deemed immaterial.

- Q1 F2021 ARR on an as-if combined basis combines the historical ARR of Absolute Software and NetMotion at September 30, 2020, as if the acquisition of NetMotion occurred on July 1, 2020.

- Total ARR, New Logo ARR and Net Dollar Retention are key metrics. Refer to the “Use of non-IFRS measures and key metrics” section of the Q1 F22 MD&A for further discussion of these measures.

- Beginning in Q2 F2021, we changed the nomenclature of Total ARR from sales to new customers during a period from “ARR from New Customers” to “New Logo ARR”. There has been no change in the methods by which these measures are calculated.

- Beginning in Q2 F2021, we have changed the nomenclature of the percentage increase or decrease in Total ARR from existing customers for a given period from “Net ARR Retention” to “Net Dollar Retention” and changed the measurement period from quarterly to annual, as we believe the annual metric is more aligned with business performance measures and industry norms.

Selected Quarterly Information

USD millions, except percentages, number of shares, and per share amounts

Notes:

- Recurring revenue represents revenue derived from cloud services, term-based subscription licenses, maintenance services and recurring managed professional services. Other revenue represents revenue derived from perpetual software licenses, non-recurring professional services and ancillary product lines, including consumer products.

- Adjusted Revenue, Adjusted EBITDA, and Adjusted EBITDA as a percentage of Adjusted Revenue are non-IFRS measures. Refer to the “Use of non-IFRS measures and key metrics” section of the Q1 F22 MD&A for further discussion of these measures.

- Total ARR is a key metric. Refer to the “Use of non-IFRS measures and key metrics” section of the Q1 F22 MD&A for further discussion of this measure.

- Deferred revenue includes current and non-current amounts.

- Total non-current financial liabilities include non-current portion of lease liabilities and long-term debt.

Q1 F2022 Business Highlights

Business and organizational developments:

- In July, we completed the acquisition of 100% of NetMotion Software, Inc., a leading provider of connectivity and security solutions.

- In August, Andre Mintz, a seasoned technology and cyber risk management executive, joined Absolute's Board of Directors.

- In September, we announced strategic leadership changes to help drive Absolute’s next phase of innovation and growth following our acquisition of NetMotion – including the appointment of John Herrema as Executive Vice President of Product and Strategy, and the promotion of Joel Windels to Chief Marketing Officer.

Product and service highlights:

- In Q1 F2022, we extended the power of Absolute’s Application Persistence™ capabilities to more mission-critical applications, including BeyondTrust™, VMware® Horizon Client, McAfee® Drive Encryption, and SmartDeploy® as well as updated versions of McAfee® ePolicy Orchestrator and F5® BIG-IP® Edge Client®. This fiscal year, to date, we have added more than a dozen new applications and updates to our Application Persistence catalog, including Microsoft® Endpoint Manager (Intune) and Defender for Endpoint, Zscaler, and Palo Alto® Cortex™ XDR.

- In August, we announced key findings from our third annual Absolute Endpoint Risk Report: Education Edition, which revealed the significant management and security challenges faced by K-12 education IT teams with the rise in digital learning and the widespread adoption of 1:1 device programs.

- In August, we introduced the Absolute DataExplorer™ tool, enabling organizations to capture critical data points from their endpoint environment and align Absolute’s expansive, on-demand endpoint telemetry with their evolving business requirements.

- In September, we delivered enhanced geolocation capabilities, enabling organizations to strengthen device and data protections in today’s work and learn-from-anywhere environments, and balance the need for increased security with end user privacy.

- In September, Absolute’s NetMotion® solution was named a Leader in the Fall 2021 Grid® Report for Zero Trust Networking published by G2, the world’s leading business solutions review website.

Partner and other highlights:

- In Q1 F2022, we added 18 new reseller partners to our global partner program - reaching 1700 total active partners.

- In July, AT&T named NetMotion by Absolute as a key solution helping to power FirstNet®, the only nationwide network built with and for America’s first responders - enabling a seamless user experience by providing resilient connectivity both inside and outside coverage areas.

- In September, Lenovo named Absolute as a strategic security partner in the launch of their global ‘Everything-as-a-Service’ strategy.

- In September, Cloud Distribution, a Nuvias Group Company, was appointed as UK distributor for NetMotion by Absolute as part of a strategic shift to a two-tier channel model – enabling us to increase end user reach and recruit new cybersecurity partners.

F2022 Financial Outlook

The Company’s financial outlook for its 2022 fiscal year (July 1, 2021 – June 30, 2022) is as follows(1):

- Updated full-year F2022 adjusted revenue(2) to be in the range of $204.5 million to $207.5 million; this equates to a full-year F2022 adjusted revenue growth of approximately 12% to 13.5% (3).

- Updated full-year F2022 Adjusted EBITDA(2) margin, calculated on adjusted revenue, to be in the range of 19% to 21%.

Notes:

- The Company does not provide a reconciliation of forward-looking non-IFRS financial measures to the most directly comparable IFRS financial measure because it is unable to predict certain items contained in the IFRS measures without unreasonable efforts.

- Adjusted revenue and adjusted EBITDA are non-IFRS measures. Please refer to “Use of non-IFRS measures and key metrics” section in this earnings release or our most recent MD&A for further discussion of these measures.

- Adjusted revenue growth rate guidance for F2022 is based on an as-if combined basis without factoring in acquisition related adjustments and includes the combined revenue of Absolute and NetMotion for F2021. Revenue attributable to Absolute is reported under IFRS and revenue attributable to NetMotion is reported under US GAAP. The amount does not include US GAAP to IFRS adjustments, which are deemed immaterial.

The foregoing outlook and expectations constitute forward-looking statements and financial outlook and are qualified in their entirety by the “Forward-Looking Statements” cautionary statement below. The purpose of this financial outlook is to provide readers with disclosure regarding management’s current reasonable expectations and plans for F2022. Readers are cautioned that this financial outlook may not be appropriate for other purposes.

Quarterly Dividend

On October 20, 2021, we declared a quarterly dividend of CAD$0.08 per share on our common shares, payable in cash on November 29, 2021 to shareholders of record at the close of business on November 17, 2021.

Quarterly Filings and Related Quarterly Financial Information

Management’s Discussion and Analysis (“MD&A”) and Consolidated Financial Statements and the notes thereto for the fiscal period ended September 30, 2021 can be obtained today from Absolute’s corporate website at www.absolute.com. The documents will also be available under Absolute’s SEDAR profile at www.sedar.com and on EDGAR at www.sec.gov. Additionally, the Company has published on the Investor Relations section of its website (www.absolute.com/company/investors/) a Q1 F2022 Earnings Presentation and a dashboard of Selected Operating and Financial Metrics.

The Company has also published its inaugural Corporate Social Responsibility Report, available at www.absolute.com/company/investors/

Conference Call

Absolute Software will host a conference call on Tuesday, November 9, 2021 at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time) to discuss its results and business outlook. The call will be accessible by dialing 1-844-763-8274 or 1-412-717-9224; participants should ask to join the Absolute Software call. A live audio webcast of the conference call will also be available via the Absolute Investor Relations website.

The conference call will be archived for replay until Tuesday, November 16, 2021. To access the archived conference call, please dial 855-669-9658 or 1-877-344-7529 and enter the reservation code 10160913. To access the replay using an international dial-in number, please use this link. An archived replay of the webcast will be available for one year.

Use of non-IFRS measures and key metrics

Throughout this press release we refer to a number of measures and metrics which we believe are meaningful in the assessment of the Company’s performance. Many of these measures and metrics do not have any standardized meaning under International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board and are unlikely to be comparable to similarly titled measures reported by other companies. Readers are cautioned that the disclosure of these items is meant to add to, and not replace, the discussion of financial results or cash flows from operations as determined in accordance with IFRS.

The purpose of these non-IFRS measures and key metrics is to provide supplemental information that may prove useful to readers who wish to consider the impact of certain non-cash or non-recurring items on the Company’s operating performance, and assist in comparison of our operating results over historical periods. Supplementing IFRS disclosures with non-IFRS measures outlined below provides management with an additional view of operational performance by excluding expenses that are not directly related to performance in any particular period. Management uses both IFRS and non-IFRS measures when planning, monitoring and evaluating the Company’s performance.

These measures and metrics are as follows.

Key Metrics

-

Total ARR, Net Dollar Retention, and New Logo ARR

As the majority of our customer contracts are sold under prepaid multi-year term licenses, there is typically a significant lag between the timing of the invoice and the associated revenue recognition. As a result, we focus on the annualized recurring value of all active contracts, measured by Annual Recurring Revenue (“ARR”), as an indicator of our future recurring revenues. ARR includes multi-year and short-term subscriptions for cloud-based services, as well as, managed professional services and professional services with terms greater than one year. Both multi-year contracts and contracts with terms less than one year are annualized by dividing the total committed contract value by the number of months in the subscription term and then multiplying by twelve. We believe that increases in the amount of New Logo ARR, and improvement in our Net Dollar Retention, will accelerate the growth of Total ARR and, in turn, our future revenues. We provide these metrics as they are used to manage the business, however we believe there is no similar measure under IFRS to which these measures can be reconciled.

Total ARR is a key metric and measures the aggregate annualized recurring revenues of all active contracts at the end of a reporting period. This measure has historically been a good indicator of our future revenue streams. Total ARR will change over a period through the retention, attrition and expansion of existing customers and the acquisition of new customers.

Net Dollar Retention (previously “Net ARR Retention”) is a key metric and measures the percentage increase or decrease in Total ARR at the end of a year for customers that comprised Total ARR at the beginning of the year. We believe this metric provides useful insight into the effectiveness of our activities to retain and expand the ARR of our existing customers.

New Logo ARR (previously “ARR from New Customers”) is a key metric and measures the addition to Total ARR from sales to new customers during a period. We believe this metric provides useful insight into the effectiveness of our efforts to secure revenue from new customers.

Non-IFRS Measures

-

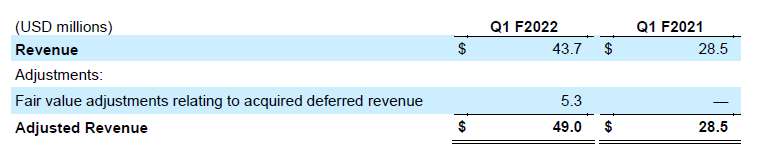

Adjusted Revenue

Adjusted Revenue is a non-IFRS measure that we defined as revenue, excluding fair value adjustments relating to acquired deferred revenue. In connection with the acquisition of NetMotion, NetMotion’s deferred revenue was written down to its fair value at the acquisition date. As a result, related revenue in the post acquisition period does not reflect the full amount of revenue that would otherwise be recognized. We believe excluding fair value adjustments relating to deferred revenue provides a useful measure of the Company’s performance as it allows for comparability across future periods, where revenue recognized would reflect the transaction price, without acquisition-related fair value adjustments.

-

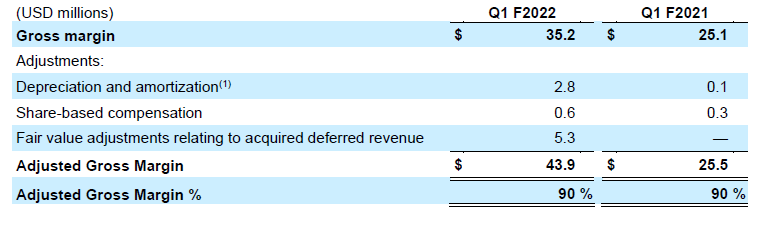

Adjusted Gross Margin and Gross Margin %

Adjusted Gross Margin is a non-IFRS measure that we defined as gross margin, adjusted for depreciation and amortization, share-based compensation expense, fair value adjustments relating to acquired deferred revenue, and non-recurring items. Adjusted Gross Margin % is defined as Adjusted Gross Margin, as a percentage of Adjusted Revenue.

-

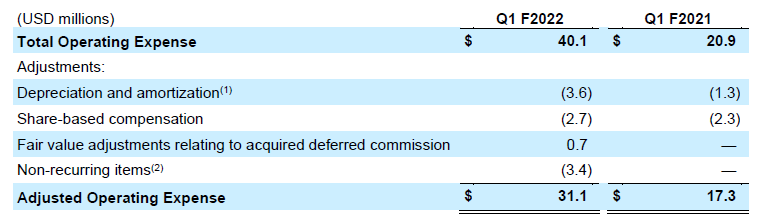

Adjusted Operating Expenses

Adjusted Operating Expenses is a non-IFRS measure that we defined as sales and marketing expense, research and development expense, and general and administrative expense, excluding depreciation and amortization, share-based compensation expense, fair value adjustments relating to acquired deferred commission expense, restructuring or reorganization charges and post-retirement benefits, and non-recurring items.

-

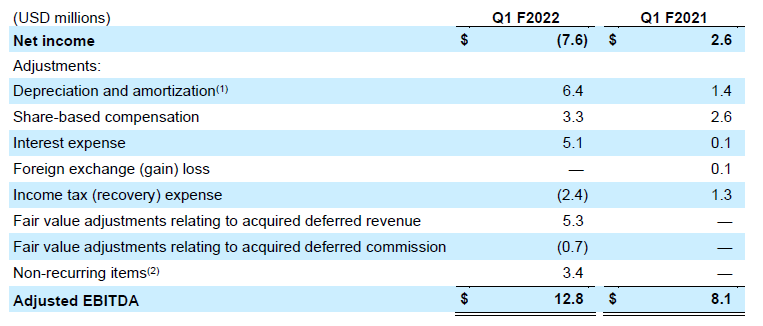

Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”)

Adjusted EBITDA is a non-IFRS measure that we defined as net income before interest income or expense, income taxes, depreciation and amortization, foreign exchange gains or losses, share-based compensation expense, fair value adjustments relating to acquired deferred revenue, fair value adjustments relating to acquired deferred commission expense, restructuring or reorganization charges and post-retirement benefits, and non-recurring items.

We believe Adjusted EBITDA provides a useful measure of the Company’s performance, as it helps illustrate underlying trends in our business that could otherwise be masked by the effect of the income or expenses that are not indicative of the core operating performance of our business.

Adjusted EBITDA has limitations as an analytical tool, and it should not be considered in isolation or as a substitute for analysis of other IFRS financial measures. Some of the limitations of Adjusted EBITDA are that it excludes recurring expenses for interest payments, does not reflect the dilution that results from share-based compensation, and does not reflect the cost to replace amortized property and equipment and right-of-use assets. It may be calculated differently by other companies in our industry, limiting its usefulness as a comparative measure.

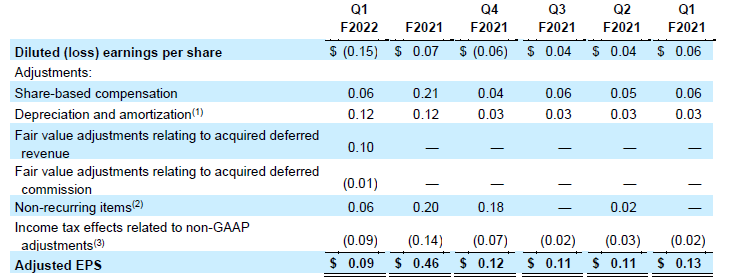

Reconciliation of non-IFRS measures from IFRS measures are presented below.

Adjusted Revenue

Adjusted Gross Margin

Adjusted Operating Expenses

Notes:

- Depreciation and amortization includes depreciation of property and equipment, amortization of right-of-use assets, and amortization of acquired intangible assets.

- Non-recurring items in Q1 F2022 includes professional fees and other costs relating to the acquisition of NetMotion, and integration related costs.

Adjusted EBITDA

Notes:

- Depreciation and amortization includes depreciation of property and equipment, amortization of right-of-use assets, and amortization of acquired intangible assets.

- Non-recurring items in Q1 F2022 includes professional fees and other costs relating to the acquisition of NetMotion, and integration related costs.